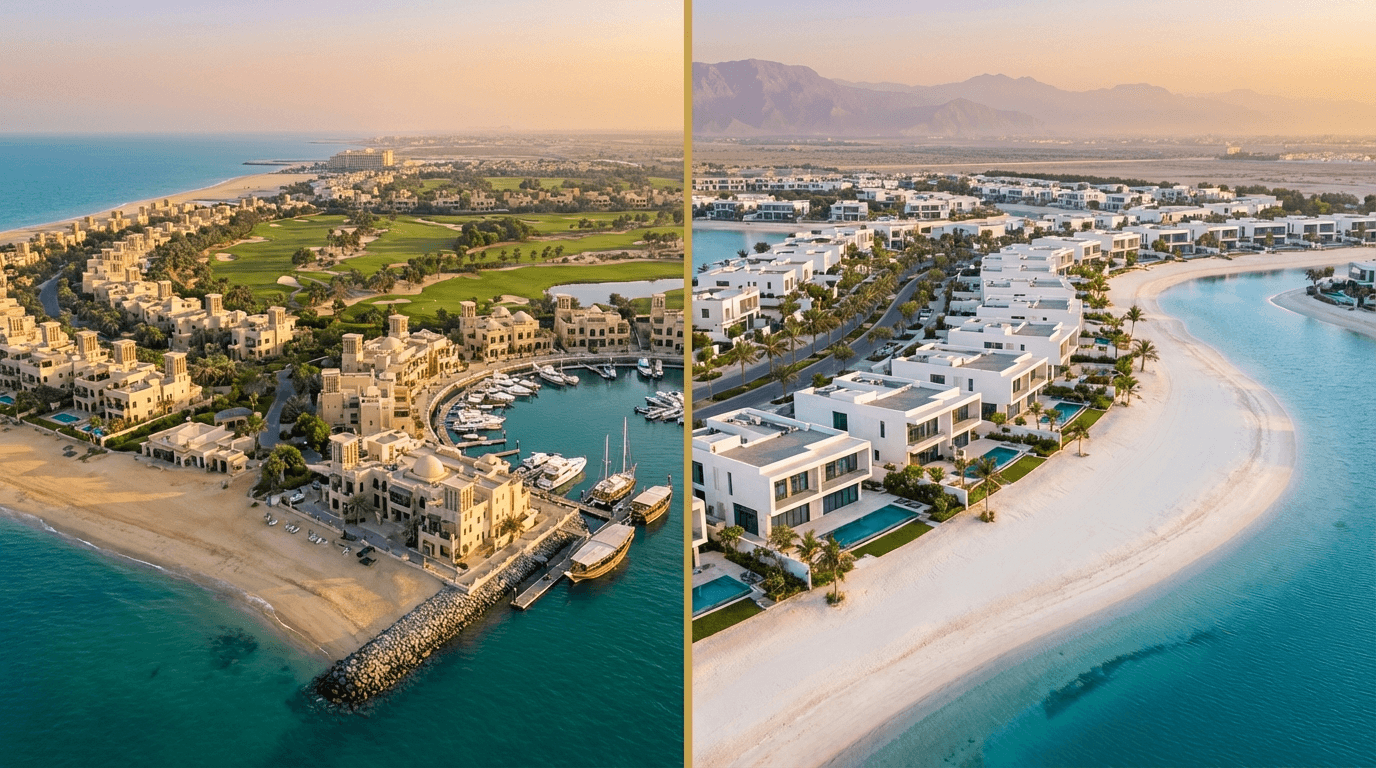

Al Hamra vs Mina Al Arab: Complete Community Comparison for RAK Investors

Comparing Al Hamra Village and Mina Al Arab in Ras Al Khaimah? Discover which premium waterfront community offers better investment returns, amenities, and growth potential.

Table Of Contents

- Al Hamra vs Mina Al Arab: Overview

- Location and Accessibility

- Property Types and Pricing

- Investment Performance: Rental Yields and Capital Appreciation

- Amenities and Lifestyle Offerings

- Infrastructure and Development Stage

- Target Investor Profile: Which Community Suits You?

- Future Growth Potential

- Making Your Investment Decision

Ras Al Khaimah has emerged as one of the UAE's most compelling property investment destinations, offering exceptional value compared to Dubai and Abu Dhabi whilst maintaining comparable quality and amenities. For investors evaluating opportunities in this burgeoning market, two communities consistently rise to the top: Al Hamra Village and Mina Al Arab.

Both developments represent premium waterfront living with championship golf courses, marina access, and resort-style amenities. However, they cater to distinctly different investment strategies and investor profiles. Al Hamra Village offers the stability of an established community with proven rental yields and mature infrastructure, whilst Mina Al Arab presents the growth potential of a newer master development with ambitious expansion plans and attractive off-plan opportunities.

This comprehensive comparison examines every aspect relevant to property investors—from pricing structures and rental yields to amenities, accessibility, and future appreciation forecasts. Whether you're seeking immediate rental income, long-term capital growth, or a luxury residence for personal use, understanding the nuances between these two exceptional communities is essential for making an informed investment decision in Ras Al Khaimah's dynamic property market.

Al Hamra vs Mina Al Arab

Your Complete RAK Investment Comparison Guide

Price Comparison Overview

Studio Apartments

Al Hamra: AED 350K-500K

Mina Al Arab: AED 280K-420K

1-Bedroom

Al Hamra: AED 450K-700K

Mina Al Arab: AED 380K-600K

3-Bed Townhouse

Al Hamra: AED 1.2M-1.8M

Mina Al Arab: AED 950K-1.5M

4-Bed Villa

Al Hamra: AED 2.5M-4.5M

Mina Al Arab: AED 2M-3.8M

Key Investment Considerations

Location Access

Al Hamra: 50 min to Dubai Airport

Mina Al Arab: 45 min to Dubai Airport, closer to RAK city

Development Stage

Al Hamra: Fully established

Mina Al Arab: Actively expanding with future phases

Lifestyle Amenities

Al Hamra: Golf, marina, 2 hotels

Mina Al Arab: Beaches, mangroves, nature-focused

Which Community Suits Your Investment Strategy?

Choose Al Hamra For:

- Immediate rental income

- Lower investment risk

- Proven track record

- Turnkey rental properties

- Strong resale liquidity

Choose Mina Al Arab For:

- Capital appreciation focus

- Off-plan opportunities

- Lower entry pricing

- Modern architectural design

- Higher growth potential

Ready to explore exclusive RAK investment opportunities?

Contact Azimira SpecialistsPremium RAK Investment Insights by Azimira Real Estate

Your trusted partner for exceptional UAE property opportunities

Al Hamra vs Mina Al Arab: Overview

Al Hamra Village stands as Ras Al Khaimah's pioneering integrated waterfront community, having welcomed residents since 2008. Developed by Al Hamra Real Estate, this 5.5 million square metre destination combines residential properties with hospitality offerings, including two hotels, championship golf facilities, and an expansive marina. The community has established itself as RAK's most recognisable address, particularly amongst European expatriates and holiday home investors.

In contrast, Mina Al Arab represents a newer vision for waterfront living in the emirate. Launched by RAK Properties in 2014, this ambitious master development spans approximately 5 million square metres and remains in active expansion. The community emphasises nature-integrated design with mangrove preservation, pristine beaches, and eco-conscious planning that appeals to environmentally aware buyers and families seeking a more contemporary lifestyle.

Whilst both communities share waterfront positioning and resort-style amenities, their maturity stages create fundamentally different investment propositions. Al Hamra offers immediate rental returns with established tenant pools and resale liquidity, whereas Mina Al Arab provides access to off-plan opportunities with substantial capital appreciation potential as the community develops and matures.

Location and Accessibility

Location significantly influences both lifestyle quality and investment performance, particularly regarding rental demand and resale value.

Al Hamra Village Location

Situated approximately 25 kilometres from Ras Al Khaimah city centre, Al Hamra Village occupies a prominent position along the emirate's western coastline. The community benefits from straightforward access via Sheikh Mohammed Bin Salem Road (E11), connecting residents to key destinations:

- Dubai International Airport: 50 minutes (approximately 75 kilometres)

- RAK International Airport: 25 minutes

- Dubai Marina: 55 minutes

- RAK City Centre: 20 minutes

The established location has fostered substantial supporting infrastructure, including nearby supermarkets, medical facilities, and dining options within the community and surrounding areas. This maturity enhances convenience for residents and strengthens rental appeal.

Mina Al Arab Location

Mina Al Arab sits closer to Ras Al Khaimah's urban core, positioned along the emirate's northern coastline near Flamingo Villas. This positioning offers slightly improved connectivity to RAK's commercial districts:

- Dubai International Airport: 45 minutes (approximately 65 kilometres)

- RAK International Airport: 15 minutes

- Dubai Marina: 50 minutes

- RAK City Centre: 12 minutes

The shorter commute to RAK city makes Mina Al Arab particularly attractive to professionals working in the emirate whilst maintaining convenient access to Dubai. However, as a developing community, some supporting retail and service infrastructure remains under construction.

Investment Implications

From an investment perspective, Al Hamra's established location with mature amenities supports consistent rental demand from tenants seeking immediate convenience. Mina Al Arab's proximity to RAK's employment centres positions it favourably for long-term tenant demand as the emirate's economy expands, whilst its developing infrastructure offers capital appreciation potential as the community completes.

Property Types and Pricing

Understanding the property inventory and pricing structures reveals each community's positioning within RAK's investment landscape.

Al Hamra Village Property Portfolio

Al Hamra Village offers diverse residential options spanning various price points:

Apartments: Studios to three-bedroom units in mid-rise buildings, many featuring golf course or lagoon views. Properties range from 500 to 2,000 square feet.

Townhouses: Two to four-bedroom configurations with private gardens and community pool access, typically between 1,800 and 3,000 square feet.

Villas: Luxury four to six-bedroom standalone properties with private pools, positioned along the golf course or waterfront, ranging from 3,500 to 7,000 square feet.

Current Pricing (as of 2025):

- Studio apartments: AED 350,000 – 500,000

- One-bedroom apartments: AED 450,000 – 700,000

- Two-bedroom apartments: AED 650,000 – 1,100,000

- Three-bedroom townhouses: AED 1,200,000 – 1,800,000

- Four-bedroom villas: AED 2,500,000 – 4,500,000

The ready secondary market provides immediate occupancy or rental income potential, with fully furnished options available for investors seeking turnkey rental solutions.

Mina Al Arab Property Portfolio

Mina Al Arab's evolving inventory includes both completed properties and off-plan opportunities:

Apartments: Contemporary studio to three-bedroom units with balconies, many offering beach or mangrove views, ranging from 450 to 1,800 square feet.

Townhouses: Modern two to four-bedroom designs with garden spaces, typically between 1,600 and 2,800 square feet.

Villas: Three to six-bedroom residences featuring private pools and beachfront access in select precincts, ranging from 2,500 to 6,500 square feet.

Current Pricing (as of 2025):

- Studio apartments: AED 280,000 – 420,000

- One-bedroom apartments: AED 380,000 – 600,000

- Two-bedroom apartments: AED 550,000 – 900,000

- Three-bedroom townhouses: AED 950,000 – 1,500,000

- Four-bedroom villas: AED 2,000,000 – 3,800,000

Mina Al Arab generally offers lower entry points, particularly for off-plan purchases with attractive payment plans extending through construction periods.

Pricing Analysis for Investors

Mina Al Arab presents approximately 15-20% lower pricing across comparable property types, reflecting its developing status. For investors prioritising capital appreciation, this pricing differential creates substantial upside potential as the community matures and infrastructure completes. Al Hamra's premium pricing reflects established desirability and immediate rental readiness, supporting investors seeking stable, immediate returns.

Off-plan opportunities in Mina Al Arab, accessible through specialists like Azimira's exclusive RAK projects, often feature favourable developer payment plans and pre-launch pricing unavailable in the resale market.

Investment Performance: Rental Yields and Capital Appreciation

Investment returns ultimately determine property selection for yield-focused and growth-oriented investors.

Al Hamra Village Investment Returns

Rental Yields: Al Hamra Village delivers competitive rental returns ranging from 6.5% to 8.5% annually, depending on property type and configuration. Smaller units (studios and one-bedroom apartments) typically achieve higher percentage yields, whilst larger villas generate substantial absolute rental income.

Typical Annual Rents:

- Studio apartments: AED 28,000 – 38,000

- One-bedroom apartments: AED 35,000 – 52,000

- Two-bedroom apartments: AED 50,000 – 75,000

- Three-bedroom townhouses: AED 85,000 – 130,000

- Four-bedroom villas: AED 180,000 – 280,000

Capital Appreciation: Established communities typically experience moderate, steady appreciation. Al Hamra has demonstrated 4-6% annual capital growth over recent years, with peaks during high-demand periods. The mature market provides resale liquidity, enabling investors to exit positions when desired.

Tenant Profile: The community attracts long-term tenants including expatriate families, golf enthusiasts, and professionals seeking quality lifestyle. Holiday rental potential exists, particularly for well-furnished waterfront units, though annual tenancy remains more common.

Mina Al Arab Investment Returns

Rental Yields: Completed properties in Mina Al Arab currently achieve 7% to 9% rental yields, benefiting from lower purchase prices relative to rental income. As a developing community, yields may compress slightly as property values appreciate.

Typical Annual Rents:

- Studio apartments: AED 24,000 – 32,000

- One-bedroom apartments: AED 32,000 – 45,000

- Two-bedroom apartments: AED 45,000 – 65,000

- Three-bedroom townhouses: AED 75,000 – 110,000

- Four-bedroom villas: AED 150,000 – 240,000

Capital Appreciation: Developing communities historically offer superior capital growth potential. Mina Al Arab has experienced 8-12% annual appreciation since launch, with off-plan buyers often realising 15-25% gains by completion. Future phases and infrastructure completion should support continued strong appreciation.

Tenant Profile: The community appeals to young families, professionals working in RAK, and tenants seeking modern, amenity-rich environments at accessible price points.

Investment Strategy Implications

Investors prioritising immediate, stable income find Al Hamra's established rental market and proven yields attractive, particularly for diversification within broader portfolios. Those focusing on capital growth and willing to accept slightly longer investment horizons benefit from Mina Al Arab's appreciation potential, especially through off-plan acquisition.

For guidance on optimising investment strategies across RAK's communities, explore Azimira's investment insights tailored to capital growth and income objectives.

Amenities and Lifestyle Offerings

Lifestyle amenities directly influence rental demand, tenant retention, and property values.

Al Hamra Village Amenities

As an established resort community, Al Hamra provides comprehensive facilities:

Recreation:

- Al Hamra Golf Club: Championship 18-hole course designed by Peter Harradine

- Al Hamra Marina: 50-berth facility with yacht charter services

- Multiple swimming pools throughout residential precincts

- Private beach access with watersports facilities

- Fitness centres and tennis courts

Retail and Dining:

- Al Hamra Mall: Supermarkets, retail outlets, and restaurants

- Numerous dining venues within the community

- Café culture and casual dining options

Hospitality:

- Waldorf Astoria Ras Al Khaimah: Luxury beachfront hotel

- DoubleTree by Hilton Resort & Spa

Education: Proximity to RAK English Speaking School and other educational institutions in RAK city.

The comprehensive amenity offering creates a self-contained lifestyle reducing residents' need to travel for daily requirements.

Mina Al Arab Amenities

Mina Al Arab emphasises nature integration and outdoor lifestyle:

Recreation:

- Pristine beaches with dedicated beach clubs

- Mangrove conservation areas with kayaking routes

- Mina Al Arab Golf Course: 18-hole championship course

- Lagoon swimming areas and watersports

- Extensive cycling and walking trails

- Community parks and children's play areas

Retail and Dining:

- Flamingo Town Centre (under development): Planned retail and F&B hub

- Limited existing retail within the community

- Growing restaurant selection in completed phases

Hospitality:

- Hampton by Hilton Marjan Island (nearby)

- Planned hotel developments within future phases

Education: German International School RAK operates within Mina Al Arab, providing convenient on-site education.

Whilst some planned amenities remain under construction, completed facilities demonstrate high quality with particular appeal to outdoor-oriented families and environmentally conscious residents.

Lifestyle Comparison

Al Hamra offers immediate, comprehensive amenities suited to buyers seeking established convenience and resort-style living. Mina Al Arab appeals to those valuing contemporary design, environmental integration, and community evolution, accepting that some facilities remain in development phases.

Infrastructure and Development Stage

Development maturity influences both immediate livability and future value appreciation.

Al Hamra Village Infrastructure

Al Hamra benefits from complete infrastructure installed over nearly two decades:

- Fully developed road networks and utilities

- Mature landscaping with established vegetation

- Comprehensive street lighting and security systems

- Reliable telecommunications and internet connectivity

- Established community management and maintenance services

This maturity ensures immediate quality of life with minimal construction disruption, supporting stable tenant satisfaction and retention.

Mina Al Arab Infrastructure

As an actively developing community, Mina Al Arab presents mixed infrastructure completion:

- Core roads and utilities installed in completed phases

- Ongoing construction in developing precincts

- Growing landscaping with improving maturity

- Expanding community facilities as phases deliver

- Committed master developer ensuring quality completion

Whilst early residents experience some construction activity as new phases launch, this development process creates appreciation potential as infrastructure completes and the community reaches full maturity.

Infrastructure Investment Perspective

Al Hamra's complete infrastructure supports immediate rental operations without construction concerns. Mina Al Arab's developing status offers capital appreciation opportunities, particularly for off-plan investors entering before full build-out, though rental investors should ensure selected properties are in substantially complete precincts to maximise tenant appeal.

Target Investor Profile: Which Community Suits You?

Selecting between Al Hamra and Mina Al Arab depends on investment objectives, risk tolerance, and portfolio strategy.

Al Hamra Village Ideal Investor

Al Hamra suits investors seeking:

Immediate Income: Established rental market generating returns from acquisition

Lower Risk Profile: Proven community with predictable performance and mature tenant demand

Resale Liquidity: Active secondary market enabling portfolio adjustments when needed

Premium Positioning: Established prestige supporting rental premiums and value retention

Turnkey Solutions: Fully furnished rental-ready properties requiring minimal preparation

Typical Al Hamra investors include conservative portfolio builders, overseas investors prioritising reliability, and buyer-occupiers seeking proven lifestyle quality.

Mina Al Arab Ideal Investor

Mina Al Arab appeals to investors prioritising:

Capital Appreciation: Growth potential as community develops and infrastructure completes

Off-Plan Opportunities: Access to pre-launch pricing and favourable payment plans

Entry Price Points: Lower acquisition costs enabling portfolio diversification or larger property access

Future Upside: Positioned for RAK's continued economic expansion and tourism development

Modern Product: Contemporary architecture and environmental design appealing to evolving buyer preferences

Typical Mina Al Arab investors include growth-focused buyers, off-plan specialists, younger investors building initial portfolios, and those entering RAK's market at attractive valuations.

Portfolio Strategy Considerations

Sophisticated investors often include both communities within diversified RAK portfolios, balancing Al Hamra's stable income against Mina Al Arab's growth potential. This approach captures immediate returns whilst positioning for capital appreciation as RAK's property market matures.

For personalised investment strategies matching your objectives, Azimira's specialists provide tailored guidance across RAK's opportunity spectrum.

Future Growth Potential

Long-term investment success depends on understanding macroeconomic drivers and community-specific catalysts.

Ras Al Khaimah Growth Drivers

Both communities benefit from emirate-level growth factors:

Economic Diversification: RAK's expanding manufacturing, tourism, and business sectors create employment growth driving housing demand.

Tourism Development: Major hospitality projects, entertainment attractions, and improved air connectivity increase visitor volumes supporting short-term rental markets.

Government Initiatives: Progressive visa policies, business incentives, and infrastructure investment enhance RAK's competitive positioning within the UAE.

Value Proposition: Significant price advantages compared to Dubai and Abu Dhabi attract buyers and tenants seeking quality at accessible price points.

These emirate-wide factors support property appreciation across RAK's premium communities.

Al Hamra Village Specific Catalysts

Al Hamra's future growth potential stems from:

- Continued recognition as RAK's premier address

- Possible further marina expansion and yacht club development

- Growing golf tourism supporting hospitality demand

- Potential rental market premiums as newer communities mature to similar standards

- Stable, predictable appreciation aligned with RAK's overall market growth

As a mature community, Al Hamra offers more predictable, moderate growth rather than explosive appreciation.

Mina Al Arab Specific Catalysts

Mina Al Arab's substantial upside potential derives from:

- Significant undeveloped land supporting future phase launches

- Planned retail and hospitality additions enhancing community completeness

- Environmental positioning aligning with global sustainability trends

- Lower current valuations relative to quality and amenity offerings

- Developer commitment to continued investment and infrastructure enhancement

- RAK Properties' track record of successful community delivery

The developing status creates multiple value inflection points as major amenities complete and the community reaches full occupancy.

Investment Horizon Implications

Investors with 3-5 year horizons benefit from Mina Al Arab's near-term catalysts, particularly infrastructure completion and phase deliveries. Those with 10+ year perspectives find both communities attractive, with Al Hamra offering stability and Mina Al Arab providing higher growth potential through multiple development cycles.

Making Your Investment Decision

Selecting between Al Hamra Village and Mina Al Arab requires aligning community characteristics with your specific investment criteria.

Key Decision Framework

Choose Al Hamra Village if you prioritise:

- Immediate rental income generation

- Established community with proven track record

- Lower operational risk and predictable performance

- Premium market positioning

- Comprehensive existing amenities

- Resale liquidity for portfolio flexibility

Choose Mina Al Arab if you prioritise:

- Capital appreciation potential

- Off-plan acquisition opportunities

- Lower entry price points

- Modern architectural product

- Environmental integration and contemporary design

- Proximity to RAK's commercial districts

Consider both communities if you seek:

- Diversified RAK exposure balancing income and growth

- Risk distribution across development stages

- Broader tenant market access

- Portfolio optimisation combining complementary assets

Due Diligence Essentials

Regardless of community selection, comprehensive due diligence remains essential:

Financial Analysis: Calculate total acquisition costs including registration fees (4% of property value in RAK), agency fees, and financing costs if applicable. Project rental yields considering service charges, maintenance reserves, and vacancy periods.

Legal Review: Engage qualified legal counsel to review Sale and Purchase Agreements, verify clear title, and ensure proper registration procedures.

Physical Inspection: Visit properties personally or through trusted representatives, assessing construction quality, finishes, and community condition.

Market Validation: Research comparable rental rates and recent sale transactions to confirm pricing competitiveness.

Developer Assessment (for off-plan): Evaluate developer track record, financial stability, and delivery history before committing to pre-construction purchases.

Accessing Exclusive Opportunities

Premium investors gain significant advantages through specialist advisors offering exclusive access to off-market properties and pre-launch opportunities. Azimira Real Estate's exclusive RAK projects provide clients with first access to exceptional off-plan investments unavailable through public channels, often at preferential pre-launch pricing.

This privileged access enables investors to secure prime units, optimal payment structures, and superior capital appreciation potential before broader market availability drives competitive pricing.

Investment Execution

Once you've selected your target community and identified suitable properties:

- Secure Financing (if required): Arrange mortgage pre-approval from UAE banks offering competitive RAK property financing

- Negotiate Terms: Experienced advisors negotiate optimal pricing and payment structures

- Execute Documentation: Complete Sale and Purchase Agreement with proper legal review

- Arrange Property Management: Establish rental management for investment properties to maximise occupancy and returns

- Complete Registration: Finalise property transfer and title registration with RAK Land Department

Professional guidance throughout this process ensures smooth execution whilst protecting your investment interests.

Both Al Hamra Village and Mina Al Arab represent exceptional investment opportunities within Ras Al Khaimah's burgeoning property market, each serving distinct investor profiles and strategic objectives.

Al Hamra Village delivers the stability and immediate returns of an established premium community, with proven rental yields, comprehensive amenities, and predictable performance appealing to conservative investors and those prioritising reliable income generation. Its mature infrastructure and recognised prestige support stable tenant demand and resale liquidity.

Mina Al Arab offers the compelling growth potential of a developing master community, with attractive entry pricing, substantial capital appreciation forecasts, and exclusive off-plan opportunities for investors willing to embrace slightly longer investment horizons. The contemporary design, environmental integration, and committed development pipeline position the community for exceptional value growth as RAK continues its economic expansion.

For sophisticated investors, both communities merit consideration within diversified RAK portfolios, balancing immediate income against future capital growth whilst capturing Ras Al Khaimah's competitive advantages relative to more expensive emirates.

The optimal choice ultimately aligns with your specific investment objectives, risk tolerance, and portfolio strategy. Whether you prioritise Al Hamra's established excellence or Mina Al Arab's appreciation potential, both communities participate in the broader RAK growth narrative transforming the emirate into one of the UAE's most attractive property investment destinations.

Success in RAK's dynamic market requires expert guidance, exclusive deal access, and comprehensive market intelligence—advantages that specialist advisors deliver to discerning investors.

Ready to Invest in Ras Al Khaimah's Premium Communities?

Azimira Real Estate provides discerning investors with exclusive access to the finest off-plan and ready properties in Al Hamra Village, Mina Al Arab, and across Ras Al Khaimah's most prestigious developments.

Our deep RAK market expertise, exclusive pre-launch opportunities, and personalised investment strategies help you identify high-yield properties aligned with your specific objectives—whether you're seeking immediate rental returns, exceptional capital appreciation, or luxury owner-occupier residences.

Contact Azimira's RAK specialists today to discuss your investment requirements and gain privileged access to off-market opportunities unavailable through traditional channels.

Discover why sophisticated investors trust Azimira as their partner for exceptional returns in the UAE's most dynamic emerging market.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.