Branded Residences vs Standard Properties in RAK: A Comprehensive ROI Analysis

Discover which property type delivers superior returns in Ras Al Khaimah. Compare branded residences against standard properties with detailed ROI analysis, rental yields, and appreciation forecasts.

Table Of Contents

- Understanding Branded Residences in RAK's Property Market

- Initial Investment Comparison: Entry Costs and Payment Structures

- Capital Appreciation Potential: Historical Data and Forecasts

- Rental Yield Analysis: Short-Term vs Long-Term Returns

- Total Ownership Costs: Hidden Expenses That Affect ROI

- Resale Value and Liquidity Considerations

- The Intangible Value: Brand Power and Lifestyle Premium

- RAK Market Dynamics: Why This Emirate Offers Unique Opportunities

- Investment Timeline Scenarios: 5-Year vs 10-Year Projections

- Which Property Type Suits Your Investment Strategy?

Ras Al Khaimah has emerged as one of the UAE's most compelling property investment destinations, offering attractive price points combined with impressive growth trajectories that have captured the attention of savvy investors. However, as the emirate's real estate landscape matures, investors face an increasingly important decision: should they pursue branded residences managed by internationally recognised hospitality giants, or focus on standard residential properties that offer more traditional ownership models?

This question carries significant financial implications. Branded residences—properties developed in partnership with luxury hotel brands such as Waldorf Astoria, Anantara, or Hilton—promise premium amenities, professional management, and the cachet of an established name. Standard properties, conversely, typically require lower initial investment and offer different operational dynamics. The difference in total returns over a five or ten-year holding period can be substantial, potentially reaching hundreds of thousands of dirhams depending on the property segment and specific development.

In this comprehensive analysis, we examine the concrete financial performance of both property types within RAK's unique market context. By evaluating capital appreciation rates, rental yields, ownership costs, and resale dynamics, we provide the data-driven insights discerning investors require to make informed decisions that align with their financial objectives and risk tolerance.

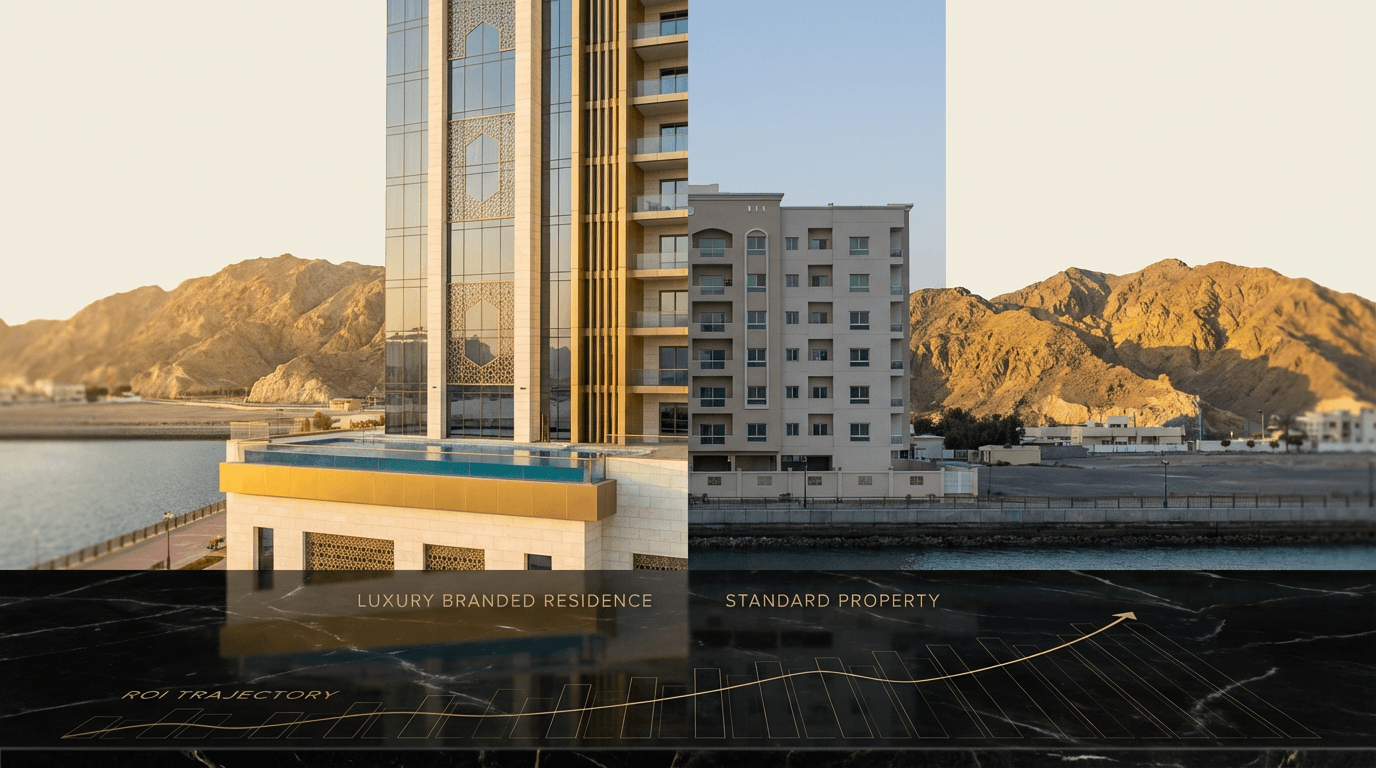

Branded vs Standard Properties in RAK

A Complete ROI Comparison for Discerning Investors

Branded Residences

Annualized Return (5-Year)

Entry: AED 1.8M - 6M

Appreciation: 10-15% annually

Standard Properties

Annualized Return (5-Year)

Entry: AED 600K - 2.5M

Appreciation: 7-10% annually

Key Investment Factors at a Glance

💰 Initial Investment

Branded: 40-60% premium pricing

Standard: More accessible entry points

📈 Rental Yield

Branded: 5-7% net (managed)

Standard: 6-9% net (self-managed)

🏗️ Service Charges

Branded: AED 25-45/sq ft annually

Standard: AED 12-22/sq ft annually

⚡ Liquidity

Branded: 90-180 days to sell

Standard: 30-90 days to sell

10-Year Investment Scenario Comparison

Based on AED 2.4M branded residence vs AED 1.5M standard property

Total Return

(AED 4.94M profit)

Total Return

(AED 2.75M profit)

Choose Branded Residences If You:

Have sufficient capital for higher entry requirements (AED 1.8M+)

Prioritize passive income with professional management

Seek maximum capital appreciation over 7-10+ years

Value luxury amenities and prestigious brand association

Choose Standard Properties If You:

Want accessible entry points to build your portfolio (AED 600K+)

Prefer higher rental yields through active management (6-9%)

Need better liquidity for shorter investment horizons (3-5 years)

Value flexibility and autonomy in property management

Ready to Maximize Your RAK Investment Returns?

Partner with Azimira Real Estate to access exclusive off-plan opportunities and expert ROI analysis tailored to your investment goals.

Schedule Your ConsultationInvestment projections based on conservative market assumptions. Actual returns may vary based on specific property selection, market conditions, and individual circumstances. Past performance does not guarantee future results.

Understanding Branded Residences in RAK's Property Market

Branded residences represent a distinctive property category that combines private residential ownership with the operational excellence and service standards of internationally recognised hospitality brands. In Ras Al Khaimah, this segment has gained considerable momentum, with developments such as Waldorf Astoria RAK, Anantara Mina Al Arab, and Hampton by Hilton RAK Beach Resort establishing the emirate as a serious contender in the luxury branded residence space.

These properties function quite differently from standard residential developments. Owners typically gain access to comprehensive hotel-style amenities—including concierge services, housekeeping, fine dining establishments, spa facilities, and beach clubs—whilst the brand operator manages rental programmes that can generate income during periods when owners aren't occupying their units. The property management company handles everything from guest bookings to maintenance, creating a genuinely passive investment experience.

Standard properties in RAK, meanwhile, encompass traditional apartment complexes, villa communities, and townhouse developments that operate on conventional ownership models. These properties range from affordable housing options in developing areas to premium waterfront developments and exclusive gated communities. Owners assume greater responsibility for property management, whether they choose to rent their units independently or occupy them personally.

The distinction between these property types extends beyond operational models to encompass pricing structures, target demographics, and investment objectives. Understanding these fundamental differences provides the foundation for meaningful ROI comparison.

Initial Investment Comparison: Entry Costs and Payment Structures

The initial capital requirement represents the first significant divergence between branded residences and standard properties in RAK. Current market data reveals that branded residences command a substantial premium, typically priced between AED 1.8 million and AED 6 million for one to three-bedroom units in established developments. Standard properties in comparable locations generally range from AED 600,000 to AED 2.5 million for similar configurations.

This price differential—often 40-60% higher for branded options—reflects several factors: prime locations (frequently beachfront or resort-integrated settings), superior construction specifications, comprehensive amenity packages, and the brand licensing fees that developers must recoup. For investors, this means branded residences require considerably more capital deployment to enter the market.

Payment structures also differ meaningfully between the two categories. Many exclusive RAK off-plan projects offering branded residences feature extended payment plans spanning the construction period, with typical structures requiring 20-30% upon purchase, 40-50% during construction in staged instalments, and the remaining 20-30% upon handover. These flexible arrangements can enhance accessibility despite higher absolute prices.

Standard properties, particularly in the off-plan segment, often present even more investor-friendly payment terms, with some developers offering 10% down payments and instalments stretched over five to seven years, including post-handover periods. This capital efficiency allows investors to deploy funds across multiple properties rather than concentrating capital in a single branded unit.

When calculating true entry costs, investors must also account for additional fees. The Dubai Land Department (which oversees property registration across the UAE, including RAK) charges a 2% registration fee plus an administrative charge of AED 2,000-5,000. Branded residences may involve additional one-time enrolment fees for owners' clubs or rental programmes, typically ranging from AED 25,000 to AED 100,000 depending on the development.

Capital Appreciation Potential: Historical Data and Forecasts

Capital appreciation—the increase in property value over time—often constitutes the primary component of total investment returns in UAE real estate. RAK's property market has demonstrated impressive growth trajectories, with average annual appreciation rates of 8-12% across various segments over the past three years, significantly outpacing more mature markets like certain Dubai neighbourhoods.

Branded residences in RAK have historically achieved superior capital appreciation compared to standard properties, with annual growth rates averaging 10-15% in established developments. This premium appreciation stems from several factors: scarcity (branded developments represent a small fraction of total inventory), aspirational appeal that attracts high-net-worth buyers, and the brand's marketing reach which expands the potential buyer pool beyond local markets to include international investors.

Standard properties have nonetheless delivered respectable appreciation, particularly in well-located developments with strong community infrastructure. Properties in emerging areas such as Mina Al Arab and Al Hamra Village have seen values increase by 7-10% annually, whilst more established locations have experienced steadier growth in the 5-8% range.

The appreciation gap between property types tends to widen during market upswings and narrow during corrections. Branded residences, positioned as luxury products, experience more pronounced value fluctuations in response to economic conditions. During the robust growth periods RAK has recently experienced, branded properties capitalise more aggressively on upward momentum. Conversely, during market stabilisation, standard properties often demonstrate greater price resilience.

Forward-looking forecasts for RAK remain exceptionally positive, driven by infrastructure developments including the expansion of RAK International Airport, new tourism initiatives, and the emirate's strategic positioning as an affordable alternative to Dubai and Abu Dhabi. Industry analysts project continued appreciation of 8-12% annually for branded residences and 6-9% for standard properties over the next five years, though these projections carry inherent uncertainty.

For investors focused primarily on capital gains, the higher initial investment in branded residences may be justified by the enhanced appreciation potential, particularly for those with longer investment horizons who can weather short-term market volatility.

Rental Yield Analysis: Short-Term vs Long-Term Returns

Rental yield—the annual rental income expressed as a percentage of property value—represents the second critical component of total investment returns. RAK's rental market presents distinct dynamics for branded versus standard properties, with significant variations based on rental strategy.

Branded residences excel in the short-term rental market, leveraging the operator's reservation systems, brand loyalty programmes, and marketing infrastructure to achieve high occupancy rates. Premium branded properties in RAK typically generate gross rental yields of 7-10% when operated as short-term holiday rentals, with nightly rates ranging from AED 800 to AED 3,500 depending on unit size and seasonality. The managed rental programmes handle all operational aspects, though they typically retain 30-45% of gross revenues as management fees.

After accounting for management fees and operational costs, net rental yields for branded residences generally settle around 5-7%—still attractive compared to many global markets, particularly when combined with capital appreciation. The convenience factor cannot be overstated; owners receive quarterly distributions without involvement in day-to-day operations.

Standard properties pursuing short-term rental strategies can achieve competitive yields, particularly when owners self-manage or use third-party platforms like Airbnb. Gross yields of 8-12% are achievable in well-located properties, though this requires significantly more owner involvement in marketing, guest communication, and property maintenance. After accounting for platform fees (typically 15-20%), cleaning costs, and maintenance, net yields generally range from 6-9%.

The long-term rental market presents a different picture. Standard properties dominate this segment, with annual tenancy contracts generating more stable, predictable income. Gross rental yields for standard properties on long-term leases typically range from 6-8% in RAK, with minimal management overhead if owners engage property management companies (charging 5-8% of annual rent).

Branded residences less commonly pursue long-term rental strategies, as this underutilises the brand infrastructure and amenities that justify premium pricing. When they do enter long-term rental markets, yields typically compress to 4-6% due to the higher asset values relative to achievable rents.

The optimal rental strategy depends heavily on investor preferences regarding involvement, income stability, and risk tolerance. Those seeking passive income with minimal effort naturally gravitate towards branded residences with managed rental programmes, whilst hands-on investors willing to manage short-term rentals in standard properties can potentially achieve superior net yields.

Total Ownership Costs: Hidden Expenses That Affect ROI

A comprehensive ROI analysis must account for all ownership costs, not merely initial purchase price and gross rental income. These ongoing expenses can significantly impact net returns, and they differ substantially between branded residences and standard properties.

Branded residences typically impose higher annual service charges, reflecting the extensive amenity packages and professional management infrastructure. Annual service charges commonly range from AED 25 to AED 45 per square foot in branded developments, compared to AED 12 to AED 22 per square foot for standard properties. For a 1,200 square foot apartment, this translates to AED 30,000-54,000 annually for branded residences versus AED 14,400-26,400 for standard properties—a difference of approximately AED 15,600-27,600 per year.

Additionally, branded residences participating in rental programmes often incur monthly fees even during owner-occupied periods, covering amenities access, utilities infrastructure, and ongoing services. These can add another AED 3,000-8,000 to annual costs.

Property maintenance and repairs present another cost consideration. Branded residences, with their comprehensive management systems, typically include routine maintenance within service charges, providing cost predictability. Standard properties require owners to budget for periodic maintenance, repairs, and replacements, which can vary considerably year-to-year but generally average 1-2% of property value annually.

Insurance costs also diverge between property types. Comprehensive coverage for branded residences (including contents insurance for furnished units in rental programmes) typically costs AED 3,000-6,000 annually, whilst standard properties can be insured for AED 1,500-3,500 depending on coverage levels.

Utilities management differs as well. Branded residences in rental programmes typically absorb utilities within their management structure, simplifying owner obligations but incorporating these costs into management fees. Standard property owners pay utilities directly when units are vacant or owner-occupied, providing more granular cost control.

When calculating net ROI, these ownership costs can reduce returns by 2-4% annually for branded residences and 1.5-3% for standard properties. The impact becomes particularly significant over longer holding periods, potentially representing hundreds of thousands of dirhams in cumulative expenses.

Resale Value and Liquidity Considerations

An often-overlooked aspect of property investment involves exit strategy—the ability to sell the asset at a favourable price within a reasonable timeframe. Liquidity and resale value dynamics differ meaningfully between branded residences and standard properties in RAK.

Branded residences benefit from enhanced marketability to specific buyer segments. International investors, in particular, demonstrate strong preference for recognised brand names that provide familiarity and perceived quality assurance. This expands the potential buyer pool geographically, incorporating purchasers from Europe, Asia, and North America who might hesitate to invest in unknown developments but feel comfortable with established hospitality brands.

However, the higher absolute prices of branded residences naturally limit the total number of qualified buyers in any given market period. Properties priced above AED 3 million face a smaller pool of potential purchasers than those below AED 1.5 million, potentially extending time-to-sale during slower market conditions.

Standard properties, particularly those in the AED 800,000 to AED 1.5 million range, access the broadest buyer demographic, including first-time investors, owner-occupiers, and portfolio builders. This larger pool generally translates to faster sales cycles and more competitive bidding during active market periods.

Resale values for both property types benefit from RAK's overall market trajectory, though branded residences typically retain value more effectively during market corrections due to their differentiated positioning and the brand's continued marketing efforts that maintain awareness and desirability.

Liquidity—the ability to convert property to cash quickly—favours standard properties in absolute terms but may favour branded residences on a relative value basis. Well-priced standard properties in desirable locations can often sell within 30-90 days during normal market conditions, whilst branded residences might require 90-180 days to find the right buyer, but often achieve prices closer to asking levels due to their distinctive positioning.

For investors prioritising exit flexibility, maintaining realistic pricing expectations and working with experienced brokers familiar with investing in RAK property becomes essential regardless of property type.

The Intangible Value: Brand Power and Lifestyle Premium

Beyond quantifiable financial metrics, branded residences offer intangible benefits that, whilst difficult to express in precise ROI calculations, nonetheless contribute to investment value and owner satisfaction.

The brand association itself carries considerable weight. Properties bearing names like Waldorf Astoria, Anantara, or Ritz-Carlton benefit from decades of brand building, quality associations, and aspirational positioning. For owners, this translates to a certain prestige factor—the social currency of owning a property within a recognised luxury brand ecosystem.

This brand power extends to the rental market, where guests willingly pay premium rates for branded experiences, often 20-40% above comparable unbranded properties. The brand's loyalty programmes, marketing reach, and established reputation create demand advantages that independent properties struggle to replicate, regardless of their actual quality.

Lifestyle amenities in branded residences typically far exceed what standard developments offer. Access to destination-quality restaurants, full-service spas, championship golf courses, water sports facilities, and curated experiences creates a resort-style living environment that appeals to both owners and renters. For investors who occasionally occupy their properties, these amenities provide genuine lifestyle value beyond pure financial returns.

The professional management infrastructure also delivers peace of mind that carries inherent value. Knowing that a reputable international operator manages your asset, maintains quality standards, and protects brand reputation provides assurance that's difficult to quantify but nonetheless valuable, particularly for international investors who cannot personally oversee their properties.

Standard properties, whilst lacking these brand associations, offer their own intangible benefits: greater autonomy in property use, flexibility in rental strategies, and freedom from brand-imposed restrictions on modifications or usage. For some investors, this independence represents valuable optionality.

RAK Market Dynamics: Why This Emirate Offers Unique Opportunities

Ras Al Khaimah's property market operates within a distinctive context that influences both branded and standard property performance. Understanding these market-specific dynamics proves essential for accurate ROI projections.

The emirate's strategic positioning as a value alternative to Dubai and Abu Dhabi creates compelling investment fundamentals. Properties in RAK typically cost 30-50% less than comparable offerings in Dubai's secondary locations, whilst offering superior quality-to-price ratios. This value proposition attracts both investors seeking affordable entry points and end-users desiring premium amenities at accessible prices.

RAK's tourism sector has experienced remarkable growth, with visitor numbers increasing by double-digit percentages annually over recent years. Government initiatives promoting RAK as an adventure and nature tourism destination—complementing Dubai's urban tourism—have successfully diversified the emirate's appeal. This tourism growth directly benefits short-term rental strategies, particularly for branded residences integrated with resort infrastructure.

Infrastructure development continues to enhance RAK's connectivity and appeal. The expansion of RAK International Airport, improvements to the Emirates Road corridor, and development of new entertainment and retail destinations progressively reduce the emirate's historical disadvantage of distance from Dubai's core.

The regulatory environment in RAK also merits consideration. The emirate offers generous freehold ownership rights in designated areas, straightforward property registration processes, and investor-friendly policies that facilitate foreign ownership. Recent announcements regarding long-term residency visas for property investors further enhance the investment case.

Supply-demand dynamics currently favour investors, with absorption rates for quality developments remaining strong whilst new supply enters the market at a measured pace. This balanced growth trajectory suggests sustainable appreciation potential rather than the speculative bubbles that have periodically affected other UAE markets.

For investors evaluating branded versus standard properties, RAK's market context arguably benefits both categories, though branded residences may capture disproportionate upside from tourism growth whilst standard properties benefit more from the expanding resident population as RAK evolves into a genuine live-work-play destination rather than purely a weekend retreat.

Investment Timeline Scenarios: 5-Year vs 10-Year Projections

To illustrate the concrete financial implications of choosing branded versus standard properties, let's examine comparative scenarios over different investment horizons, using representative properties and conservative assumptions.

Scenario 1: Five-Year Investment Horizon

Consider a branded one-bedroom residence purchased for AED 2.4 million versus a standard one-bedroom apartment at AED 1.5 million, both in quality beachfront locations.

Branded Residence: Assuming 10% annual appreciation, the property value reaches approximately AED 3.86 million after five years. Net rental yields of 5.5% annually generate approximately AED 660,000 in cumulative net rental income. Total ownership costs (service charges, fees, insurance) of approximately AED 42,000 annually result in cumulative costs of AED 210,000. Total return equals capital appreciation of AED 1.46 million plus net rental income of AED 660,000 minus ownership costs of AED 210,000, totalling AED 1.91 million on an AED 2.4 million investment—approximately 79.6% total return or 12.4% annualised.

Standard Property: Assuming 8% annual appreciation, the property value reaches approximately AED 2.20 million after five years. Net rental yields of 7% annually generate approximately AED 525,000 in cumulative net rental income. Total ownership costs of approximately AED 24,000 annually result in cumulative costs of AED 120,000. Total return equals capital appreciation of AED 700,000 plus net rental income of AED 525,000 minus ownership costs of AED 120,000, totalling AED 1.105 million on an AED 1.5 million investment—approximately 73.7% total return or 11.7% annualised.

Over five years, the branded residence delivers slightly superior percentage returns and substantially higher absolute gains, though requiring 60% more initial capital.

Scenario 2: Ten-Year Investment Horizon

Extending the same properties over a decade amplifies the compounding effects.

Branded Residence: At 10% annual appreciation, value reaches approximately AED 6.22 million. Cumulative net rental income totals approximately AED 1.58 million. Cumulative ownership costs reach AED 462,000 (accounting for service charge increases). Total return equals capital appreciation of AED 3.82 million plus rental income of AED 1.58 million minus costs of AED 462,000, totalling AED 4.938 million—approximately 205.8% total return or 11.8% annualised.

Standard Property: At 8% annual appreciation, value reaches approximately AED 3.24 million. Cumulative net rental income totals approximately AED 1.27 million. Cumulative ownership costs reach AED 264,000. Total return equals capital appreciation of AED 1.74 million plus rental income of AED 1.27 million minus costs of AED 264,000, totalling AED 2.746 million—approximately 183.1% total return or 11% annualised.

The ten-year horizon reveals how the branded residence's higher appreciation rate compounds significantly, creating a wider absolute returns gap of over AED 2.1 million, whilst percentage returns also diverge more meaningfully.

These scenarios employ conservative assumptions and simplified calculations. Actual performance depends on numerous variables including specific property selection, market conditions, rental management effectiveness, and individual ownership costs. However, they illustrate the fundamental dynamics: branded residences typically deliver superior absolute and percentage returns over longer timeframes, particularly when markets appreciate robustly, whilst requiring substantially more initial capital.

Which Property Type Suits Your Investment Strategy?

The choice between branded residences and standard properties ultimately depends on individual investment objectives, capital availability, risk tolerance, and personal preferences rather than a universally "correct" answer.

Branded residences prove optimal for investors who:

- Possess sufficient capital to meet higher entry requirements without over-leveraging

- Prioritise passive income and professional management over hands-on involvement

- Seek maximum capital appreciation potential and can tolerate higher volatility

- Value the lifestyle amenities and may occasionally occupy the property personally

- Target international resale markets and appreciate brand recognition advantages

- Invest with longer time horizons (7-10+ years) that maximise compounding appreciation

- Prefer concentrated investments in fewer, higher-value assets

Standard properties suit investors who:

- Seek more accessible entry points to begin building property portfolios

- Desire greater flexibility in property use and rental strategies

- Prioritise current income (yield) over long-term capital appreciation

- Prefer portfolio diversification across multiple properties rather than concentration

- Accept more hands-on involvement in exchange for potentially higher net yields

- Target shorter investment horizons (3-5 years) where liquidity matters more

- Focus on the growing resident population rather than tourism-driven demand

Many sophisticated investors ultimately pursue both property types, constructing diversified portfolios that balance the growth potential of branded residences with the income generation and accessibility of standard properties. This approach captures benefits from both segments whilst mitigating category-specific risks.

The RAK market, with its current growth trajectory and diverse development pipeline, accommodates both strategies effectively. The key lies in matching property selection to clearly defined investment criteria rather than following trends or pursuing properties that exceed comfortable risk levels.

Working with specialists who possess deep understanding of RAK's nuanced submarkets, emerging developments, and property-specific performance characteristics significantly enhances investment outcomes regardless of chosen strategy. The difference between a well-selected property and a mediocre one within the same category often exceeds the average performance gap between categories themselves.

The choice between branded residences and standard properties in Ras Al Khaimah represents more than a simple financial calculation—it reflects your investment philosophy, capital position, and lifestyle preferences. Our analysis reveals that branded residences typically deliver superior total returns over extended holding periods, with annualised returns potentially exceeding standard properties by 0.7-1.5 percentage points when combining capital appreciation and rental income. However, this performance advantage requires substantially higher initial capital deployment and acceptance of higher ongoing ownership costs.

Standard properties offer compelling value propositions in their own right: accessible entry points that facilitate portfolio building, competitive rental yields especially for hands-on investors, and strong liquidity characteristics that support shorter investment horizons. For many investors, particularly those beginning their RAK property journey, standard properties provide an optimal foundation for wealth building within the emirate's dynamic market.

The exceptional aspect of RAK's current market environment is that both property categories offer genuinely attractive risk-adjusted returns compared to many global alternatives. The emirate's combination of robust economic fundamentals, strategic government initiatives, infrastructure development, and relative affordability positions it for continued outperformance within the UAE property market.

Successful property investment ultimately depends less on choosing the theoretically superior category and more on selecting specific, well-positioned properties that align with your individual circumstances. Market timing, development quality, location selection, and purchase price negotiation often impact returns more significantly than the broad category distinction between branded and standard properties.

As RAK continues its evolution from weekend retreat to comprehensive lifestyle destination, opportunities in both segments will proliferate. The investors who thrive will be those who combine thorough market knowledge, clear investment criteria, and disciplined execution—regardless of whether they pursue the prestige of branded residences or the versatility of standard properties.

Partner with RAK Property Investment Specialists

Navigating RAK's diverse property landscape requires expert guidance and market insights that only come from dedicated specialisation. At Azimira Real Estate, we provide discerning investors with exclusive access to both premium branded residences and carefully selected standard properties across Ras Al Khaimah's most promising developments.

Our deep market expertise, established developer relationships, and commitment to personalised service ensure you identify opportunities perfectly aligned with your investment objectives and financial parameters. Whether you're pursuing your first RAK property or expanding an established portfolio, we guide you through every stage of the acquisition journey.

Discover how our curated selection of off-plan and ready properties, combined with detailed ROI analysis and ongoing support, can accelerate your wealth-building journey in one of the UAE's most exciting emerging markets.

Schedule your confidential investment consultation today and gain access to exclusive opportunities not available to the general public.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.