Building Passive Income with RAK Property: Complete Strategy Guide

Discover proven strategies for building sustainable passive income through RAK property investments. Expert guidance on rental yields, off-plan opportunities, and wealth-building tactics.

Table Of Contents

- Why Ras Al Khaimah Offers Exceptional Passive Income Potential

- Understanding Passive Income Models in RAK Real Estate

- Selecting the Right Property Type for Maximum Returns

- Off-Plan vs Ready Properties: Which Generates Better Passive Income?

- Financial Planning: Structuring Your RAK Investment for Optimal Cash Flow

- Rental Yield Optimisation Strategies

- Long-Term Wealth Building Through Capital Appreciation

- Legal Considerations and Property Management

- Common Pitfalls to Avoid When Building Passive Income

- How Azimira Maximises Your Passive Income Potential

Building a reliable passive income stream through property investment has become increasingly attractive for discerning investors seeking financial independence and wealth preservation. Whilst traditional markets like Dubai and Abu Dhabi have long dominated the UAE investment landscape, Ras Al Khaimah (RAK) has emerged as a compelling alternative that combines affordability with exceptional growth potential and attractive rental yields.

The northernmost emirate offers a unique proposition: lower entry points than its southern neighbours, robust infrastructure development, and a growing expatriate community that's driving consistent rental demand. For investors who understand how to navigate this market strategically, RAK property presents opportunities to generate sustainable passive income whilst benefiting from significant capital appreciation—a combination that's increasingly rare in mature markets.

This comprehensive guide explores the complete strategy for building passive income through RAK property investments. From selecting the right property type and understanding financial structures to optimising rental yields and avoiding common pitfalls, you'll discover the proven frameworks that successful investors are using to build wealth in this dynamic market. Whether you're seeking immediate cash flow or long-term appreciation with rental income, this guide provides the roadmap you need to succeed.

Why Ras Al Khaimah Offers Exceptional Passive Income Potential

Ras Al Khaimah has undergone a remarkable transformation over the past decade, evolving from a quiet northern emirate into a strategic investment destination that savvy investors are increasingly recognising. The emirate's government has invested billions in infrastructure development, including the expansion of RAK International Airport, new road networks connecting to Dubai and other emirates, and world-class amenities that rival those found in more established markets. This infrastructure growth has catalysed population expansion, with expatriate professionals and families drawn to RAK's combination of affordability, quality of life, and proximity to Dubai's economic opportunities.

The passive income potential in RAK stems from several converging factors that create a favourable investment environment. Property prices remain significantly lower than Dubai or Abu Dhabi—often 40-60% less for comparable properties—which means lower capital requirements and higher percentage returns on investment. Meanwhile, rental demand continues to strengthen as businesses establish operations in RAK's free zones and residents seek affordable alternatives to Dubai's escalating costs. This supply-demand dynamic translates into rental yields that frequently exceed 7-9% annually, compared to 5-6% in more saturated markets.

Beyond immediate rental returns, RAK's strategic development initiatives position the emirate for sustained capital appreciation. The government's RAK 2030 Economic Vision focuses on tourism expansion, industrial diversification, and becoming a regional logistics hub. Major projects like Al Marjan Island's luxury developments, the expansion of business parks, and new entertainment destinations are attracting international attention and investment capital. For passive income investors, this means properties purchased today benefit from both current rental yields and the potential for significant value appreciation as these development plans materialise over the coming years.

Understanding Passive Income Models in RAK Real Estate

Successful passive income generation through RAK property requires understanding the various models available and selecting the approach that aligns with your financial objectives, risk tolerance, and investment timeline. Each model offers distinct advantages and considerations that influence both short-term cash flow and long-term wealth accumulation.

Traditional Buy-to-Let remains the most straightforward passive income model, where investors purchase completed properties and lease them to tenants on annual contracts. This approach provides immediate rental income once the property is acquired and tenanted, with relatively predictable cash flows assuming proper tenant selection and property management. In RAK, buy-to-let investors typically target apartments in established communities or villas in family-oriented developments, where tenant demand remains consistent and vacancy periods are minimal. The key advantage lies in immediate income generation, though investors must account for property management responsibilities and ongoing maintenance costs that can impact net returns.

Off-Plan Investment with Deferred Income represents a more capital-efficient approach that's particularly relevant in RAK's growing market. Investors purchase properties during the construction phase, benefiting from developer payment plans that spread the purchase price over 2-4 years whilst the property is being built. Although rental income is deferred until completion, this model offers several advantages: lower initial capital requirements, potential for capital appreciation before completion, and the ability to acquire multiple properties with the same capital that would purchase one ready property. Many sophisticated investors use this model to build a portfolio of properties that begin generating passive income sequentially as each completes, creating a staged income stream that grows over time.

Hybrid Portfolio Strategy combines both ready and off-plan properties to balance immediate income with future growth. This approach might involve purchasing one or two ready properties that generate cash flow immediately whilst simultaneously acquiring off-plan units that will appreciate and begin producing income in future years. The hybrid model provides income stability from current rentals whilst building long-term wealth through the capital appreciation typically associated with off-plan investments. For investors seeking to build substantial passive income over a 3-5 year horizon, this balanced approach offers both immediate returns and compounding growth potential.

Selecting the Right Property Type for Maximum Returns

Property type selection fundamentally determines your passive income potential, as different property categories attract distinct tenant demographics, command varying rental rates, and require different management approaches. Understanding these dynamics enables strategic selection that maximises returns whilst minimising vacancy risks and management complexity.

Studio and one-bedroom apartments serve the young professional and single expatriate market, offering the highest yields relative to purchase price—often 8-10% in well-located RAK developments. These units typically rent quickly due to their affordability and appeal to the large demographic of single workers employed in RAK's free zones and hospitality sector. However, tenant turnover tends to be higher, as renters in this category frequently relocate for career opportunities or upgrade to larger accommodations as their circumstances change. Investors selecting this property type should prioritise developments near employment centres, with quality amenities that justify premium rents and help retain tenants longer.

Two and three-bedroom apartments attract small families and sharing professionals, providing a middle ground between yield and stability. Rental rates are higher in absolute terms than studios, though yields typically range from 7-9% depending on location and development quality. Family tenants generally remain longer—often renewing for multiple years—which reduces vacancy periods and turnover costs. These properties perform particularly well in communities with good schools, family amenities, and safe environments. For investors seeking predictable, stable passive income with moderate management requirements, this category often represents the optimal balance.

Luxury villas and townhouses cater to affluent families and executives, commanding premium rents but requiring higher capital investment. Yields typically range from 6-8%, lower in percentage terms but often higher in absolute income due to elevated rental rates. The tenant pool is smaller and more selective, potentially resulting in longer marketing periods when vacancies occur. However, tenants in this segment typically maintain properties to high standards, remain for extended periods, and pay reliably. Investors with sufficient capital who prioritise income stability over maximum percentage yields often find luxury properties provide the best risk-adjusted returns, particularly in prestigious communities with waterfront access or golf course views.

Emerging property types including serviced apartments and holiday homes offer alternative passive income models worth considering. Serviced apartments combine residential property with hotel-style management, generating income through short-term rentals whilst the management company handles all operational aspects. Holiday homes in resort areas can produce higher per-night rates during peak seasons, though income fluctuates seasonally and management is more intensive. These alternatives suit investors comfortable with less predictable income patterns in exchange for potentially higher returns during strong periods.

Off-Plan vs Ready Properties: Which Generates Better Passive Income?

The choice between off-plan and ready properties represents one of the most critical decisions in structuring your passive income strategy, as each approach offers distinct financial profiles, risk characteristics, and timeline considerations that significantly impact your overall returns.

Off-plan properties provide several compelling advantages for passive income investors with medium to long-term perspectives. Developer payment plans typically require only 10-20% down payment, with the balance spread across construction milestones over 2-4 years. This structure enables capital-efficient portfolio building, allowing investors to secure multiple properties with the same capital that would purchase one ready unit. Historical data from RAK's property market shows that well-selected off-plan properties often appreciate 15-25% between purchase and completion, meaning investors benefit from capital growth before receiving the first rental payment. When completed properties begin generating 7-9% annual yields on the appreciated value, the effective return on initial capital invested can exceed 20-30% annually when combining rental income with realised appreciation.

However, off-plan investment requires patience and careful developer selection, as passive income is deferred until project completion. Construction delays—whilst less common with reputable developers—can extend the timeline before rental income commences. Investors must also maintain financial capacity to meet payment instalments throughout the construction period without receiving offsetting rental income. This model works best for investors who have alternative income sources during the construction phase and view off-plan purchases as strategic wealth-building positions rather than immediate income requirements.

Ready properties deliver immediate passive income, making them suitable for investors who require current cash flow or prefer the certainty of established assets. Upon completion of purchase, properties can typically be tenanted within 30-60 days, generating rental returns immediately. There's no construction risk, no waiting period, and the property's condition and community amenities are fully visible before purchase. For investors transitioning to retirement, seeking to supplement current income, or uncomfortable with the uncertainties inherent in off-plan investment, ready properties provide the security and immediacy that aligns with these objectives.

The trade-off lies in higher initial capital requirements and potentially lower overall returns. Ready properties require full payment (or substantial down payments if financed), absorbing more capital per unit and limiting portfolio diversification. Without the appreciation runway that off-plan properties typically enjoy, ready properties must generate all returns through rental yields alone. In RAK's current market, this often means 7-9% annual returns rather than the combined 20-30% that successful off-plan investments can achieve when factoring in both appreciation and subsequent rental yields.

Strategic investors often employ a sequenced approach: beginning with one or two ready properties that generate immediate passive income, then using that cash flow to fund payment instalments on off-plan properties that will appreciate and begin producing income upon completion. This progression creates a self-funding portfolio expansion strategy where early investments finance later acquisitions, compounding wealth whilst maintaining income throughout the journey. By understanding Investing in RAK Property: Unlocking Exceptional Returns and Growth, investors can structure their acquisition timeline to balance immediate income needs with long-term wealth accumulation objectives.

Financial Planning: Structuring Your RAK Investment for Optimal Cash Flow

Effective financial structuring determines whether your RAK property investment generates genuinely passive income or becomes a capital drain that undermines your wealth-building objectives. Strategic investors approach financial planning holistically, considering not just acquisition costs but the complete lifecycle of expenses, income streams, and tax implications that influence net returns.

Capital Allocation Strategy begins with determining your total investment capacity and dividing it optimally across deposits, reserves, and diversification. Conservative financial planning suggests allocating no more than 70-80% of available capital to property deposits, maintaining 20-30% as liquidity reserves for unforeseen expenses, vacancy periods, or opportunistic additional investments. Within the property allocation, diversification across 2-3 properties reduces concentration risk compared to committing all capital to a single unit. If you have AED 500,000 available for investment, structuring this as deposits on two off-plan properties (AED 175,000 each) with AED 150,000 in reserves provides better risk management than purchasing one ready property for AED 450,000 with minimal reserves.

Financing Considerations significantly impact passive income generation, as mortgage payments directly reduce net rental income. UAE banks typically offer mortgages to expatriate investors at 75% loan-to-value for ready properties and 50% for off-plan, with interest rates ranging from 4-6% annually. Running detailed cash flow projections is essential: a property generating AED 60,000 annual rent appears attractive, but after deducting AED 35,000 in mortgage payments, AED 6,000 in service charges, AED 3,000 in maintenance, and AED 2,000 in management fees, net passive income reduces to AED 14,000—just 2.8% yield on the total property value. Many successful passive income investors in RAK choose to purchase properties outright or with minimal financing, accepting smaller portfolios in exchange for higher net yields and genuine passivity without mortgage obligations.

Expense Forecasting requires accounting for all costs that reduce gross rental income. Beyond obvious expenses like service charges (typically AED 8-15 per square foot annually in RAK) and property management fees (usually 5-8% of annual rent), investors must budget for periodic maintenance, municipality fees (5% of annual rent in RAK), insurance, and vacancy provisions. Conservative financial planning assumes 4-6 weeks of vacancy between tenancies, during which no rent is received whilst service charges and other costs continue. Creating a comprehensive expense model before purchase ensures you understand true net yields rather than being surprised by costs that erode projected returns. Properties marketed with "10% gross yields" often deliver 6-7% net yields after all expenses—still attractive, but significantly different from initial impressions.

Tax Efficiency Planning takes advantage of the UAE's favourable tax environment whilst preparing for potential future changes. Currently, the UAE imposes no personal income tax on rental income, meaning investors retain all net income generated. However, investors who are tax residents in other jurisdictions must understand their home country's tax treatment of foreign property income. Additionally, whilst the UAE introduced corporate tax in 2023, natural persons holding property for investment purposes generally fall outside corporate tax scope. Consulting with tax advisors familiar with both UAE regulations and your home jurisdiction ensures compliant structuring that maximises after-tax returns. Some investors establish UAE companies to hold properties, which may offer advantages for estate planning or if eventually moving into commercial property investment, though this adds complexity and costs that should be weighed carefully against benefits.

Rental Yield Optimisation Strategies

Maximising passive income from RAK property extends beyond initial purchase decisions to encompass active strategies that optimise rental yields, reduce vacancy periods, and enhance tenant retention. Whilst the goal is passive income, strategic interventions during the tenanting and management phases can increase annual returns by 15-25% compared to passive approaches.

Strategic Property Presentation significantly influences both achievable rental rates and speed of tenanting. Professional photography, virtual tours, and detailed property descriptions that highlight unique features attract higher-quality tenant enquiries and justify premium pricing. In RAK's competitive rental market, properties presented professionally often achieve 5-10% higher rents than comparable units with amateur marketing. Similarly, ensuring properties are immaculately clean, freshly painted, and in perfect working order before viewings creates positive impressions that translate into stronger offers and faster agreements. The AED 3,000-5,000 invested in professional presentation typically returns multiples through higher rents and reduced vacancy periods.

Furnishing Decisions require market-specific analysis, as the optimal approach varies by property type and target tenant demographic. Studio and one-bedroom apartments often achieve 15-25% rental premiums when offered fully furnished, as young professionals prefer move-in-ready accommodations and lack furniture from relocations. However, furnished properties also experience higher wear and require periodic furniture replacement, potentially negating premium income. Larger family apartments and villas typically rent unfurnished in RAK, as families relocating to the emirate bring their own furniture and prefer customising their living spaces. Investors should research comparable listings in their specific development and property category to determine whether furnishing investments will generate positive returns.

Tenant Screening and Retention directly impacts passive income stability and long-term returns. Implementing thorough screening processes—including employment verification, reference checks, and financial capability assessment—reduces default risks and problematic tenancies that can result in legal costs and extended vacancy periods. Once quality tenants are secured, proactive retention strategies including responsive maintenance, reasonable renewal terms, and positive landlord relationships encourage multi-year tenancies that eliminate vacancy costs and turnover expenses. Offering modest rent increases at renewal (3-5% rather than market maximums of 8-10%) often proves financially superior when factoring in the 1-2 months of vacancy and re-marketing costs associated with tenant turnover.

Amenity Enhancement through modest upgrades can justify rental premiums that exceed improvement costs. Installing quality appliances, upgrading bathroom fixtures, adding built-in wardrobes, or improving lighting creates tangible value that tenants will pay for. In RAK's market, a AED 10,000 kitchen upgrade might support AED 2,000-3,000 higher annual rent—a 20-30% return on the improvement investment annually. Strategic investors analyse which specific upgrades generate the highest marginal rent increases in their property category, focusing capital on high-return improvements rather than comprehensive renovations that may not proportionally increase rental income.

Long-Term Wealth Building Through Capital Appreciation

Whilst immediate passive income through rental yields attracts many investors to RAK property, the most substantial wealth accumulation typically occurs through capital appreciation—the increase in property values over time. Understanding how to position investments for maximum appreciation whilst generating current income creates a powerful dual-return strategy that compounds wealth exponentially.

RAK's property market has demonstrated consistent appreciation trends over the past five years, with well-located properties in premium developments appreciating 35-50% since 2019. This growth reflects the emirate's fundamental transformation: population increases, infrastructure improvements, economic diversification, and growing recognition among international investors. Unlike speculative appreciation driven by market euphoria, RAK's value growth stems from genuine demand increases and supply constraints in the most desirable locations. Properties in developments like Al Marjan Island's waterfront communities or premium villa projects near championship golf courses have shown particularly strong appreciation as these areas establish reputations for lifestyle quality and investment returns.

Positioning for appreciation requires selecting properties and locations with clear growth catalysts that will drive future demand. Proximity to announced infrastructure projects—new road connections, airport expansions, commercial developments—often predicts above-average appreciation as these improvements materialise. Similarly, properties in communities that are building strong reputations for quality, management excellence, and resident satisfaction tend to appreciate faster than comparable properties in less distinguished developments. Savvy investors research development track records, community governance structures, and master plan completion timelines to identify properties likely to benefit from these appreciation drivers.

The compounding effect of combining rental yields with appreciation creates extraordinary wealth-building potential. Consider a property purchased off-plan for AED 800,000 that appreciates to AED 1,000,000 by completion—a 25% gain. Upon completion, the property generates AED 80,000 annual rent (8% yield on current value). After five years of rental income totalling AED 400,000 and further appreciation to AED 1,200,000, the total return is AED 800,000 on the initial AED 800,000 investment—effectively doubling capital in five years whilst generating passive income throughout. This compounding dynamic explains why experienced investors often reinvest rental income into additional property deposits rather than consuming the income, accelerating portfolio expansion and wealth multiplication.

Strategic holding periods balance income generation with appreciation capture. Whilst some investors hold properties indefinitely, continuously collecting rental income, others employ targeted holding periods of 3-5 years, selling once substantial appreciation is realised and reinvesting proceeds into newer off-plan opportunities where the appreciation cycle can repeat. This recycling strategy—buying off-plan, holding through completion and initial rental periods, selling after appreciation, and reinvesting—can generate superior long-term returns compared to indefinite holding, particularly in markets like RAK where new development opportunities continuously emerge. The optimal approach depends on individual financial objectives, but understanding both strategies enables informed decisions aligned with your wealth-building timeline.

Legal Considerations and Property Management

Navigating RAK's legal framework and establishing effective property management systems are essential foundations for sustainable passive income generation. Whilst the UAE offers investor-friendly regulations, understanding specific requirements and structuring compliant arrangements protects your investment and ensures uninterrupted income streams.

Ownership Structures and Regulations in RAK permit freehold ownership for expatriate investors in designated areas, providing the same ownership rights enjoyed by UAE nationals within these zones. Foreign investors can acquire properties in freehold communities without requiring UAE residency, though property ownership above certain thresholds may qualify investors for residence visas—a valuable benefit for those seeking UAE residency options. Title registration occurs through RAK's Land Department, which has implemented efficient digital systems that streamline property transfers and provide transparent ownership records. Understanding these ownership rights and registration requirements ensures proper legal title and protects your investment from disputes or claims.

Tenancy Regulations governing landlord-tenant relationships are established by RAK Municipality and largely align with broader UAE tenancy laws whilst incorporating emirate-specific provisions. Rental contracts must be registered with the municipality, with fees calculated as 5% of annual rent (often split between landlord and tenant by negotiation). Contracts typically follow annual terms with rents paid in 1-4 cheques depending on negotiations. Rent increase limitations apply: landlords cannot increase rents more frequently than annually, and increases must align with RAK's rental index that establishes maximum permissible increases based on market comparisons. Understanding these regulations prevents legal violations that could result in penalties or tenant disputes that disrupt income.

Property Management Options range from self-management to full-service professional management, with the optimal approach depending on your involvement preference, property count, and location relative to your residence. Self-management offers maximum cost control, with landlords handling tenant communications, maintenance coordination, and rent collection directly. This approach suits investors with single properties, local residence, and willingness to address occasional tenant issues personally. However, self-management becomes impractical for investors with multiple properties, international residence, or preferences for genuinely passive arrangements.

Professional property management companies typically charge 5-8% of annual rent, handling all tenant interactions, maintenance coordination, rent collection, and lease renewals. Quality managers add substantial value: they market properties effectively, reducing vacancy periods; screen tenants thoroughly, minimising default risks; coordinate maintenance efficiently, preserving property condition; and handle disputes professionally, avoiding escalation. For investors seeking truly passive income, professional management is essential despite the cost. The key is selecting reputable managers with RAK-specific experience, verified references, and transparent reporting systems that provide visibility into property performance and financial accounts.

Maintenance and Insurance require proactive planning to protect passive income streams from disruption. Establishing maintenance reserves equal to 1-2% of property value annually provides capital for addressing air conditioning failures, plumbing issues, or appliance replacements without impacting rental income. Comprehensive property insurance—covering building structure, owner's fixtures, and liability—protects against catastrophic losses from fire, flooding, or tenant incidents. Whilst insurance costs are modest (typically AED 1,000-2,000 annually for standard apartments), the protection provided is invaluable for preserving both the asset and income-generating capacity.

Common Pitfalls to Avoid When Building Passive Income

Even experienced investors can fall prey to common mistakes that undermine passive income objectives when entering new markets. Understanding these pitfalls enables proactive avoidance, protecting both capital and income potential whilst accelerating your path to sustainable returns.

Chasing headline yields without expense analysis represents perhaps the most frequent error. Properties marketed with "12% guaranteed returns" or "10% yields" often fail to disclose that these are gross figures before service charges, management fees, maintenance costs, and vacancy provisions. Investors who purchase based on gross yields without conducting detailed net yield calculations frequently discover actual returns are 30-40% lower than expectations. Always calculate net yields using realistic expense assumptions: service charges, management fees, maintenance reserves, municipality fees, insurance, and vacancy provisions. Properties with 8% net yields after all expenses deliver better passive income than properties claiming 12% gross yields that net only 6% after costs.

Inadequate due diligence on developers and projects can result in delayed completions, quality issues, or worst case, project cancellations that eliminate anticipated income entirely. Not all developers maintain equal standards of financial stability, construction quality, and completion reliability. Investors should verify developer track records, visit completed projects to assess quality standards, review financial stability indicators, and understand legal protections including escrow arrangements. In RAK's growing market, established developers with multiple completed projects offer substantially lower risk than new entrants without proven track records, even if the latter offer slightly lower prices.

Overleveraging through excessive financing creates financial fragility where passive income becomes negative cash flow that requires ongoing capital injections. When mortgage payments, service charges, and other expenses exceed rental income—a situation called negative gearing—properties consume rather than generate cash. Whilst some investors accept temporary negative gearing expecting future rent increases to reverse the situation, this strategy contradicts passive income objectives and creates financial stress if rental markets soften. Conservative financing where rental income comfortably exceeds all expenses including debt service ensures genuinely passive, positive cash flow regardless of market fluctuations.

Neglecting tax implications in home jurisdictions can result in unexpected tax liabilities that significantly reduce net returns. Whilst the UAE imposes no income tax on rental income, investors who are tax residents in countries with worldwide taxation may owe substantial taxes on UAE rental income. Without proper planning and potentially establishing UAE tax residency, these obligations can consume 20-40% of rental income. Consulting with international tax advisors before investing ensures compliant structuring and realistic net return expectations after all tax obligations.

Failing to maintain adequate reserves leaves investors financially exposed when unexpected expenses arise. Air conditioning failures, plumbing emergencies, tenant defaults, or extended vacancy periods require capital to address without disrupting passive income or forcing distressed property sales. Maintaining liquidity reserves equal to 6-12 months of property expenses provides resilience to navigate challenges whilst preserving long-term investment positions. Properties may be illiquid assets, but successful passive income strategies require liquid reserves to support them.

How Azimira Maximises Your Passive Income Potential

Navigating RAK's property market successfully requires more than understanding general investment principles—it demands local expertise, exclusive access to premium opportunities, and strategic guidance tailored to your specific passive income objectives. Azimira Real Estate's specialised focus on RAK and broader UAE off-plan investments positions the company to deliver advantages that significantly enhance your wealth-building outcomes.

Azimira's exclusive access to pre-launch and off-market properties provides clients with opportunities unavailable through general market channels. By maintaining close relationships with RAK's leading developers, Azimira secures allocation in premium projects before public release, often at preferential pricing that immediately creates equity and enhances future returns. These pre-launch opportunities represent the properties with greatest appreciation potential, as early investors benefit from all subsequent price increases as projects progress through construction and marketing phases. For passive income investors, purchasing at initial release prices means rental yields are calculated on appreciated values by completion, substantially enhancing effective returns.

The company's deep market insights and investment strategy expertise enable precise property selection aligned with your passive income goals. Rather than offering generic recommendations, Azimira's consultants analyse your capital position, income requirements, risk tolerance, and timeline to structure bespoke strategies combining optimal property types, locations, and acquisition timing. This tailored approach might recommend a hybrid portfolio balancing ready properties for immediate income with off-plan acquisitions for future appreciation, or focus exclusively on high-yield apartment investments if current cash flow is your priority. Understanding Exclusive RAK Off-Plan Projects currently available enables strategic positioning in developments with strongest passive income potential.

Azimira's end-to-end service throughout the acquisition journey transforms what could be a complex, uncertain process into a streamlined experience that preserves your time and mental energy. From initial consultation and property selection through legal documentation, payment processing, and eventual handover, Azimira's team manages all complexities on your behalf. This comprehensive support is particularly valuable for international investors who may be unfamiliar with UAE processes or unable to be physically present throughout the transaction. By handling all administrative requirements, legal coordination, and developer liaison, Azimira enables you to focus on strategic decisions whilst the operational details are expertly managed.

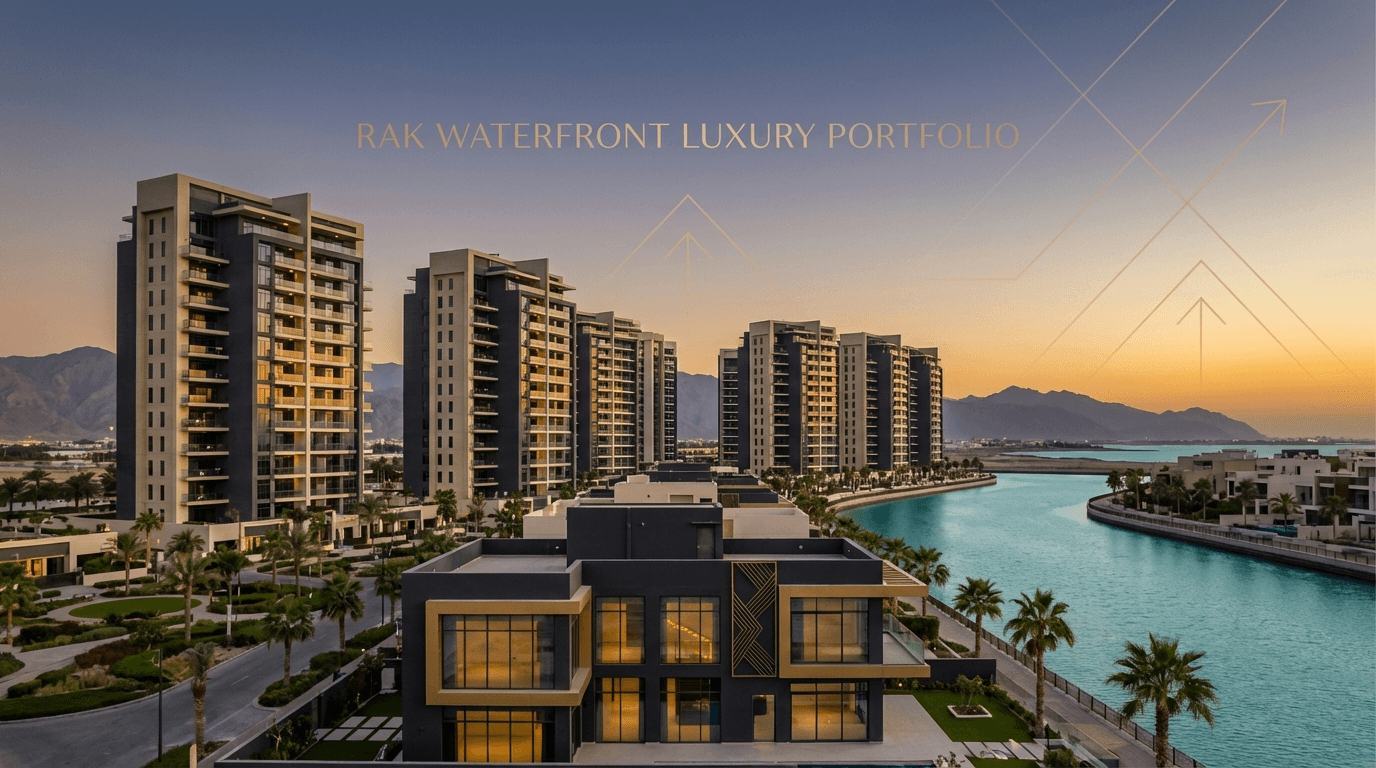

The company's commitment to premium, high-growth properties ensures your portfolio comprises assets positioned for maximum appreciation alongside strong rental yields. Azimira's curated selection focuses on luxury waterfront apartments, exclusive villa communities, and premium developments in RAK's most desirable locations—properties that attract affluent tenants willing to pay premium rents whilst appreciating substantially as RAK continues its transformation. This quality-focused approach contrasts with volume-oriented agencies that may recommend properties based on commission potential rather than client outcomes. For passive income investors, Azimira's alignment with your success—through recommendations that genuinely optimise your returns—creates the foundation for long-term wealth building.

Strategic market timing guidance helps you capitalise on RAK's development cycles and market conditions. Property markets move in cycles, with periods of exceptional opportunity alternating with phases where returns moderate. Azimira's market monitoring and developer relationship intelligence enables identification of optimal entry points—moments when pre-launch pricing, payment terms, and appreciation potential converge to create superior investment opportunities. This timing advantage can mean the difference between good returns and exceptional returns, as properties acquired at cycle inflection points often deliver substantially higher appreciation than purchases made during peak periods.

Building sustainable passive income through RAK property represents one of the most compelling wealth-building strategies available to investors today, combining the UAE's tax-free environment with RAK's unique combination of affordability, growth potential, and attractive rental yields. The strategies outlined in this guide—from understanding income models and selecting optimal property types to structuring finances effectively and avoiding common pitfalls—provide the framework for success in this dynamic market.

The key to exceptional outcomes lies in strategic execution: selecting properties positioned for both immediate rental yields and long-term appreciation, structuring finances to ensure genuinely positive cash flow, and partnering with experts who provide exclusive access to the market's best opportunities. RAK's transformation from quiet northern emirate to strategic investment destination is well underway, but substantial appreciation potential remains for investors who position themselves thoughtfully in the coming years.

Whether you're seeking to replace employment income, fund retirement, or build generational wealth, RAK property offers proven pathways to these objectives through carefully structured passive income strategies. The combination of current yields exceeding 7-9% and appreciation potential of 15-25% over medium-term holding periods creates a compelling dual-return proposition that few markets globally can match. By applying the insights and frameworks explored in this guide whilst leveraging specialist expertise to navigate RAK's specific opportunities and requirements, you position yourself to build the passive income streams that support your financial independence and wealth accumulation goals.

Start Building Your RAK Passive Income Portfolio Today

Transform your financial future with strategic RAK property investments that generate sustainable passive income whilst building long-term wealth. Azimira Real Estate's exclusive access to premium off-plan and luxury properties, combined with tailored investment strategies and comprehensive support, ensures you capitalise on RAK's exceptional opportunities.

Schedule your confidential consultation with Azimira's investment specialists to discover how carefully selected RAK properties can create the passive income streams you're seeking. Our team will analyse your specific objectives, present exclusive opportunities aligned with your goals, and guide you through every step of building your wealth-generating property portfolio.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.