Ground Floor vs High Floor Units: Which Rents Better in RAK?

Discover which floor level delivers superior rental returns in Ras Al Khaimah. Expert analysis of ground floor vs high floor units for savvy property investors.

Table Of Contents

- Understanding RAK's Unique Rental Market Dynamics

- Ground Floor Units: Rental Performance Analysis

- High Floor Units: Rental Market Performance

- RAK Tenant Preferences: What the Data Reveals

- Rental Yield Comparison: Ground vs High Floors

- Location-Specific Factors in RAK

- Amenity Access and Rental Appeal

- Long-Term Investment Perspective

- Making the Right Choice for Your Investment Strategy

When investing in Ras Al Khaimah's burgeoning property market, one question consistently emerges amongst discerning investors: does floor level genuinely impact rental performance? The answer is more nuanced than many realise, particularly in RAK's distinctive market where waterfront living, mountain views, and family-oriented communities create unique tenant preferences.

Whilst Dubai and Abu Dhabi have established rental patterns, RAK's emerging market presents exceptional opportunities for investors who understand the subtle dynamics between ground floor accessibility and high floor premium positioning. The floor level you select can significantly influence not only your initial rental yield but also tenant retention rates, maintenance costs, and long-term capital appreciation.

This comprehensive analysis examines actual rental performance data, tenant demographics, and RAK-specific market factors to help you make an informed investment decision. Whether you're considering a luxury waterfront apartment or an exclusive villa community investment, understanding floor-level dynamics is essential for maximising your returns in this exciting emirate.

Understanding RAK's Unique Rental Market Dynamics

Ras Al Khaimah has experienced remarkable transformation over recent years, evolving from a quiet emirate into a sought-after residential and investment destination. Unlike the high-density vertical living characteristic of Dubai Marina or Downtown Dubai, RAK's property market emphasises lifestyle, space, and natural surroundings. This fundamental difference shapes tenant preferences in ways that don't always align with traditional UAE rental patterns.

The emirate attracts a diverse tenant base including young families seeking affordable quality accommodation, professionals working in RAK's growing industrial and tourism sectors, and expatriates prioritising lifestyle over proximity to Dubai's commercial districts. Each demographic group demonstrates distinct preferences regarding floor levels, influenced by factors such as children's safety, pet ownership, outdoor space access, and view premiums.

RAK's rental market also benefits from comparatively lower price points than Dubai or Abu Dhabi, meaning tenants often secure larger units with superior specifications for similar budgets. This value proposition influences floor-level preferences, as tenants may prioritise practical considerations like garden access over prestige factors that dominate in more expensive markets. Understanding these unique dynamics is essential for optimising your investment strategy.

Ground Floor Units: Rental Performance Analysis

Ground floor apartments in RAK have demonstrated surprisingly robust rental performance, often contradicting assumptions that higher floors automatically command premium rents. The key lies in understanding which tenant segments find ground floor living most appealing and how RAK's development characteristics enhance these units' value proposition.

Key Advantages for Rental Income

Family appeal and immediate accessibility represent the primary rental advantage for ground floor units in RAK. Families with young children consistently favour ground floor apartments, particularly those with direct garden or terrace access. The ability to supervise children playing outdoors whilst remaining inside the unit creates significant appeal for this substantial tenant demographic. Many RAK developments feature generous outdoor spaces, transforming ground floor units from basic apartments into semi-villa experiences.

Pet-friendly premium positioning has emerged as a notable rental differentiator in RAK's market. Ground floor units with direct outdoor access command rental premiums from pet owners, who represent a growing and underserved tenant segment. The convenience of garden access for pets eliminates common friction points associated with higher floor living, making these units particularly attractive to this demographic willing to pay above-market rates for suitable accommodation.

Extended living space and lifestyle value substantially enhance ground floor rental appeal. Units with terraces, private gardens, or courtyard access effectively double usable space, creating exceptional value perception amongst tenants. In RAK's lifestyle-focused market, outdoor living space carries particular weight, with many tenants prioritising garden access over additional bedroom space. This translates into strong rental demand and competitive yields.

Reduced tenant turnover and longer tenancies represent often-overlooked financial benefits. Ground floor units suited to families and pet owners typically experience longer tenancy periods, reducing vacancy rates and turnover costs. When tenants with children or pets find suitable ground floor accommodation, they're statistically more likely to renew leases, providing landlords with stable, predictable rental income.

Potential Rental Challenges

Despite their advantages, ground floor units present specific considerations that investors must evaluate. Privacy concerns and security perceptions can deter certain tenant segments, particularly single professionals or couples without children who may prefer the perceived security of higher floors. Properties with inadequate landscaping, window treatments, or boundary definitions may struggle to attract premium rents from privacy-conscious tenants.

Noise exposure and disturbance factors vary significantly by development quality and location. Ground floor units adjacent to communal facilities, parking areas, or high-traffic zones may experience noise issues that impact rental appeal. However, well-designed RAK developments with thoughtful landscaping and unit positioning largely mitigate these concerns, maintaining strong rental performance.

Limited view premiums mean ground floor units typically cannot command the view-related rental uplifts available to high floor apartments overlooking RAK's stunning coastline or Hajar Mountains. In developments where views represent a primary value proposition, this limitation may impact comparative rental yields.

High Floor Units: Rental Market Performance

High floor apartments in RAK occupy a distinct market position, appealing to tenant demographics with different priorities and typically commanding rental premiums in developments where views and prestige carry significant weight.

Premium Rental Positioning

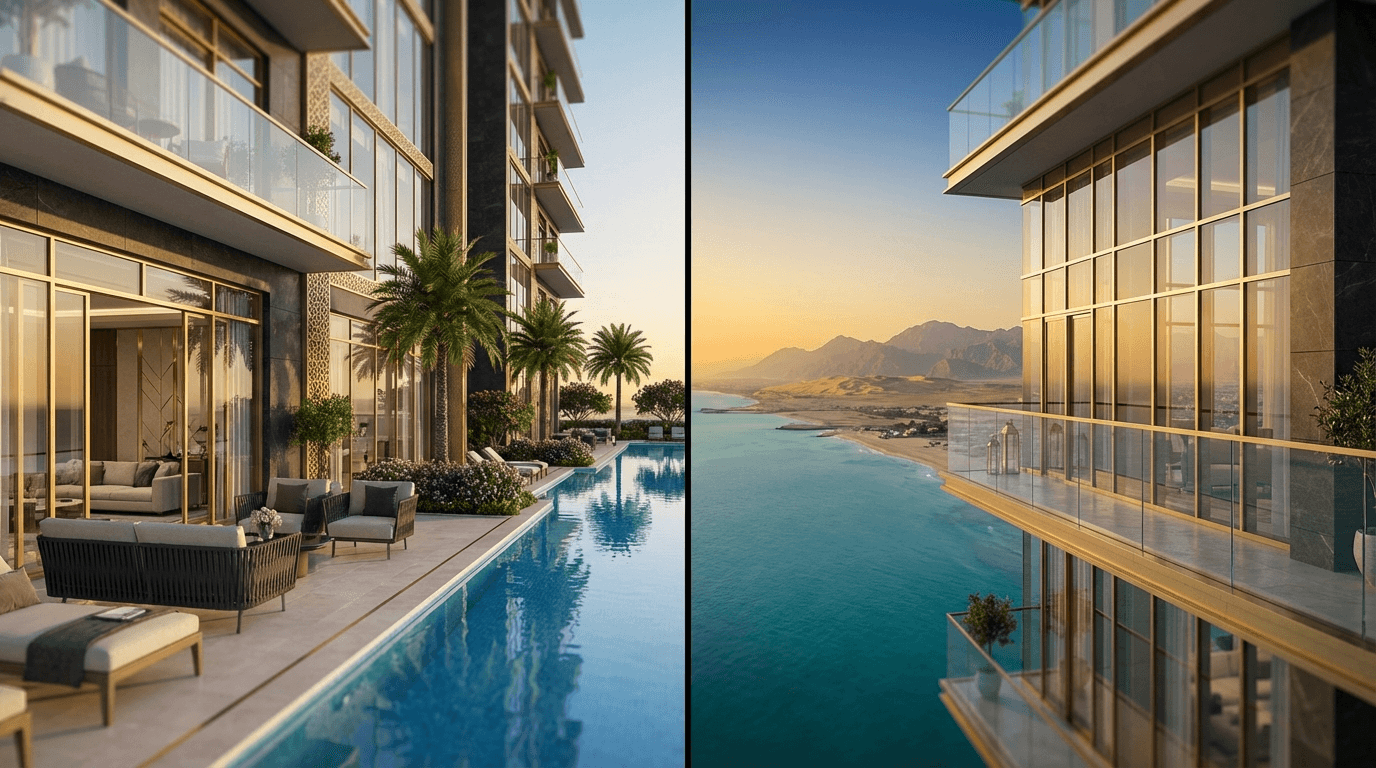

Panoramic views and visual appeal represent the defining advantage of high floor units in RAK's market. Apartments offering unobstructed vistas of the Arabian Gulf, mangrove forests, or dramatic mountain ranges consistently achieve rental premiums of 10-20% compared to lower floors in the same development. RAK's natural beauty creates genuine scarcity value for these view corridors, supporting sustained premium positioning.

Privacy and security perception strongly appeals to professional couples, executives, and tenants without children who prioritise these factors over outdoor access. High floor units eliminate ground-level privacy concerns, offering sanctuary-like environments particularly valued by tenants seeking peaceful retreats from busy professional lives. This demographic typically demonstrates strong payment reliability and lower maintenance requirements.

Reduced noise and environmental disturbance enhances quality of life for high floor residents. Elevation above street level, amenity areas, and general activity zones creates noticeably quieter living environments. In RAK's waterfront developments, higher floors also benefit from enhanced airflow and coastal breezes, improving comfort particularly during warmer months.

Prestige positioning and status appeal shouldn't be underestimated in RAK's luxury developments. Certain tenant segments actively seek higher floors as status markers, willing to pay premiums for penthouse-level or upper-floor positioning. Whilst less pronounced than in Dubai's ultra-luxury market, this factor influences rental performance in RAK's premium waterfront and resort-style developments.

Considerations for Landlords

High floor units present specific ownership considerations that impact overall investment returns. Lift dependency and accessibility concerns can affect tenant satisfaction, particularly in developments with limited lift provision or during maintenance periods. Families with small children, elderly tenants, and those with mobility considerations may specifically avoid higher floors, narrowing your potential tenant pool.

Maintenance and service charge implications sometimes run higher for upper-floor units, particularly regarding window cleaning, facade maintenance, and cooling costs in top-floor apartments subject to greater sun exposure. These ongoing costs must be factored into net yield calculations.

Move-in logistics and tenant convenience present minor but notable friction points. Higher floors complicate furniture delivery, moving processes, and general logistics, which some tenant segments find off-putting. This rarely impacts rental rates but may slightly extend marketing periods.

RAK Tenant Preferences: What the Data Reveals

Analysis of RAK's rental transaction data reveals fascinating patterns that challenge conventional assumptions about floor-level preferences. The emirate's tenant demographics skew notably towards families and lifestyle-focused residents rather than the young professional demographic dominant in Dubai's high-rise districts.

Approximately 60% of RAK's rental market comprises family units with children, according to market research from leading property consultancies operating in the emirate. This demographic demonstrates clear preference for ground floor and lower-floor units (up to third floor) with outdoor access, prioritising practical living considerations over view premiums. These tenants typically seek 2-3 bedroom configurations with dedicated outdoor space, willing to sacrifice elevation for garden or terrace access.

Conversely, the professional and executive segment, representing roughly 25% of the rental market, shows strong preference for higher floors in premium developments. This group prioritises views, privacy, and modern specifications, typically occupying 1-2 bedroom units in waterfront locations. They demonstrate willingness to pay 15-20% premiums for superior views and top-floor positioning.

The remaining 15% comprises diverse tenant types including retirees, multi-generational families, and pet owners with specific requirements. Interestingly, pet owners demonstrate the strongest floor-level preferences, with ground floor units commanding measurable premiums in pet-friendly developments.

Rental Yield Comparison: Ground vs High Floors

When examining actual rental yields across RAK's major residential communities, the performance gap between ground and high floors proves smaller than many investors anticipate, with specific developments showing inverted typical patterns.

In RAK's family-oriented communities such as Mina Al Arab and certain Al Hamra Village phases, ground floor units with garden access frequently achieve comparable or superior yields to high floor equivalents. A ground floor 2-bedroom apartment with terrace might command AED 45,000-50,000 annually, matching or exceeding high floor units at AED 48,000-52,000 despite lower absolute rent, due to reduced acquisition costs for ground floor inventory during the purchase phase.

Conversely, in RAK's luxury waterfront developments with exceptional sea views, high floor units demonstrate clear yield advantages. Top-floor 1-bedroom apartments with panoramic Gulf views can achieve AED 38,000-42,000 annually compared to ground floor equivalents at AED 32,000-36,000, with the percentage premium justifying the initial purchase price differential.

Mid-floor units (floors 3-7 in typical developments) often represent the yield optimisation point, combining reasonable views with accessibility whilst avoiding both ground floor privacy concerns and high floor premium pricing. These floors frequently deliver the strongest risk-adjusted returns for investors prioritising consistent rental income over maximum capital appreciation.

Location-Specific Factors in RAK

RAK's diverse development locations create substantial variation in floor-level performance that investors must carefully evaluate when making acquisition decisions.

Waterfront developments along the Arabian Gulf coastline heavily favour high floor units, where sea views represent the primary value proposition. Developments in areas such as Al Marjan Island and certain Al Hamra Village phases see pronounced rental premiums for upper floors with unobstructed water views. Ground floor units in these locations perform adequately but cannot match the rental appeal of view-corridor apartments.

Mountain-view communities present more balanced floor-level dynamics. The Hajar Mountains provide dramatic backdrops visible from multiple elevations, meaning mid-floor units often capture excellent views without requiring top-floor positioning. Ground floor units in these developments benefit from landscaped settings with mountain vistas, creating strong rental appeal for family tenants.

Inland residential communities focused on family living demonstrate the strongest ground floor performance. Developments prioritising community amenities, green spaces, and family facilities attract tenant demographics that actively prefer ground floor accessibility and outdoor space. Higher floors in these locations rarely command significant premiums, making ground floor units the yield-optimised choice.

Mixed-use urban developments in RAK's emerging business districts show rental patterns more aligned with traditional UAE markets, where higher floors escape street-level commercial activity and noise. These locations suit high floor investment strategies, particularly for attracting professional tenants working in RAK's growing corporate sector.

Amenity Access and Rental Appeal

The relationship between floor level and amenity access significantly influences rental performance in RAK's resort-style developments, where extensive facilities represent key value propositions.

Ground floor units in developments with exceptional pool, gym, and recreational facilities benefit from immediate access, creating genuine lifestyle convenience that appeals to active families and fitness-focused tenants. The ability to access swimming pools, children's play areas, and sports facilities without lift dependency adds measurable value for certain demographics.

However, this proximity can become a disadvantage when ground floor units sit immediately adjacent to high-traffic amenity zones. Units overlooking pool decks or positioned near gym facilities may experience noise and privacy impacts that depress rental values. Location within the ground floor inventory matters enormously—corner units or those positioned away from amenity zones substantially outperform those with direct amenity exposure.

High floor units escape amenity-related noise and activity whilst maintaining reasonable access via lifts in well-serviced buildings. For developments with rooftop facilities, top-floor units may actually offer superior amenity access compared to ground floor apartments, supporting rental premium positioning.

Long-Term Investment Perspective

Beyond immediate rental yield considerations, floor level influences long-term investment performance through capital appreciation patterns, maintenance trajectories, and portfolio diversification strategies.

Capital appreciation patterns in RAK's emerging market show interesting divergence from established emirates. Whilst Dubai's ultra-luxury market demonstrates clear appreciation advantages for penthouses and high floors, RAK's family-focused market may see stronger appreciation for ground floor units with gardens as the emirate matures and families increasingly prioritise quality of life. This appreciation potential remains speculative but warrants consideration for long-term investors.

Maintenance cost trajectories favour ground floor units over extended holding periods. High floor apartments typically incur higher service charges, facade maintenance costs, and periodic refurbishment expenses related to lift access and building systems. Over a 10-15 year investment horizon, these incremental costs meaningfully impact net returns, potentially offsetting rental premium advantages.

Portfolio diversification strategies should incorporate floor-level variation to capture different tenant segments and market cycles. Sophisticated investors building RAK portfolios often combine ground floor family-oriented units with high floor executive apartments, creating balanced exposure to RAK's diverse tenant demographics whilst hedging against preference shifts.

Future market evolution will likely see converging performance between ground and high floors as RAK matures. Early-stage markets often show exaggerated floor-level premiums that moderate as markets develop and tenant preferences diversify. Investors should anticipate narrowing yield gaps whilst maintaining awareness of location-specific factors that sustain genuine differentiation.

Making the Right Choice for Your Investment Strategy

Selecting the optimal floor level for your RAK investment requires aligning property characteristics with your specific investment objectives, risk tolerance, and market positioning.

For maximum rental yield optimisation, ground floor units in family-oriented developments with quality outdoor space typically deliver superior risk-adjusted returns. These properties combine strong tenant demand, extended tenancy periods, and competitive acquisition pricing, creating excellent cash flow profiles for investors prioritising income generation.

For capital appreciation focus, high floor units in prestigious waterfront developments with exceptional views offer stronger long-term growth potential. Scarcity of premium view corridors and appeal to high-net-worth tenants and eventual owner-occupiers support price appreciation trajectories that may outpace ground floor equivalents.

For balanced investment approaches, mid-floor units (floors 3-6) in quality developments often deliver optimal combinations of rental yield, capital growth, and tenant appeal. These floors avoid ground-level concerns whilst escaping high-floor premium pricing, creating sustainable investment profiles.

For portfolio investors, diversification across floor levels captures broader market opportunities whilst hedging against demographic preference shifts. Combining ground floor family units with high floor professional apartments creates resilient portfolios responsive to varying market conditions.

Ultimately, floor level represents one variable within comprehensive investment analysis that must encompass development quality, location fundamentals, developer reputation, and RAK's broader market trajectory. The most successful investors evaluate floor-level considerations within this holistic framework rather than applying simplistic rules about height premiums.

RAK's emerging market status creates exceptional opportunities for investors who understand these nuanced dynamics. Whether you favour ground floor accessibility or high floor prestige, the emirate offers compelling investment propositions across the elevation spectrum. Success lies in matching property characteristics to genuine tenant demand within your target market segment, supported by rigorous analysis of location-specific factors that distinguish RAK from more established UAE markets.

For investors seeking exclusive RAK off-plan projects with optimal floor-level selection, working with specialists who understand these market dynamics proves invaluable. The right property at the right floor level can dramatically enhance your investment returns in this exciting emirate.

The question of whether ground floor or high floor units rent better in RAK defies simple answers, as performance depends fundamentally on development type, location characteristics, and target tenant demographics. Ground floor units with quality outdoor space excel in family-oriented communities, delivering robust yields and tenant retention. High floor apartments command premiums in waterfront developments where views represent primary value propositions, appealing to professional tenants willing to pay for visual amenity and privacy.

RAK's unique market positioning—emphasising lifestyle, family living, and value—creates rental dynamics that differ substantially from Dubai's high-rise markets. Investors who recognise these distinctions and align floor-level selection with genuine tenant preferences position themselves for superior returns in this burgeoning emirate.

The most successful investment strategies evaluate floor level as one component within comprehensive property analysis, considering development quality, location fundamentals, and long-term market evolution. Whether you prioritise immediate rental yield or long-term capital appreciation, RAK offers compelling opportunities across the elevation spectrum for discerning investors who understand the market's distinctive characteristics.

Ready to identify the perfect investment opportunity in RAK's dynamic property market? Azimira Real Estate specialises in exclusive off-plan projects and premium properties across Ras Al Khaimah, providing expert guidance on floor-level selection, development quality, and investment strategy. Our deep market insights and access to pre-launch opportunities ensure you secure properties with exceptional rental potential and capital growth prospects. Contact our investment specialists today to discover how we can help you build a high-performing RAK property portfolio tailored to your investment objectives.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.