Melbourne Professional's Journey to RAK Golden Visa Ownership: A Complete Investment Guide

Discover how a Melbourne professional secured UAE Golden Visa through RAK property investment. Expert insights on requirements, investment strategies, and the complete acquisition journey.

Table Of Contents

- Introduction: From Melbourne to RAK

- Understanding the RAK Golden Visa Property Investment Pathway

- Why Melbourne Professionals Are Choosing RAK Over Dubai

- The Investment Journey: A Step-by-Step Account

- RAK Property Investment Requirements for Golden Visa Eligibility

- Off-Plan vs Ready Properties: Strategic Considerations

- Tax Advantages for Australian Investors

- Common Challenges and How to Overcome Them

- The Long-Term Value Proposition

- Conclusion: Your Pathway to RAK Golden Visa Success

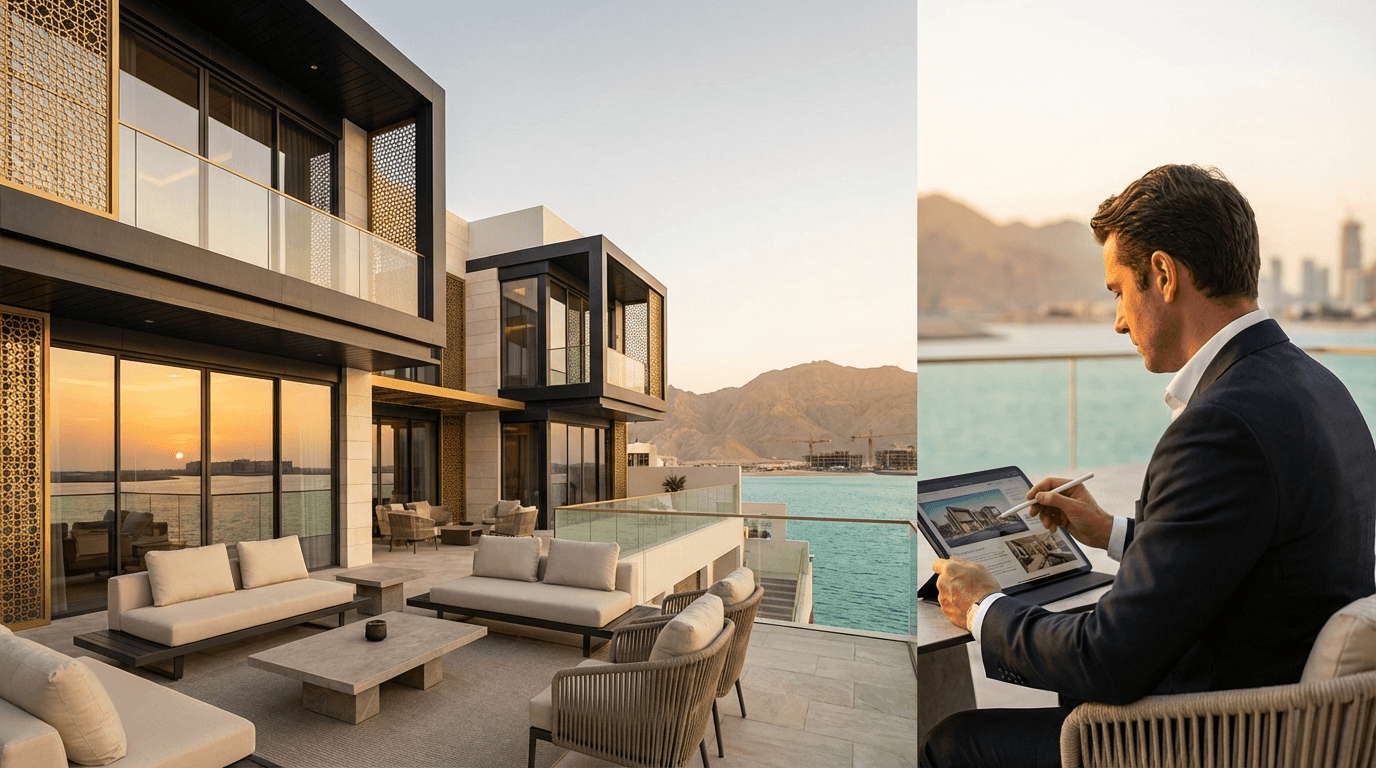

For Sarah Mitchell, a 42-year-old corporate lawyer from Melbourne's CBD, the decision to pursue UAE Golden Visa residency through Ras Al Khaimah property investment represented more than a financial strategy—it marked a transformative shift in her family's global mobility and wealth preservation approach.

Like many Australian professionals navigating uncertain domestic property markets and seeking international diversification, Sarah discovered that the pathway to UAE long-term residency through strategic property investment offered compelling advantages: zero income tax, exceptional capital growth forecasts, and access to one of the world's most dynamic economic hubs.

What sets RAK apart from Dubai's saturated property market is its emerging status as the UAE's best-kept investment secret. With property prices significantly lower than Dubai whilst offering identical Golden Visa benefits, RAK presents discerning investors with exceptional entry points into the UAE real estate market. For Melbourne professionals like Sarah, this represented an opportunity to secure 10-year UAE residency through a strategic investment that aligned perfectly with both lifestyle aspirations and wealth-building objectives.

This comprehensive guide chronicles Sarah's complete journey from initial research to Golden Visa approval, providing actionable insights for Australian professionals considering the RAK property investment pathway. Whether you're seeking global mobility, tax efficiency, or simply exposure to one of the world's fastest-growing property markets, this detailed account offers the roadmap you need to navigate your own successful RAK investment journey.

Understanding the RAK Golden Visa Property Investment Pathway

The UAE Golden Visa programme represents one of the world's most attractive long-term residency schemes, offering 10-year renewable residency to qualifying property investors. Unlike traditional visa programmes that require continuous physical presence, the Golden Visa imposes no minimum stay requirements, making it ideal for international professionals maintaining careers abroad whilst securing UAE residency benefits.

For property investors, the pathway is straightforward: purchase qualifying real estate valued at AED 2 million or above (approximately AUD 830,000), and you become eligible for 10-year residency that extends to your spouse and children under 18 (or unmarried daughters of any age and sons under 25 if they're students).

What makes RAK particularly compelling is that property prices remain substantially below Dubai levels—often 30-40% less expensive—whilst offering identical Golden Visa benefits. A two-bedroom luxury apartment in Dubai Marina might cost AED 3.5 million, whereas a comparable waterfront property in RAK's premium developments starts around AED 2 million, meeting the Golden Visa threshold precisely whilst maximising capital growth potential.

The regulations, updated in October 2022, specify that the AED 2 million threshold can be met through a single property or combined property portfolio. The investment must be maintained for at least three years from the visa issuance date, and the property cannot be purchased through a loan unless the loan is fully settled before visa application.

Why Melbourne Professionals Are Choosing RAK Over Dubai

Sarah's decision to focus on RAK rather than Dubai stemmed from rigorous market analysis that revealed several compelling advantages for Australian investors seeking optimal value proposition.

Price-to-Value Ratio: RAK properties consistently deliver superior square metreage for equivalent investment. Sarah's AED 2.1 million investment secured a three-bedroom villa with private beach access in an exclusive gated community—a property specification that would command AED 4-5 million in comparable Dubai locations.

Capital Growth Forecasts: Emerging markets typically outperform mature markets during growth phases. RAK's property sector has posted year-on-year growth exceeding 15% in prime locations, compared to Dubai's 8-10% in established areas. For investors seeking appreciation rather than immediate rental yield, RAK's trajectory presents exceptional opportunity.

Lifestyle and Authenticity: Many Melbourne professionals appreciate RAK's relaxed coastal atmosphere, which more closely resembles Australia's lifestyle culture than Dubai's metropolitan intensity. The emirate offers mountain landscapes, pristine beaches, championship golf courses, and a slower pace of life whilst remaining just 45 minutes from Dubai International Airport.

Lower Competition: Dubai's property market attracts global attention, creating intense competition for prime units. RAK's relative obscurity among international investors means access to pre-launch opportunities, off-market listings, and negotiating leverage that simply doesn't exist in Dubai's competitive environment.

For Sarah, these factors combined to create a compelling investment thesis: enter an emerging market at ground-floor pricing whilst securing identical residency benefits to Dubai investors paying premium prices.

The Investment Journey: A Step-by-Step Account

Initial Research and Market Analysis

Sarah's journey began with comprehensive research into UAE residency options. Having explored various global residency programmes—from Portugal's Golden Visa to Caribbean citizenship schemes—she identified the UAE pathway as offering optimal tax efficiency, visa-free travel benefits, and strategic geographic positioning between Europe, Asia, and Australia.

Her initial research phase involved:

Regulatory verification through official UAE government sources (u.ae and the Federal Authority for Identity and Citizenship), ensuring complete accuracy regarding investment thresholds, eligibility criteria, and application procedures. Sarah discovered that regulations had recently been updated, making it crucial to verify current requirements rather than relying on outdated information.

Market analysis comparing Dubai, Abu Dhabi, and RAK investment opportunities. She examined price trends, rental yields, upcoming infrastructure developments, and capital appreciation forecasts across different emirates and specific developments.

Professional consultation with property investment specialists focusing specifically on off-plan opportunities. Sarah recognised that pre-launch and off-market properties offered advantages unavailable through general property portals—primarily better pricing, payment plans, and access to premium units before public release.

This research phase took approximately three months, during which Sarah educated herself on UAE property law, foreign ownership regulations, and the specific dynamics of the RAK market.

Property Selection and Due Diligence

With her research foundation established, Sarah engaged with Azimira Real Estate, seeking specialist guidance on RAK investment opportunities aligned with her Golden Visa objectives and investment criteria.

Her property selection criteria were specific:

- Golden Visa qualification: Minimum AED 2 million valuation with clear title documentation acceptable for visa application

- Off-plan opportunity: Staggered payment plans to optimise cash flow whilst benefiting from below-market entry pricing

- Premium location: Waterfront or beach-access property in established or master-planned community

- Capital growth potential: Development in area with strong infrastructure investment and appreciation forecasts

- Lifestyle alignment: Property suitable for family holidays and potential future relocation

After reviewing curated opportunities from Azimira's exclusive RAK portfolio, Sarah identified a three-bedroom villa in a luxury beachfront development. The property met all her criteria: AED 2.1 million valuation, payment plan spanning 24 months, direct beach access, and location within a master-planned community benefiting from upcoming government infrastructure investment.

The due diligence process involved:

Developer verification: Confirming the developer's track record, previous project delivery, and financial stability

Legal review: Engaging UAE property lawyers to review sale contracts, verify clear title, and ensure documentation met Golden Visa requirements

Payment structure analysis: Confirming the payment schedule aligned with construction milestones and provided adequate buyer protection

Community assessment: Visiting RAK to inspect the development site, assess surrounding infrastructure, and experience the lifestyle offering firsthand

This comprehensive due diligence took six weeks but provided Sarah with complete confidence in her investment decision.

Financial Structuring and Purchase Process

As an Australian resident purchasing UAE property, Sarah needed to navigate cross-border financial considerations including currency exchange, fund transfers, and tax implications.

Her financial structuring involved:

Currency strategy: Working with foreign exchange specialists to optimise AUD-to-AED conversion timing, ultimately saving approximately 2.3% through strategic timing compared to immediate bank transfer rates.

Fund transfer: Establishing international wire transfer protocols compliant with both Australian and UAE banking regulations, including appropriate documentation for international property purchase.

Tax planning: Consulting with Australian tax advisers regarding foreign property ownership implications, capital gains considerations, and potential rental income treatment under Australian tax law.

Payment plan management: Establishing systems to ensure timely milestone payments according to the developer's schedule, accounting for currency fluctuations and international transfer timeframes.

The off-plan purchase structure provided significant cash flow advantages. Sarah's payment schedule was:

- 20% deposit on reservation (AED 420,000)

- 40% during construction across eight quarterly instalments (AED 105,000 each)

- 40% on completion (AED 840,000)

This structure allowed Sarah to spread her investment over 24 months whilst securing below-market pricing—the property's projected market value on completion was AED 2.6 million, representing 24% appreciation before taking ownership.

Golden Visa Application and Approval

Upon securing the property purchase agreement and completing the initial deposit, Sarah became eligible to begin the Golden Visa application process. The timing was strategic: whilst the property remained under construction, the purchase agreement and deposit payment met the investment threshold requirements.

The Golden Visa application process involved:

Document preparation: Gathering sale agreement, deposit payment confirmation, property valuation certificate, passport copies, Emirates ID photographs, and various attestations and certifications.

Application submission: Filing through approved typing centres in Dubai, which manage the Federal Authority for Identity and Citizenship application process.

Medical examination: Completing required health screening at approved medical centres in the UAE.

Biometric registration: Attending in-person for fingerprinting and photograph capture for Emirates ID issuance.

Approval and visa stamping: Receiving approval notification followed by visa stamping in passport and Emirates ID card issuance.

The complete process took approximately 12 weeks from initial application to receiving her stamped Golden Visa. Sarah travelled to the UAE twice during this period—once for the initial application and medical examination, and again for biometric registration and visa collection.

Her immediate family (husband and two children aged 14 and 16) were included in the application, all receiving 10-year residency visas as dependants. The total government fees for a family of four totalled approximately AED 15,000 (around AUD 6,200), including visa fees, Emirates ID costs, and medical examinations.

RAK Property Investment Requirements for Golden Visa Eligibility

Understanding the precise requirements ensures your investment qualifies for Golden Visa processing without complications or delays.

Minimum Investment Value: The property or combined property portfolio must equal or exceed AED 2 million. This valuation must be confirmed through official property valuation from approved assessors—the sale price alone may not suffice if market conditions have changed since purchase agreement.

Property Type: Residential properties qualify, including apartments, villas, and townhouses. Commercial properties do not qualify for the investor category Golden Visa. The property must be located in areas where foreign ownership is permitted (freehold or designated leasehold areas).

Financing Restrictions: If the property was purchased using mortgage financing, the loan must be fully settled before Golden Visa application. Alternatively, some investors purchase properties valued above AED 2 million and use the unfinanced equity portion for visa application, though this requires precise documentation.

Retention Period: The investment must be maintained for a minimum of three years from visa issuance. Selling the property before this period may result in visa cancellation, though regulations permit selling one property and purchasing another provided the AED 2 million threshold is continuously maintained.

Documentation Requirements: Applications require comprehensive documentation including sale agreement, title deed, property valuation certificate, deposit and payment confirmation, and various standard visa application documents (passport copies, photographs, etc.).

Off-Plan Considerations: For off-plan properties, investors can apply for Golden Visa once they have:

- Secured a sale and purchase agreement from a registered developer

- Paid the minimum deposit (typically 20-30% of property value)

- Obtained confirmation that total investment meets or exceeds AED 2 million

- Secured property valuation documentation

This provision makes off-plan investment particularly attractive, as investors gain residency benefits before property completion whilst benefiting from payment plans and pre-launch pricing.

Off-Plan vs Ready Properties: Strategic Considerations

Sarah's decision to pursue off-plan investment rather than completed property reflected careful analysis of the advantages each approach offers Golden Visa seekers.

Off-Plan Advantages:

Payment flexibility: Staggered payments over 12-36 months reduce immediate capital requirements, allowing investors to spread costs whilst securing residency earlier in the process.

Below-market pricing: Pre-launch and construction-phase properties typically offer 15-25% discounts compared to completion values, maximising capital appreciation potential.

Newer specifications: Off-plan properties feature contemporary designs, modern amenities, and current building standards, potentially offering better long-term value retention.

First choice of units: Early investors access premium unit selection—best views, preferred floor levels, corner positions—before general market release.

Ready Property Advantages:

Immediate occupation: Completed properties allow instant use for holidays, short-term rentals, or personal residence without waiting for construction completion.

Immediate rental income: If investment strategy includes rental yield, ready properties generate returns immediately rather than waiting 12-24 months for completion.

Certainty: No construction delays, specification changes, or developer completion risks—what you inspect is what you receive.

Faster visa processing: Some investors prefer ready properties to streamline visa applications, though off-plan documentation is equally acceptable when properly structured.

For Sarah, the off-plan approach aligned perfectly with her objectives: maximise capital growth, minimise immediate capital outlay, and secure residency whilst the property appreciated during construction. Her projected 24% appreciation before taking ownership vindicated this strategic choice.

Tax Advantages for Australian Investors

One of the Golden Visa's most compelling features for Melbourne professionals like Sarah is the UAE's zero personal income tax environment combined with strategic benefits for Australian tax residents.

Zero UAE Income Tax: The UAE imposes no personal income tax on residents, meaning any rental income generated from RAK properties, capital gains on property sales, or other UAE-sourced income remains untaxed at the emirate level.

Australian Tax Considerations: Australian residents remain subject to Australian taxation on worldwide income, meaning rental income from UAE properties must be declared on Australian tax returns. However, Australian tax law provides foreign income tax offsets, and since the UAE charges zero tax, the effective tax treatment depends on individual circumstances and professional tax advice.

Capital Gains Treatment: For Australian residents, UAE property sales may trigger capital gains tax in Australia. However, various concessions, timing strategies, and potential residency planning can optimise outcomes. Many investors consult cross-border tax specialists to structure holdings appropriately.

Estate Planning: The UAE's residency benefits extend to estate planning flexibility, offering potential advantages for high-net-worth individuals managing international asset portfolios.

Business Opportunities: Golden Visa holders can establish UAE businesses, access regional markets, and benefit from the UAE's extensive double taxation treaty network covering over 130 countries.

Sarah engaged Australian tax advisers specialising in expatriate taxation to optimise her structure, ensuring compliance whilst maximising the tax efficiency benefits her UAE residency and property investment offered.

Common Challenges and How to Overcome Them

Sarah's journey, whilst ultimately successful, involved navigating several challenges common to international property investors pursuing Golden Visa residency.

Challenge: Regulatory Complexity and Changing Requirements

UAE property and visa regulations evolve regularly. Information found online often becomes outdated within months, creating confusion about current requirements.

Solution: Sarah verified all information through official government sources (u.ae and Federal Authority for Identity and Citizenship) and worked with specialists maintaining current regulatory knowledge. This ensured her investment structure and documentation met current requirements rather than outdated criteria.

Challenge: Cross-Border Banking and Fund Transfers

International property purchases involve complex banking procedures, anti-money laundering verification, and currency exchange considerations.

Solution: Early engagement with international banking specialists and foreign exchange providers streamlined the process. Sarah established relationships with UAE banks before property purchase, accelerating approval timeframes when purchase agreements were ready for execution.

Challenge: Property Market Information Asymmetry

RAK's emerging status means limited publicly available market data compared to established markets like Sydney or Melbourne.

Solution: Working with specialists offering exclusive access to RAK off-plan projects provided Sarah with market insights, pricing benchmarks, and development quality assessment that general property portals couldn't offer.

Challenge: Physical Distance and Time Zone Differences

Managing property transactions from Melbourne involves 6-7 hour time differences and the challenge of inspecting properties and completing in-person requirements from 10,000 kilometres away.

Solution: Strategic trip planning combined with comprehensive video tours and virtual inspections minimised travel requirements. Sarah made two trips to the UAE—one for property inspection and contract signing, another for visa processing—optimising efficiency whilst ensuring critical steps received proper attention.

Challenge: Understanding True Costs

Property purchase involves costs beyond the purchase price: transfer fees (typically 2% for buyer and 2% for seller, though often negotiated), agency fees, legal costs, valuation fees, visa application costs, and ongoing service charges.

Solution: Comprehensive financial modelling during the research phase ensured Sarah budgeted for complete costs. Her total investment including all fees and charges was approximately AED 2.35 million (AUD 975,000), about 12% above the base property price.

The Long-Term Value Proposition

Eighteen months after beginning her RAK investment journey, Sarah reflected on the comprehensive value her Golden Visa and property investment had delivered—benefits extending well beyond simple residency or financial returns.

Global Mobility: Her UAE Golden Visa provides visa-free or visa-on-arrival access to over 180 countries, significantly enhancing international travel flexibility for both business and leisure. For a legal professional managing international client relationships, this mobility proves invaluable.

Portfolio Diversification: Geographic diversification across Australian and UAE property markets reduces concentration risk whilst providing exposure to one of the world's fastest-growing economies.

Lifestyle Flexibility: The family now spends Australian winters (June-August) in their RAK villa, enjoying Northern Hemisphere summer whilst escaping Melbourne's coldest months. This lifestyle benefit wasn't initially a priority but has become one of the investment's most appreciated outcomes.

Capital Appreciation: The property's valuation increased from AED 2.1 million at purchase to an estimated AED 2.75 million eighteen months later—approximately 31% appreciation driven by RAK's strong market fundamentals and the development's growing reputation.

Business Opportunities: Sarah has begun exploring legal consulting opportunities in the UAE, leveraging her Golden Visa residency status to potentially establish regional business operations—an option that wouldn't exist without her residency status.

Educational Options: With children approaching university age, UAE residency opens access to regional educational institutions at resident fee levels, potentially offering alternatives to Australian university pathways.

Future Flexibility: Perhaps most valuable is the optionality the Golden Visa provides. Whether the family eventually relocates to the UAE, maintains the property as a holiday home and investment, or simply retains residency as strategic insurance, the 10-year visa term provides a decade to optimise their choice.

For Melbourne professionals evaluating international diversification strategies, Sarah's experience demonstrates that RAK Golden Visa investment offers compelling value across multiple dimensions—financial returns, lifestyle enhancement, global mobility, and strategic optionality.

Conclusion: Your Pathway to RAK Golden Visa Success

Sarah Mitchell's journey from Melbourne corporate lawyer to UAE Golden Visa holder through strategic RAK property investment illustrates a pathway increasingly attractive to Australian professionals seeking international diversification, tax efficiency, and global mobility.

The key elements of her success were:

Thorough research and verification of regulations, requirements, and market conditions through authoritative sources

Strategic market selection prioritising RAK's exceptional value proposition over Dubai's premium pricing

Professional guidance from specialists offering exclusive access to off-plan RAK opportunities unavailable through general property channels

Comprehensive due diligence covering legal, financial, and practical considerations before commitment

Patient execution allowing time for proper research, property selection, and application processing

For Melbourne professionals considering similar pathways, the RAK Golden Visa investment opportunity remains exceptionally compelling. With property prices still significantly below Dubai levels whilst offering identical residency benefits, RAK represents perhaps the UAE's best value Golden Visa pathway.

The combination of capital growth potential, lifestyle benefits, tax advantages, and 10-year residency creates a value proposition that few global investment migration programmes can match. For those seeking to establish UAE connections whilst building international property portfolios, RAK offers the optimal entry point.

Whether your priorities are financial returns, lifestyle enhancement, global mobility, or simply strategic optionality for your family's future, the RAK Golden Visa property investment pathway deserves serious consideration as part of your international wealth strategy.

Sarah's experience demonstrates that successful RAK Golden Visa investment requires more than simply meeting the AED 2 million threshold. It demands strategic property selection, comprehensive due diligence, expert guidance, and patient execution throughout the acquisition and application journey.

For Australian professionals seeking to replicate her success, the opportunity remains strong. RAK's property market continues delivering exceptional value, regulatory pathways remain clear and accessible, and the long-term residency benefits provide genuine strategic advantage for individuals and families thinking globally about their future.

The key is beginning with proper research, engaging with specialists who understand both the RAK market and the specific needs of Australian investors, and approaching the journey as a long-term strategic investment rather than a transactional property purchase.

With the right approach, guidance, and commitment to thorough due diligence, Melbourne professionals can follow Sarah's pathway to securing UAE Golden Visa residency through strategic RAK property investment—unlocking a decade of residency rights, exceptional capital growth potential, and lifestyle opportunities that extend well beyond the initial investment thesis.

Start Your RAK Golden Visa Journey Today

Are you ready to explore how strategic RAK property investment can unlock UAE Golden Visa residency for you and your family?

Azimira Real Estate specialises in guiding Australian professionals through the complete RAK investment journey, from initial consultation and exclusive off-plan property access to Golden Visa application support and beyond.

Our curated portfolio includes pre-launch opportunities, off-market listings, and premium developments unavailable through general property channels—ensuring you access the exceptional value propositions that make RAK investment so compelling.

Contact our RAK investment specialists today to begin your journey towards UAE Golden Visa ownership through strategic property investment.

Discover exclusive opportunities. Secure expert guidance. Unlock your UAE future.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.