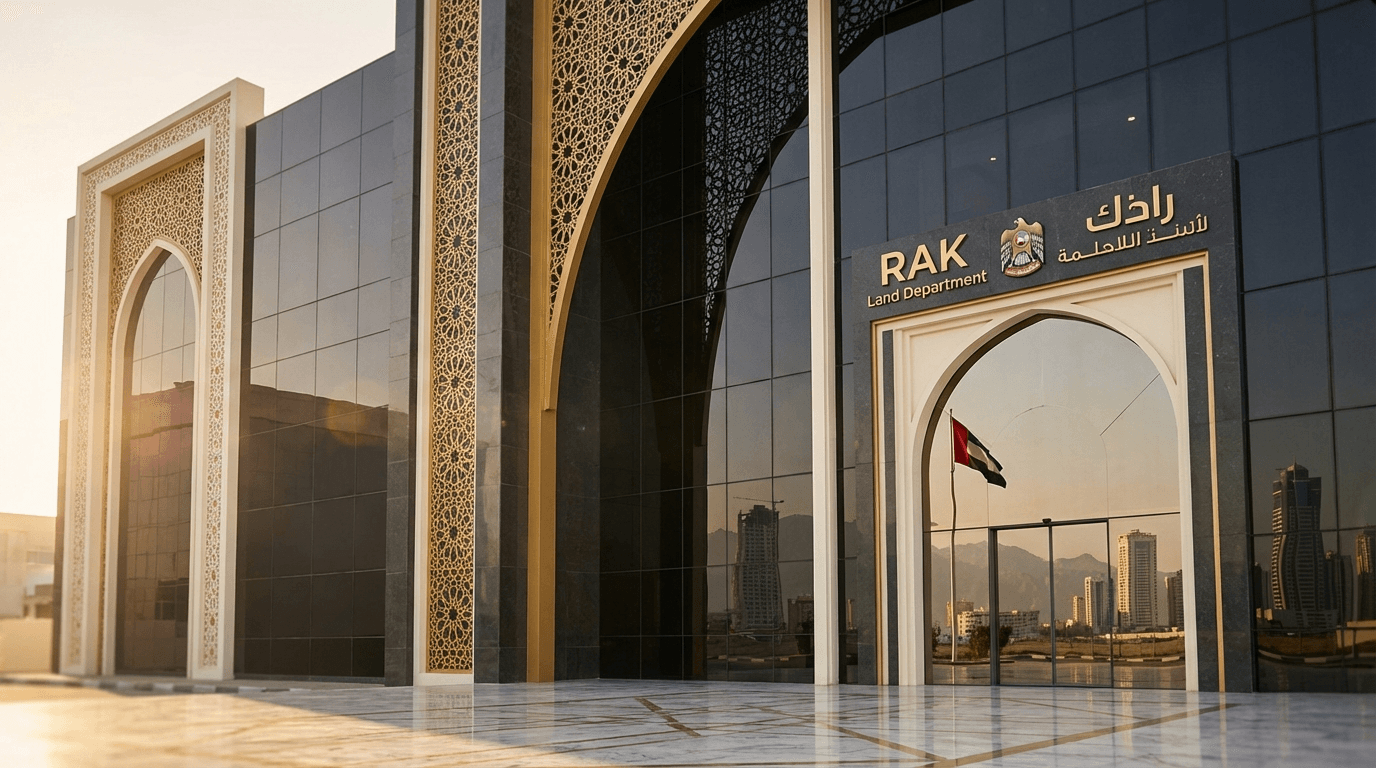

RAK Land Department: Complete Guide to Services, Fees, and Navigation

Discover RAK Land Department services, fees, and registration processes. Navigate property transactions in Ras Al Khaimah with confidence using our comprehensive guide.

Table Of Contents

- Understanding the RAK Land Department

- Core Services Offered

- Property Registration Fees and Costs

- Step-by-Step Property Registration Process

- Required Documentation

- Digital Services and Online Portal

- Ownership Types and Restrictions

- Common Challenges and How to Overcome Them

- Why RAK Represents Exceptional Investment Opportunity

Ras Al Khaimah's property market has emerged as one of the UAE's most compelling investment destinations, offering exceptional value propositions that savvy investors are increasingly recognising. However, navigating the administrative landscape—particularly the RAK Land Department (also known as the Real Estate Registration Department)—can seem daunting for those unfamiliar with the emirate's procedures. Whether you're purchasing your first off-plan apartment in a luxury waterfront development or adding a premium villa to your investment portfolio, understanding the services, fees, and processes of the RAK Land Department is essential for a smooth transaction.

This comprehensive guide demystifies the entire journey, providing you with detailed insights into registration procedures, associated costs, required documentation, and practical tips for navigating the system efficiently. By understanding these fundamentals, you'll be better positioned to capitalise on RAK's burgeoning property market with confidence and clarity.

Understanding the RAK Land Department

The RAK Real Estate Registration Department operates under the jurisdiction of the Ras Al Khaimah Government and serves as the primary authority for all property-related transactions within the emirate. Established to regulate, organise, and facilitate real estate activities, the department plays a crucial role in maintaining transparent property records whilst protecting the rights of buyers, sellers, and investors.

Unlike Dubai's Land Department, which has been handling property transactions for decades, RAK's regulatory framework has evolved more recently, offering streamlined processes that benefit from lessons learnt across other emirates. The department oversees freehold and leasehold property transactions, maintains the official property registry, and ensures compliance with local real estate regulations. For investors, this means robust legal protection and clear ownership documentation—fundamental requirements for any property investment.

The department operates both physical offices in RAK and increasingly sophisticated digital platforms, reflecting the UAE's broader commitment to government digitalisation. This dual approach ensures accessibility for international investors whilst maintaining the personal service that complex transactions sometimes require.

Core Services Offered

The RAK Land Department provides a comprehensive suite of services designed to facilitate every aspect of property ownership and transaction. Understanding these services helps investors and buyers navigate their specific requirements efficiently.

Property Registration and Title Deed Issuance

The primary function involves registering property purchases and issuing official title deeds (سند ملكية in Arabic). This service applies to both off-plan properties upon completion and ready properties in the secondary market. The department verifies all transaction details, ensures proper payment of fees, and issues the legal documentation that confirms your ownership rights.

Transfer of Ownership

When purchasing property from an existing owner, the department facilitates the official transfer of ownership. This process involves verifying the seller's title, confirming no outstanding liens or encumbrances exist, and registering the new owner's details in the official registry. The transfer service ensures legal continuity and protects both parties throughout the transaction.

Mortgage Registration

For investors utilising financing, the department registers mortgages against properties, creating a legal charge that protects the lender's interests. This registration is mandatory for all financed purchases and must be completed before the property can be mortgaged. Upon full repayment, the department also processes mortgage release documentation.

Gift Deeds and Inheritance Registration

Property transferred through inheritance or as gifts requires specific documentation and registration. The department processes these non-sale transfers, ensuring proper legal recognition whilst applying relevant fee structures that differ from standard purchase transactions.

Property Valuation Services

Official property valuations are available for various purposes, including mortgage applications, legal disputes, or investment analysis. These valuations provide authoritative assessments recognised by financial institutions and legal entities throughout the UAE.

No Objection Certificates (NOCs)

Developers and property owners can obtain NOCs for various purposes, including property modifications, tenant registrations, or sale permissions in developments with specific restrictions. These certificates confirm compliance with regulations and development guidelines.

Property Registration Fees and Costs

Understanding the complete cost structure is essential for accurate investment planning. RAK's fee structure is generally more competitive than Dubai or Abu Dhabi, contributing to the emirate's attractive investment proposition.

Standard Registration Fees

The primary registration fee for property purchases in RAK is typically 2.25% of the property value. This breaks down as follows:

- 2% registration fee payable to the RAK Land Department

- 0.25% administrative fee covering documentation and processing

For a property valued at AED 1,000,000, the total registration fee would amount to AED 22,500. This represents significant savings compared to Dubai's 4% transfer fee, making RAK particularly attractive for investors seeking to maximise capital efficiency.

Additional Costs and Considerations

Beyond the standard registration fee, investors should budget for:

- Trustee office fees: Approximately AED 2,000–5,000 depending on the transaction complexity

- Mortgage registration fees: If financing is involved, typically 0.25% of the loan amount plus AED 290 for the mortgage registration certificate

- Title deed issuance: Generally included in the registration fee, though certified copies cost approximately AED 50–100 each

- NOC from developer: For off-plan or community properties, developers typically charge AED 2,000–5,000 for NOCs required during registration

Off-Plan Property Considerations

For off-plan investments, registration occurs upon project completion and handover. During the construction phase, investors typically pay booking fees (usually 10% of property value) and instalments according to the payment plan. The final registration fee is calculated on the agreed purchase price and paid during the final handover process.

It's worth noting that RAK's competitive fee structure, combined with generally lower property prices compared to Dubai, creates compelling total acquisition costs. This affordability factor has contributed significantly to RAK's growing appeal amongst both regional and international investors seeking exceptional value.

Step-by-Step Property Registration Process

Navigating the registration process efficiently requires understanding each stage and preparing accordingly. Here's the comprehensive journey from purchase agreement to title deed in hand.

1. Initial Purchase Agreement – Once you've identified your ideal property through channels such as exclusive RAK off-plan projects, you'll sign a Sale and Purchase Agreement (SPA) with either the developer (for off-plan) or the seller (for secondary market). This legally binding document outlines all transaction terms, payment schedules, and completion timelines. Ensure thorough legal review before signing, as this forms the foundation of your ownership rights.

2. Obtain No Objection Certificate – The developer or current owner must provide an NOC confirming permission to complete the sale. This certificate verifies that no outstanding service charges, fees, or restrictions prevent the transaction. For community properties, the homeowners' association may also need to provide clearance. Processing typically takes 3–7 working days.

3. Arrange Payment and Financing – If purchasing outright, arrange fund transfers ensuring compliance with UAE anti-money laundering regulations. For financed purchases, finalise mortgage approval with your chosen lender. Banks will require property valuations, which can be obtained through the RAK Land Department or approved independent valuers.

4. Prepare Required Documentation – Gather all necessary documents (detailed in the next section) ensuring everything is current and properly attested where required. Missing or incorrect documentation is the most common cause of registration delays.

5. Book Appointment with Land Department – Schedule your registration appointment through the RAK Land Department's online portal or by visiting their office. Booking in advance, particularly during busy periods, ensures minimal waiting time. Both buyer and seller (or their authorised representatives) must attend unless power of attorney has been arranged.

6. Attend Registration Appointment – At the appointment, a land department official will verify all documentation, confirm the transaction details, and calculate applicable fees. Both parties will sign the transfer documents in the presence of the official. Payment of all fees must be completed during this appointment.

7. Title Deed Issuance – Upon successful completion of registration and fee payment, the RAK Land Department issues the official title deed. This document represents your legal proof of ownership and should be stored securely. Many investors keep the original in bank safe deposit boxes whilst retaining certified copies for reference.

8. Update Utility Connections – Following registration, update utility accounts (electricity, water, and cooling if applicable) into your name. This ensures uninterrupted services and proper billing. The title deed serves as proof of ownership when establishing these accounts.

The entire process, from signed agreement to title deed receipt, typically takes 2–4 weeks for straightforward transactions. Complex situations involving multiple owners, offshore companies, or inheritance matters may require additional time.

Required Documentation

Proper documentation preparation prevents delays and ensures smooth processing. Requirements vary slightly depending on whether you're an individual or corporate buyer, and whether you're a UAE resident or international investor.

For Individual Buyers (UAE Residents)

- Valid Emirates ID (original and copy)

- Passport copy with valid residency visa

- Sale and Purchase Agreement (original)

- No Objection Certificate from developer/seller

- Proof of payment or bank transfer documentation

- Mortgage approval letter (if applicable)

- Current title deed (for secondary market purchases)

For Individual Buyers (Non-Residents)

- Valid passport (original and copy)

- Entry stamp or visit visa documentation

- Sale and Purchase Agreement (original)

- No Objection Certificate from developer/seller

- Proof of payment or bank transfer documentation

- Power of attorney (if not attending personally, must be UAE-attested)

- Mortgage approval letter (if applicable)

For Corporate Buyers

- Trade licence (original and copy)

- Memorandum and Articles of Association

- Board resolution authorising the purchase and naming authorised signatories

- Authorised signatory's Emirates ID and passport

- Sale and Purchase Agreement (original)

- No Objection Certificate from developer/seller

- Proof of payment

- Certificate of Incorporation

All documents in foreign languages must be translated into Arabic by certified translators and attested by the UAE Ministry of Foreign Affairs. For international documents, consular attestation from your home country followed by UAE embassy attestation is typically required.

Digital Services and Online Portal

RAS Al Khaimah has invested significantly in digital infrastructure, making property transactions increasingly accessible and efficient. The RAK Smart Government initiative encompasses various e-services that streamline interactions with the Land Department.

Available Online Services

Through the digital portal, investors and property owners can:

- Check property ownership and registration status

- Request title deed copies and certificates

- Book registration appointments

- Pay fees and charges electronically

- Track application status

- Request property valuation certificates

- Access property transaction history

These services operate 24/7, providing exceptional convenience for international investors in different time zones. The portal accepts various payment methods, including credit cards and electronic bank transfers, facilitating seamless transactions.

Mobile Applications

RAK Government has also developed mobile applications that provide property-related services on smartphones and tablets. These apps enable investors to monitor their property portfolios, receive notifications about important deadlines or updates, and access documentation whilst travelling.

Whilst digital services have greatly improved accessibility, complex transactions often benefit from in-person visits or engagement with experienced property consultants who understand the nuances of RAK's regulatory environment. This is where specialist firms provide invaluable support, navigating potential complications before they arise.

Ownership Types and Restrictions

Understanding ownership types available in RAK is crucial for investment planning and ensuring compliance with local regulations.

Freehold Ownership

Foreign investors can acquire freehold ownership in designated areas of RAK, granting complete ownership rights without time limitations. Freehold properties can be sold, inherited, mortgaged, or leased at the owner's discretion. Most contemporary developments, particularly luxury waterfront apartments and exclusive villa communities, are offered as freehold, providing maximum flexibility and investment security.

Designated freehold areas include Al Marjan Island, Al Hamra Village, Mina Al Arab, and other investment zones specifically developed to attract international capital. These areas have been strategically designed to offer world-class amenities and infrastructure that appeal to discerning investors.

Leasehold Ownership

Some properties in RAK are available on leasehold basis, typically for 99 years. Leasehold grants long-term usage rights but ultimate ownership remains with the freeholder (often the government or developer). Upon lease expiry, renewal options may be available subject to prevailing regulations. Leasehold properties are generally less common in RAK's investment zones but may apply to certain commercial or older residential areas.

Usufruct Rights

Occasionally, properties may be offered with usufruct rights, granting the right to use and derive income from a property for a specified period (typically 25–50 years) without actual ownership. This arrangement is relatively uncommon in RAK's residential market but may apply to specific commercial or agricultural properties.

Ownership Restrictions

Certain areas remain restricted to UAE and GCC nationals only. Before committing to any property investment, verify that the specific location permits foreign ownership. Reputable developers and property consultants ensure their offerings comply with these regulations, but independent verification provides additional assurance.

Common Challenges and How to Overcome Them

Whilst RAK's property registration system is generally efficient, investors occasionally encounter challenges. Anticipating these issues and understanding solutions ensures smoother transactions.

Challenge: Documentation Delays

Missing or improperly attested documents frequently cause registration delays. International investors particularly may struggle with document attestation requirements.

Solution: Begin document preparation early, ideally before finalising the purchase agreement. Engage professional document clearing services or legal advisors familiar with UAE attestation requirements. Maintaining a comprehensive checklist and verifying requirements with the Land Department before your appointment prevents last-minute complications.

Challenge: Developer NOC Processing

Some developers process NOCs slowly, particularly during periods of high transaction volume or when multiple approvals are required within their organisation.

Solution: Request the NOC immediately upon signing the SPA rather than waiting until registration is imminent. Maintain regular communication with the developer's sales team, and if delays persist, escalate through formal channels. Experienced property consultants often have established developer relationships that facilitate faster processing.

Challenge: Financing Coordination

Synchronising mortgage approval, property valuation, and registration timelines can be complex, particularly when multiple parties and institutions are involved.

Solution: Begin mortgage pre-approval before identifying specific properties. Once you've selected your investment, maintain close coordination between your mortgage provider, the seller/developer, and the Land Department. Clear communication about timelines and requirements across all parties prevents costly delays.

Challenge: Language Barriers

Whilst many Land Department staff speak English, official documentation is primarily in Arabic, and nuances can be lost in translation.

Solution: Engage bilingual legal advisors or property consultants who can accurately interpret documentation and ensure you fully understand all terms and conditions. Never sign documents you don't completely understand—professional translation services are a worthwhile investment for such significant transactions.

Challenge: Fee Calculation Discrepancies

Occasionally, disputes arise regarding the property value upon which fees are calculated, particularly if the transaction price differs significantly from recent market valuations.

Solution: Obtain official property valuations before finalising purchase agreements. This provides clarity on likely registration fees and helps negotiate transaction terms. If discrepancies arise, the Land Department's valuation is generally definitive, so understanding this benchmark prevents surprises.

Why RAK Represents Exceptional Investment Opportunity

Understanding the administrative processes is essential, but equally important is recognising why navigating these procedures in RAK specifically offers such compelling rewards. The emirate has emerged as a premier investment destination for discerning investors seeking exceptional capital growth and value propositions not readily available in more established markets.

Competitive Pricing and Strong Appreciation Potential

RAK property prices remain significantly below Dubai and Abu Dhabi equivalents whilst offering comparable—and in some cases superior—quality and amenities. This pricing differential, combined with substantial infrastructure investment and tourism development, creates powerful appreciation potential. Early investors in RAK's premium developments are positioned to capture exceptional capital growth as the emirate's profile continues rising.

World-Class Infrastructure Development

The RAK government has committed billions to infrastructure projects, including the expansion of RAK International Airport, new road networks, and tourism attractions. These developments enhance accessibility and desirability, directly supporting property values. Investors who understand investing in RAK property recognise these fundamentals drive long-term appreciation.

Attractive Rental Yields

RAK offers rental yields often exceeding 7–8% annually, substantially higher than Dubai's 5–6% average. This income generation potential, combined with capital appreciation prospects, delivers compelling total returns for investment portfolios.

Lifestyle and Amenity Quality

Luxury waterfront apartments with marina views, exclusive villa communities with private beaches, championship golf courses, and five-star hospitality infrastructure provide exceptional lifestyle quality. These amenities attract both long-term residents and short-term tourists, supporting robust rental demand across various property types.

Strategic Positioning and Accessibility

RAK's proximity to Dubai (approximately 45 minutes' drive) positions it as an accessible alternative for those working in the emirate's commercial centres whilst preferring a more relaxed residential environment. This strategic location supports both owner-occupier and investment demand.

Simplified Administrative Environment

As this guide has demonstrated, RAK's property registration processes, whilst thorough, are streamlined and cost-effective compared to other emirates. Lower transaction costs mean more capital available for the actual investment, improving overall returns.

For investors seeking to capitalise on these exceptional opportunities, partnering with specialists who possess deep RAK market insights and established relationships with premier developers provides invaluable advantages. Access to pre-launch and off-market properties not available to the general public can significantly enhance investment outcomes, securing prime units in the most desirable developments before broader market release.

Navigating RAK's property landscape—from identifying high-yield opportunities through to final title deed registration—requires expertise, market knowledge, and attention to administrative detail. Investors who approach this market with proper preparation and professional guidance position themselves to capture the exceptional returns that RAK's burgeoning real estate market offers.

The RAK Land Department serves as the cornerstone of property transactions in one of the UAE's most exciting emerging markets. Whilst the administrative processes may initially appear complex, understanding the services offered, fee structures, required documentation, and registration procedures demystifies the journey from property selection to ownership.

Ras Al Khaimah's competitive transaction costs, streamlined processes, and increasingly sophisticated digital infrastructure make property acquisition remarkably accessible for both UAE residents and international investors. When combined with the emirate's compelling value propositions—competitive pricing, strong appreciation forecasts, attractive yields, and world-class lifestyle amenities—the administrative effort required becomes a minor consideration against the substantial rewards available.

Success in RAK's property market comes from combining practical knowledge of registration procedures with strategic market insights that identify the highest-potential opportunities. Whether you're acquiring your first investment property or expanding an existing portfolio, thorough preparation and expert guidance throughout the process ensure optimal outcomes and position you to capitalise on RAK's exceptional growth trajectory.

Start Your RAK Property Journey with Expert Guidance

Navigating RAK's property market and Land Department procedures is significantly easier with experienced specialists by your side. At Azimira Real Estate, we provide comprehensive support throughout your entire property acquisition journey—from identifying exclusive off-plan opportunities and pre-launch projects to guiding you through every administrative requirement for seamless registration.

Our deep RAK market expertise, established developer relationships, and thorough understanding of Land Department procedures ensure you avoid common pitfalls whilst securing premium properties with exceptional appreciation potential.

Ready to explore RAK's most compelling investment opportunities? Contact our team today and discover how we can help you unlock exceptional returns in the UAE's most exciting emerging property market.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.