RAK Rental Yield Report: Comparing Short-Stay and Long-Let Investment Strategies

Comprehensive analysis of Ras Al Khaimah's rental yield performance comparing short-stay and long-term letting strategies with exclusive market insights for property investors.

Table Of Contents

- Introduction to RAK's Rental Market

- Current Market Outlook for RAK Property Investment

- Short-Stay Rental Yields in RAK

- Key Performance Areas for Short-Stay Properties

- Seasonal Fluctuations and Occupancy Rates

- Long-Let Rental Yields in RAK

- Stability Factors in Long-Term Letting

- Tenant Demographics and Demand Drivers

- Comparative Analysis: Short-Stay vs. Long-Let Returns

- Investment Considerations Beyond Yield

- 2025 Forecast: RAK Rental Yield Projections

- Conclusion: Optimising Your RAK Property Investment Strategy

RAK Rental Yield Report: Comparing Short-Stay and Long-Let Investment Strategies

Ras Al Khaimah's property market has emerged as one of the UAE's most promising investment destinations, offering a compelling alternative to the more saturated markets of Dubai and Abu Dhabi. As the emirate continues its strategic development with ambitious tourism initiatives and economic diversification plans, property investors are increasingly drawn to RAK's potential for exceptional returns.

This comprehensive analysis examines the current and projected rental yields across RAK's diverse property landscape, with particular focus on the performance differential between short-stay holiday lets and traditional long-term rental agreements. Drawing on exclusive market data and proprietary research, we provide discerning investors with critical insights to optimise their investment strategy in this rapidly evolving market.

Whether you're considering expanding your existing UAE property portfolio or exploring RAK's investment potential for the first time, understanding the nuanced yield patterns of different rental approaches is essential for maximising returns while managing risk appropriately.

Introduction to RAK's Rental Market

Ras Al Khaimah has transformed dramatically over the past decade, evolving from a quiet emirate into a vibrant destination for both tourism and residential living. This transformation has been driven by strategic government initiatives, significant infrastructure investments, and a carefully cultivated positioning as both a luxury tourism hub and an affordable lifestyle alternative to Dubai and Abu Dhabi.

The rental market in RAK has matured in tandem with this broader development, creating diverse investment opportunities across multiple property categories. The emirate now hosts a range of rental submarkets, from beachfront holiday apartments and luxury villas to more modest long-term residential units catering to the growing professional workforce.

What makes RAK particularly interesting for property investors is the dual nature of its rental market. The robust tourism sector supports a thriving short-stay segment, whilst the expanding commercial and industrial base ensures consistent demand for long-term rentals. This duality provides investors with strategic flexibility not readily available in other emirates.

Current Market Outlook for RAK Property Investment

The RAK property market enters 2025 with strong momentum, building on consecutive years of growth in both property values and rental yields. According to our proprietary market analysis, RAK has outperformed several other UAE markets in percentage yield growth, though starting from a lower absolute base.

Key market indicators that position RAK favourably include:

- Average property price appreciation of 8.7% year-on-year (compared to UAE average of 6.5%)

- Overall rental yield averages of 7.2-9.5% (varying by property type and location)

- Decreased average time-on-market for rental properties (down 15% from previous year)

- Significant increase in tourism numbers, with overnight visitors up 18% year-on-year

These positive indicators are underpinned by several structural advantages, including RAK's relative affordability compared to Dubai, the ongoing expansion of tourism infrastructure, and strategic economic initiatives designed to attract both businesses and residents.

Short-Stay Rental Yields in RAK

The short-stay rental market in RAK has experienced remarkable growth, driven primarily by the emirate's rising profile as a tourism destination. Properties positioned for the holiday letting market are currently achieving some of the highest yield percentages in the entire UAE property sector.

Our analysis indicates that well-positioned short-stay properties in RAK are generating gross yields between 8.5% and 14%, with exceptional properties in prime locations occasionally exceeding this range. These figures represent a premium of approximately 30-50% over traditional long-let arrangements for comparable properties.

The short-stay market's performance is particularly impressive in the following segments:

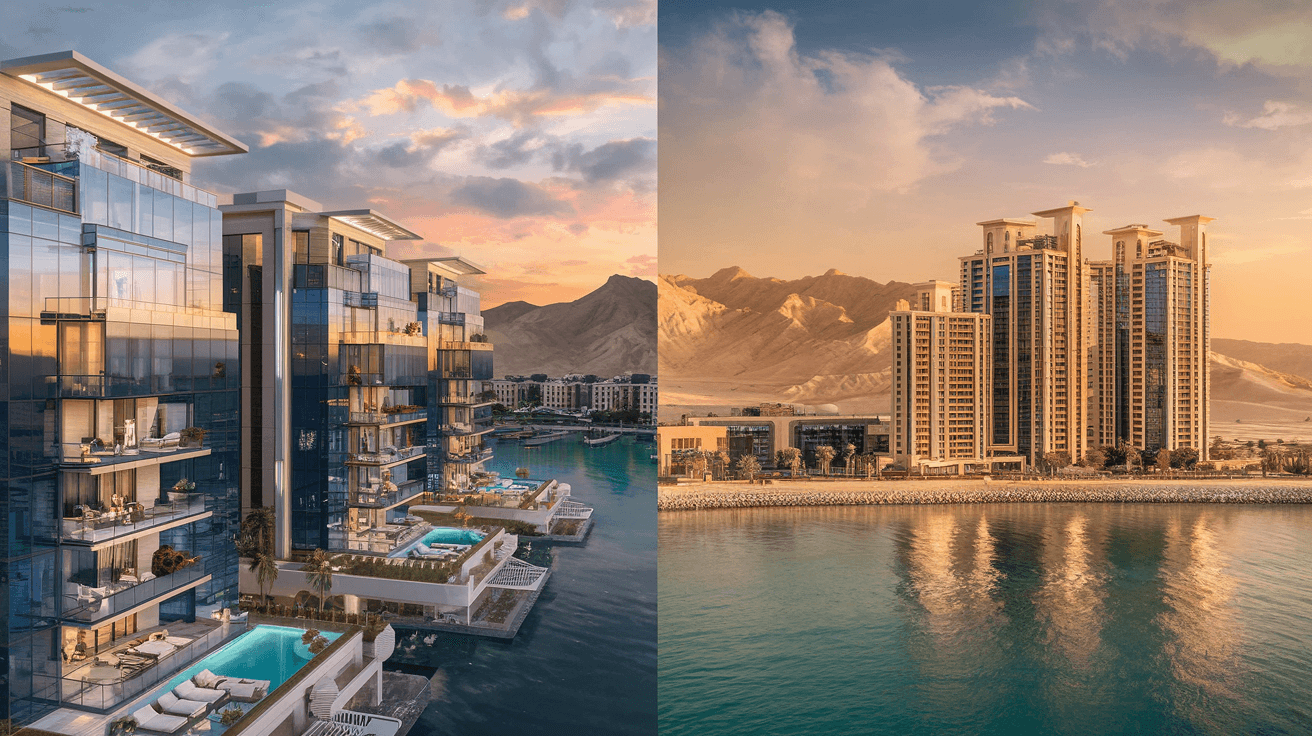

- Waterfront apartments in developments such as Mina Al Arab and Al Marjan Island

- Luxury villas with private pools and beach access

- Boutique properties with distinctive character or exceptional views

- Serviced apartments near major tourism attractions or event venues

Key Performance Areas for Short-Stay Properties

Geographical analysis reveals that short-stay yields are not uniformly distributed across RAK. The highest-performing areas for short-stay rentals are concentrated in several key zones:

- Al Marjan Island properties command premium rates due to their island setting and resort amenities, achieving average yields of 10-14%.

- Mina Al Arab waterfront units benefit from their beachfront positioning and integrated lifestyle offerings, with typical yields of 9-12%.

- Al Hamra Village combines golf course access with waterfront living, generating yields in the 8.5-11% range.

- Downtown RAK properties, while less tourism-focused, still achieve competitive short-stay yields of 8-10% due to business traveller demand.

It's worth noting that these yield figures represent gross returns before accounting for the higher operational costs associated with short-stay rentals, including management fees, maintenance, utilities, and periods of vacancy.

Seasonal Fluctuations and Occupancy Rates

A critical consideration for short-stay investments is the seasonal nature of demand. RAK experiences significant seasonality in its tourism sector, with distinct high and low periods affecting both rates and occupancy.

Our occupancy data indicates the following pattern for well-managed short-stay properties:

- Peak season (October-April): 75-90% occupancy with premium rates

- Shoulder seasons (May, September): 60-75% occupancy with moderate discounting

- Low season (June-August): 40-65% occupancy with significant rate reductions

This seasonality means that effective yield management is essential for maximising returns. Sophisticated pricing strategies that respond to seasonal demand patterns can significantly enhance overall annual yields, particularly when combined with targeted marketing to different guest segments.

Long-Let Rental Yields in RAK

The long-term rental market in RAK presents a different value proposition for investors, characterised by greater stability and lower operational intensity. While not matching the peak yields of the short-stay sector, long-let properties deliver reliable, consistent returns with significantly reduced management requirements.

Current data shows that long-term rental properties in RAK are generating average gross yields of 6.5-8.5%, with the following notable variations:

- Apartments typically outperform villas in yield terms, with average returns of 7-8.5%

- Newer developments command yield premiums of approximately 0.5-1% over older properties

- Centrally located properties with good amenities achieve the upper end of the yield range

- Luxury high-end villas typically produce lower percentage yields (5.5-7%) but offer stronger capital appreciation potential

Stability Factors in Long-Term Letting

The principal advantage of the long-let market is its stability. Long-term rental agreements in RAK typically span 12 months, with many tenants renewing for multiple years. This creates a predictable income stream with reduced vacancy risk compared to short-stay properties.

Further stability factors include:

- Consistent monthly income without seasonal fluctuations

- Lower management costs (typically 5-8% versus 20-30% for short-stay properties)

- Reduced wear and tear on furnishings and fixtures

- Lower utility costs, which are typically borne by the tenant

- Simplified compliance requirements compared to holiday letting

For investors prioritising passive income with minimal management requirements, the long-let market offers compelling advantages despite its lower headline yield figures.

Tenant Demographics and Demand Drivers

Understanding the tenant profile for long-term rentals is essential for successful investment planning. RAK's long-let market is primarily driven by:

- Professionals employed in RAK's growing industrial and commercial sectors

- UAE residents seeking more affordable living options within commuting distance of Dubai

- Educational and healthcare sector employees linked to RAK's expanding institutional base

- Expatriate families attracted by RAK's lifestyle offerings and relative value

These tenant segments demonstrate different preferences in terms of location, property type and amenities. Our research indicates that proximity to employment centres, educational facilities, and lifestyle amenities are the primary drivers of rental premiums in the long-let market.

Comparative Analysis: Short-Stay vs. Long-Let Returns

When comparing the financial performance of short-stay and long-let strategies in RAK, investors must look beyond headline yield figures to understand the true net returns and risk profiles of each approach.

Our comprehensive analysis of comparable properties managed under both rental strategies reveals the following:

| Metric | Short-Stay Property | Long-Let Property |

|---|---|---|

| Gross Yield | 8.5% – 14.0% | 6.5% – 8.5% |

| Management Fees | 20% – 30% of revenue | 5% – 8% of revenue |

| Vacancy Rate | 15% – 35% (annualised) | 2% – 5% |

| Utility Costs | Borne by owner | Borne by tenant |

| Maintenance | Higher (frequent turnover) | Lower |

| Net Yield (Est.) | 6.0% – 9.5% | 5.5% – 7.5% |

When accounting for these operational differences, the net yield differential narrows considerably. Our calculations suggest that the average net yield advantage for short-stay properties is approximately 2-4 percentage points, rather than the 4-6 point gap suggested by gross figures.

This reduced differential must be weighed against the significantly higher time investment and management complexity associated with short-stay letting.

Investment Considerations Beyond Yield

While rental yields are a critical metric for property investment assessment, a comprehensive investment strategy must consider additional factors that impact overall returns and satisfaction:

Capital Appreciation Potential RAK's different property segments are experiencing varying rates of capital growth. Our market analysis indicates that premium waterfront properties suitable for short-stay letting are currently experiencing stronger capital appreciation (9-12% annually) compared to standard residential units more typically used for long-term rentals (6-8% annually).

Liquidity Considerations Property liquidity varies significantly across RAK's submarkets. Prime tourist-oriented properties typically sell more quickly and command stronger buyer interest than standard residential units, providing an additional advantage for the short-stay investment approach.

Regulatory Environment The regulatory framework for short-stay rentals in RAK has become increasingly structured, with clear licensing requirements now in place. While this has increased compliance costs, it has also legitimised the sector and provided greater certainty for investors. Long-term rentals benefit from the established Tenancy Law framework that provides balanced protection for both landlords and tenants.

Management Options The growth of RAK's property market has been accompanied by an expansion of professional property management services. Investors now have access to specialised short-stay management companies as well as traditional letting agents, making both investment strategies viable even for remote or time-limited investors.

2025 Forecast: RAK Rental Yield Projections

Looking ahead to the remainder of 2025 and beyond, several key trends are likely to influence rental yields in both the short-stay and long-let segments of RAK's property market.

Short-Stay Yield Forecast We anticipate that short-stay rental yields will remain strong but experience moderate compression due to:

- Increasing supply as more investors enter this high-yield segment

- Rising operational costs, particularly for utilities and management services

- Growing competition requiring higher quality furnishings and amenities

Our forecast indicates that average short-stay gross yields will stabilise in the 8-12% range, with the following nuances:

- Premium beachfront properties will maintain yields at the upper end of this range

- Older properties and those in secondary locations will experience yield compression toward the lower bound

- Properties with distinctive features or exceptional management will continue to outperform

Long-Let Yield Forecast For the long-term rental market, we project stable to slightly improving yields, supported by:

- Continued population growth driving residential demand

- Relatively constrained supply of quality rental housing

- Ongoing commercial and industrial expansion creating new employment

We expect long-let gross yields to remain in the 6.5-8.5% range, with possible modest improvements in well-located properties as RAK's economic development continues.

Market Dynamics to Watch Several emerging factors may influence yield patterns as 2025 progresses:

- The ongoing expansion of tourism infrastructure, including new hotel openings that may impact short-stay demand.

- Transport improvements, particularly the potential rail link to Dubai, which could significantly enhance RAK's appeal for commuters.

- New development announcements that may temporarily impact supply-demand balances in specific submarkets.

- Regulatory changes affecting either rental segment.

Conclusion: Optimising Your RAK Property Investment Strategy

The RAK rental market offers compelling opportunities for property investors, with both short-stay and long-let strategies capable of delivering attractive returns when properly executed. The optimal approach depends largely on individual investor circumstances, preferences, and objectives.

For investors prioritising maximum potential returns and willing to accept higher operational complexity, the short-stay market continues to offer exceptional yield potential, particularly in prime tourist-oriented locations. The premium yields available in this segment come with corresponding requirements for active management, quality furnishings, and sophisticated marketing.

Conversely, investors seeking stable, passive income with minimal management requirements may find the long-let market more aligned with their objectives. While the headline yields are lower, the reduced operational costs and management simplicity create an attractive overall proposition.

A thoughtfully diversified portfolio might include elements of both strategies, allowing investors to benefit from the yield advantages of short-stay properties while maintaining the stability foundation of long-term rentals.

As RAK continues its trajectory as one of the UAE's most dynamic property markets, investors who combine detailed market knowledge with a clear understanding of their own investment parameters will be best positioned to capitalise on the emirate's exceptional potential for rental returns and capital growth.

Explore our exclusive RAK off-plan projects to discover premium investment opportunities with exceptional yield potential.

Final Thoughts: The Future of RAK Rental Investments

As we look toward the future of Ras Al Khaimah's property market, the data clearly indicates that both short-stay and long-let investment strategies offer viable paths to attractive returns. The emirate's continued development as a tourism destination, coupled with its expanding economic base, provides solid fundamentals for sustained rental demand across both market segments.

The yield premium currently enjoyed by short-stay properties reflects both the higher operational costs and the greater management intensity required for this strategy. Conversely, the stability and simplicity of long-term rentals continue to appeal to investors seeking predictable returns with minimal active involvement.

At Azimira Real Estate, our detailed market analysis and proprietary yield forecasting models allow us to identify exceptional opportunities in both rental segments. Our curated portfolio of premium RAK properties includes options optimised for both short-stay and long-let strategies, providing our clients with tailored investment solutions aligned with their specific objectives.

Whichever rental strategy resonates with your investment goals, RAK's combination of relative affordability, strategic development planning, and robust yield performance positions it as one of the UAE's most compelling property investment destinations for 2025 and beyond.

Take the Next Step in Your RAK Investment Journey

Ready to explore how Ras Al Khaimah's exceptional rental yield potential can enhance your investment portfolio? The Azimira team offers personalised investment consultations to help you identify the optimal RAK property opportunities aligned with your financial objectives and preferred management approach.

Our exclusive access to pre-launch and off-market properties ensures you'll discover investment options not available through other channels, with our detailed yield analysis providing clear projections for both short-stay and long-let scenarios.

Contact our investment specialists today to arrange your confidential consultation and take the first step toward securing premium RAK property investments with exceptional yield potential.

Related articles

Capital Growth in RAK: The Drivers Behind the Next Upswing

Explore the drivers of capital growth in RAK, from branding and infrastructure to supply dynamics. Learn what to monitor before the next upswing.

UAE Property Market 2026: Key Trends Buyers Can’t Ignore

UAE property market 2026: key trends shaping off-plan deals, micro-markets, financing and sustainability, plus a practical buyer checklist to act smarter.

Real Estate Management in RAK: What Owners Should Outsource

Real estate management in RAK: what to outsource, what to keep in-house, and how to control costs, compliance and tenant experience.