Serviced Apartments in RAK: Hotel-Style Returns for Investors

Discover how serviced apartments in Ras Al Khaimah deliver hotel-style returns with yields up to 10%. Expert insights on RAK's emerging investment opportunities.

Table Of Contents

- What Are Serviced Apartments and Why Do They Matter?

- The RAK Advantage: Why Ras Al Khaimah Is Attracting Savvy Investors

- Hotel-Style Returns: Understanding the Revenue Model

- Expected Rental Yields and Capital Appreciation in RAK

- Key Locations for Serviced Apartment Investments in RAK

- Operational Considerations: Management and Maintenance

- Comparing Serviced Apartments to Traditional Rentals

- How to Identify High-Yield Serviced Apartment Opportunities

The UAE's property investment landscape is evolving rapidly, and discerning investors are increasingly looking beyond Dubai and Abu Dhabi to uncover exceptional opportunities. Ras Al Khaimah (RAK) has emerged as a compelling destination for those seeking hotel-style returns through serviced apartment investments—a property class that combines the passive income benefits of traditional rentals with the higher yields typically associated with hospitality assets.

Serviced apartments in RAK represent a unique convergence of factors: the emirate's strategic positioning as an emerging tourism and business hub, competitive entry prices compared to more established markets, and a growing demand for flexible, hotel-alternative accommodation. For investors who understand how to navigate this niche, the potential rewards are substantial, with annual yields reaching up to 10% in select developments whilst capital values continue their upward trajectory.

This comprehensive guide explores the serviced apartment investment opportunity in RAK, examining the revenue models that deliver hotel-style returns, the locations offering the strongest appreciation forecasts, and the operational considerations that separate successful investments from underperforming assets. Whether you're an experienced property investor or exploring your first UAE acquisition, understanding RAK's serviced apartment market is essential for capitalising on one of the region's most promising growth stories.

What Are Serviced Apartments and Why Do They Matter?

Serviced apartments occupy a distinctive position between traditional residential rentals and hotel rooms, offering fully furnished units with hotel-like amenities and housekeeping services whilst providing the space and privacy of a conventional apartment. These properties cater to business travellers, relocating professionals, and tourists seeking extended stays, typically ranging from a few days to several months.

From an investment perspective, serviced apartments matter because they generate revenue through short-term lettings at daily or weekly rates rather than annual tenancy agreements. This operational model creates multiple revenue opportunities throughout the year and allows operators to adjust pricing based on seasonal demand, local events, and market conditions. The result is a dynamic income stream that can significantly outperform traditional buy-to-let investments when properly managed.

The appeal of serviced apartments has grown considerably across the UAE, with RAK particularly well-positioned to capture this demand. The emirate's tourism infrastructure has expanded substantially in recent years, with luxury resorts, adventure tourism facilities, and business conference centres all contributing to increased visitor numbers. However, hotel capacity hasn't kept pace with demand growth, creating opportunities for serviced apartment operators to fill the gap with competitively priced, flexible accommodation options.

For investors, the serviced apartment model offers several distinct advantages: higher gross yields compared to traditional rentals, professional management that removes day-to-day landlord responsibilities, and the potential for capital appreciation as RAK's property market matures. These factors combine to create an investment proposition that delivers hotel-style returns without requiring direct operational involvement.

The RAK Advantage: Why Ras Al Khaimah Is Attracting Savvy Investors

Ras Al Khaimah's transformation from a quiet northern emirate to a dynamic investment destination represents one of the UAE's most compelling development stories. The emirate has strategically positioned itself as an affordable yet premium alternative to Dubai and Abu Dhabi, attracting both tourists and residents with its natural beauty, lower cost of living, and improving infrastructure.

Several macro factors make RAK particularly attractive for serviced apartment investments. The emirate's tourism sector has experienced consistent growth, with visitor numbers increasing by double-digit percentages annually in recent years. Major attractions including Jebel Jais (the UAE's highest peak), luxury beach resorts, and the developing Al Marjan Island have established RAK as a leisure destination, whilst growing business activity creates corporate travel demand.

Property prices in RAK remain considerably more accessible than in Dubai, with entry points for quality apartments starting at levels that would barely secure a studio in established Dubai neighbourhoods. This pricing differential creates exceptional value for investors, particularly when considering that rental rates and daily letting prices in RAK are converging towards broader UAE norms. The arbitrage opportunity—buying at RAK prices whilst achieving revenues approaching Dubai levels—underpins the strong yield potential in this market.

Infrastructure development continues to enhance RAK's investment credentials. The RAK International Airport serves growing passenger numbers, road connections to Dubai and the Northern Emirates have improved significantly, and the emirate's free zones attract international businesses that generate accommodation demand. Government initiatives to streamline property regulations and promote tourism have created a supportive environment for real estate investment, with transparent ownership structures and investor-friendly policies.

For those exploring investment opportunities in RAK property, the serviced apartment sector offers particularly attractive risk-adjusted returns, combining the emirate's growth trajectory with a proven revenue model that has delivered consistently across the UAE.

Hotel-Style Returns: Understanding the Revenue Model

The term "hotel-style returns" refers to the revenue generation approach used by serviced apartments, which mirrors hospitality operations rather than traditional residential lettings. Understanding this model is essential for evaluating investment opportunities and setting realistic return expectations.

Serviced apartments generate income through short-term bookings, typically ranging from one night to several months. Properties are listed on booking platforms, marketed to corporate clients, and managed by specialist operators who handle reservations, guest services, housekeeping, and maintenance. Guests pay daily or weekly rates that include utilities, Wi-Fi, cleaning services, and access to amenities such as gyms, pools, and concierge services.

This operational approach creates several revenue advantages. Firstly, daily rates typically generate higher monthly income than traditional annual leases when occupancy levels are strong. A serviced apartment in RAK might achieve daily rates of AED 300-600 depending on location and specification, translating to AED 9,000-18,000 monthly at full occupancy—substantially higher than comparable unfurnished annual rentals.

Secondly, dynamic pricing allows operators to maximise revenue during peak periods. Winter months, when tourists flock to the UAE's pleasant climate, command premium rates, as do periods surrounding major events and public holidays. This flexibility means annual revenue isn't limited by a fixed rental agreement but can capture market opportunities throughout the year.

Thirdly, the serviced apartment model allows for revenue diversification. Beyond accommodation charges, operators may generate additional income from extended-stay discounts that still exceed traditional rental rates, corporate contracts that guarantee baseline occupancy, and ancillary services such as airport transfers or additional housekeeping.

However, hotel-style returns also involve hotel-style costs. Management fees typically range from 20-35% of gross revenue, covering marketing, booking management, guest services, and administration. Utilities, maintenance, and furnishing replacement create ongoing expenses that exceed those of unfurnished rentals. Occupancy rates fluctuate seasonally and rarely achieve 100% annually, meaning revenue projections must account for realistic occupancy levels of 65-80% depending on location and management quality.

When properly structured and professionally managed, these factors combine to deliver net returns that significantly exceed traditional buy-to-let investments, making serviced apartments an attractive proposition for investors seeking higher yields from UAE property assets.

Expected Rental Yields and Capital Appreciation in RAK

Rental yields form the cornerstone of any serviced apartment investment analysis, and RAK currently offers some of the most attractive returns in the UAE property market. Understanding both the income potential and capital appreciation forecasts is essential for making informed investment decisions.

Gross rental yields for well-located serviced apartments in RAK typically range from 8-10% annually, with exceptional properties and superior management occasionally exceeding this range. These figures represent the gross annual rental income as a percentage of the purchase price, calculated before operating expenses and management fees. To illustrate: a serviced apartment purchased for AED 800,000 generating AED 80,000 in annual gross rental income would deliver a 10% gross yield.

Net yields—which account for management fees, service charges, maintenance, and other operating costs—typically range from 5-7% for serviced apartments in RAK. Whilst lower than gross yields, these net returns still substantially exceed the 3-5% net yields commonly achieved by traditional unfurnished rentals in the same locations, demonstrating the income advantage of the serviced apartment model.

Several factors influence yield performance within RAK's serviced apartment market. Location remains paramount, with waterfront properties, developments near tourist attractions, and apartments in areas with strong corporate presence commanding higher occupancy rates and daily prices. Property specification matters considerably; modern, well-appointed units with quality furnishings and amenities attract premium-paying guests and positive reviews that drive future bookings.

Management quality represents perhaps the most critical yield determinant. Professional operators with established marketing channels, strong online presence, corporate relationships, and efficient operations consistently outperform those with limited expertise or resources. The difference between competent and exceptional management can represent 2-3 percentage points of net yield—a substantial variation that underscores the importance of selecting the right operational partner.

Beyond rental income, capital appreciation provides the second component of total returns for serviced apartment investors. RAK's property market has demonstrated strong price growth in recent years, with quality developments in prime locations experiencing annual appreciation of 8-12%. This capital growth reflects the emirate's improving fundamentals, increasing demand from both end-users and investors, and the natural maturation of RAK's real estate market towards broader UAE pricing norms.

Combining rental yields of 5-7% net with capital appreciation of 8-12% annually creates a compelling total return proposition of 13-19% per annum for well-selected serviced apartment investments in RAK. These figures position the emirate as one of the UAE's most attractive property investment destinations for investors seeking both income generation and capital growth.

For those interested in exclusive RAK off-plan projects specifically designed for serviced apartment operations, working with specialists who understand the nuances of yield optimisation and appreciation potential is essential for achieving these performance targets.

Key Locations for Serviced Apartment Investments in RAK

Location selection fundamentally determines serviced apartment investment success, with certain areas of RAK offering substantially better prospects for occupancy, daily rates, and long-term appreciation. Understanding the emirate's key investment zones helps investors identify opportunities aligned with their return objectives.

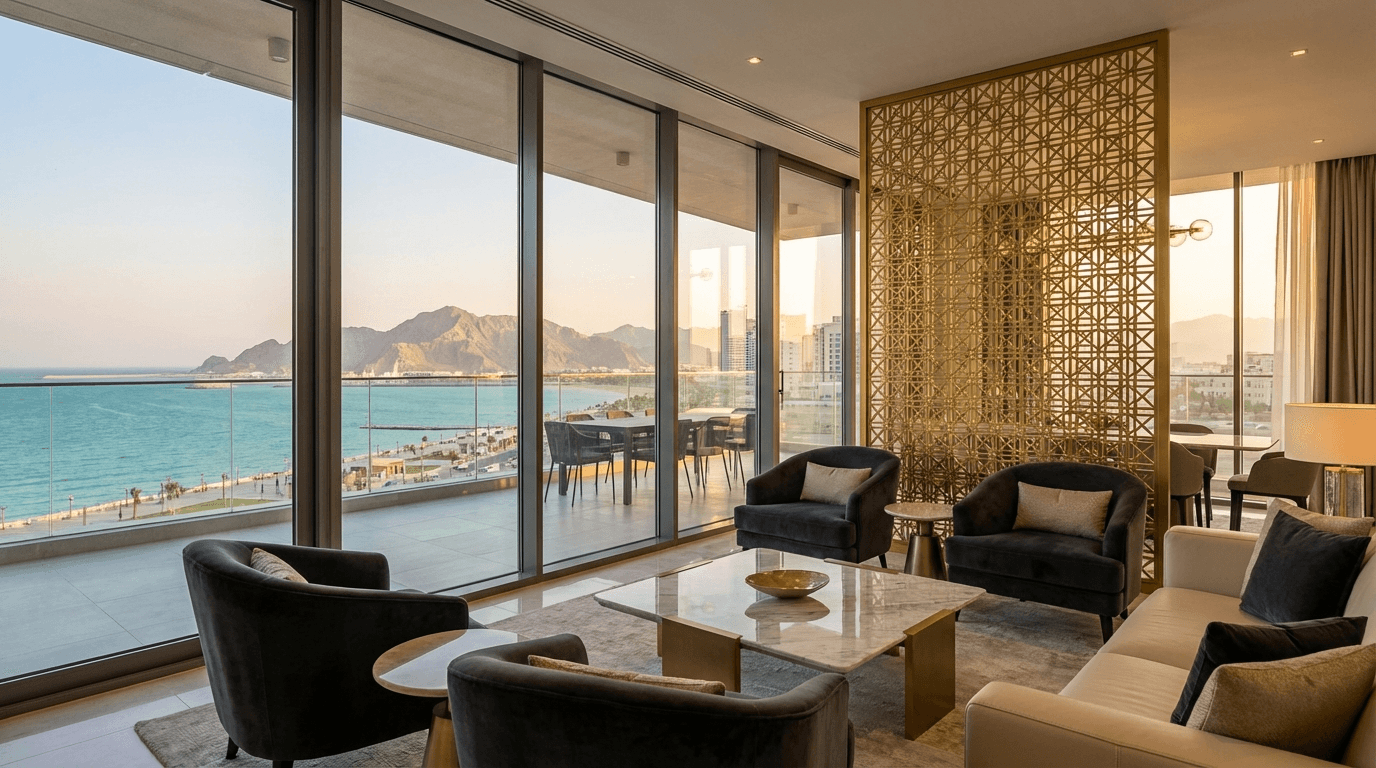

Al Marjan Island represents RAK's premier waterfront development and arguably its strongest serviced apartment location. This man-made archipelago features luxury residential towers, beach resorts, and dining venues, creating a self-contained destination that attracts both tourists and business visitors. Serviced apartments here benefit from waterfront positioning, resort-style amenities, and proximity to leisure facilities, commanding premium daily rates and strong year-round occupancy. The island's ongoing development, including new hotel openings and entertainment venues, continues to enhance its investment appeal.

RAK City Centre and surrounding urban areas offer different advantages, particularly for corporate-focused serviced apartments. Properties near business districts, government offices, and commercial zones attract business travellers, relocated professionals, and extended-stay guests who prioritise convenience over resort amenities. Daily rates may be moderately lower than beachfront locations, but occupancy often proves more stable throughout the year, with less seasonal variation. Urban serviced apartments also benefit from lower entry prices, creating attractive yield-on-cost metrics.

Mina Al Arab has emerged as a compelling middle-ground option, combining waterfront living with more accessible pricing than Al Marjan Island. This integrated community features residential properties, beaches, and leisure facilities whilst maintaining proximity to RAK's commercial areas. Serviced apartments in Mina Al Arab appeal to families and leisure travellers seeking resort-style accommodation at competitive rates, creating steady demand and strong appreciation potential as the development matures.

Al Hamra Village offers established infrastructure, golf course proximity, and a mix of residential and hospitality facilities that support serviced apartment operations. The area's reputation as a quality residential destination attracts longer-stay guests and corporate relocations, whilst its beach club and marina facilities appeal to leisure visitors. Properties here benefit from a proven track record of rental performance and relatively stable occupancy patterns.

When evaluating specific locations within these broader areas, investors should consider proximity to key amenities, beach or waterfront access, views and orientation, transport connections, and the quality of surrounding developments. Properties within walking distance of restaurants, supermarkets, and leisure facilities typically achieve higher occupancy and guest satisfaction scores, translating to better financial performance.

The concentration of future supply also warrants consideration. Areas with substantial upcoming serviced apartment inventory may experience occupancy pressure and rate competition, whilst locations with limited new supply and growing demand offer more favourable supply-demand dynamics. Understanding the development pipeline in your target location is essential for avoiding oversupplied markets and identifying areas positioned for strong performance.

Operational Considerations: Management and Maintenance

Serviced apartment investments require professional operational management to deliver promised returns, making the selection and structuring of management arrangements a critical investment decision. Unlike traditional buy-to-let properties where owners may self-manage, serviced apartments demand specialist expertise, established systems, and significant operational resources.

Most serviced apartment investments in RAK operate under one of two management models. Operator management involves partnering with established serviced apartment or hotel operators who handle all aspects of the business, from marketing and reservations to housekeeping and guest services. These arrangements typically involve management fees of 25-35% of gross revenue, with the operator responsible for delivering agreed occupancy and rate targets. The advantage lies in leveraging professional expertise, established brands, and proven operational systems, though higher fees reduce net yields.

Independent management through property management companies offers an alternative approach, with specialist firms handling operations for a lower fee structure, typically 15-25% of gross revenue. These companies manage multiple properties across various owners, creating economies of scale whilst maintaining more competitive fee levels. The trade-off involves potentially less brand recognition and possibly lower average daily rates compared to established operator brands, though well-executed independent management can deliver excellent results.

Regardless of the chosen model, several operational elements critically influence performance. Marketing reach determines how effectively your property reaches potential guests, with successful operators maintaining strong presence on major booking platforms, corporate accommodation networks, and direct booking channels. Guest experience drives repeat bookings and online reviews, making quality housekeeping, responsive maintenance, and professional guest services essential for sustained occupancy.

Maintenance requirements for serviced apartments substantially exceed those of traditional rentals due to higher usage intensity and guest expectations for hotel-standard conditions. Furnishings, appliances, and finishes experience greater wear, requiring regular replacement and refurbishment. Successful investors budget 10-15% of gross revenue annually for maintenance and periodic upgrades, ensuring properties remain competitive and continue commanding premium rates.

Service charges and community fees for serviced apartment developments typically run higher than standard residential buildings due to enhanced amenities and facilities. Properties with pools, gyms, concierge services, and extensive common areas generate higher service costs, usually ranging from AED 8-15 per square foot annually in RAK. These costs must be factored into net yield calculations alongside management fees and maintenance provisions.

Utility costs represent another operational consideration, as serviced apartments typically include electricity, water, and internet in the daily rate. RAK's utility costs are generally lower than Dubai, but consumption patterns for short-term guests—who may be less conservation-minded than long-term residents—can create significant expense. Efficient operators implement energy-saving measures and monitor consumption patterns to control these costs without compromising guest comfort.

Insurance requirements differ from traditional residential properties, with serviced apartments requiring commercial hospitality coverage that protects against guest-related incidents, business interruption, and liability claims. Annual insurance costs typically represent 0.5-1% of property value, though comprehensive coverage is essential for protecting your investment.

The operational complexity of serviced apartments underscores the importance of selecting the right management partner and establishing clear performance expectations, reporting requirements, and fee structures. Investors who treat operational arrangements as strategic decisions rather than administrative details consistently achieve superior returns and avoid the performance disappointments that plague poorly managed assets.

Comparing Serviced Apartments to Traditional Rentals

Investors evaluating RAK property opportunities frequently compare serviced apartments against traditional long-term rentals, weighing the higher return potential against increased complexity and costs. Understanding the key differences helps determine which investment approach aligns with your objectives and risk tolerance.

Income potential represents the most significant differentiator. Serviced apartments in RAK typically generate gross yields of 8-10% and net yields of 5-7%, substantially exceeding the 4-6% gross and 3-5% net yields common for unfurnished annual rentals in comparable locations. This income advantage stems from higher daily rates, dynamic pricing, and the ability to capture seasonal demand, though it requires professional management and carries occupancy risk.

Operational complexity differs markedly between the two approaches. Traditional rentals involve relatively straightforward management: securing a tenant, collecting monthly rent, and handling occasional maintenance. Serviced apartments require continuous marketing, daily operations, guest services, and frequent cleaning and maintenance. Whilst professional managers handle these tasks, the inherent complexity means more can go wrong, and management quality has greater impact on returns.

Upfront investment requirements favour traditional rentals in terms of simplicity. Serviced apartments require full furnishing to hotel standards, including quality furniture, appliances, linens, kitchenware, and décor, typically adding AED 60,000-100,000 to initial costs for a one-bedroom unit. Traditional unfurnished rentals require no furnishing investment, reducing upfront capital requirements and simplification.

Tenant stability provides traditional rentals with predictable, stable income. Annual or multi-year tenancy agreements create reliable cash flow with minimal vacancy periods in strong rental markets. Serviced apartments experience variable occupancy, with periods of high demand offset by quieter seasons, creating less predictable monthly income despite higher annual totals.

Capital appreciation potential generally favours well-located serviced apartments in RAK's current market phase. Properties specifically designed and approved for short-term letting operations command premium prices from investors seeking higher yields, whilst growing demand for serviced accommodation creates strong appreciation drivers. Traditional rental properties appreciate based on broader market movements and location fundamentals, which remain positive in RAK but may not capture the serviced apartment premium.

Regulatory considerations in RAK currently allow short-term letting in designated tourist and commercial zones, with specific licensing requirements for serviced apartment operations. Traditional residential tenancies operate under established tenancy laws with clear landlord-tenant frameworks. Understanding applicable regulations and ensuring compliance is essential for both investment types, though serviced apartments face more complex licensing and operational requirements.

Exit flexibility differs between the approaches. Serviced apartments appeal to a specific investor profile seeking yield and operational returns, potentially creating a smaller buyer pool upon sale. Traditional rental properties attract both investors and end-users, often providing broader market demand. However, well-performing serviced apartments in prime locations typically sell quickly to yield-focused investors, whilst poorly performing traditional rentals in oversupplied areas may languish on the market.

For investors seeking maximum returns and willing to engage professional management, serviced apartments in RAK currently offer compelling advantages. Those prioritising simplicity, stability, and hands-off ownership may find traditional rentals better aligned with their preferences, accepting lower yields in exchange for reduced complexity.

How to Identify High-Yield Serviced Apartment Opportunities

Successfully identifying serviced apartment investments that deliver promised returns requires systematic evaluation of multiple factors, from location fundamentals to operational arrangements. Applying a structured approach helps separate genuinely high-yield opportunities from developments with optimistic projections unlikely to materialise.

Begin by evaluating location quality using specific criteria relevant to serviced apartment performance. Assess proximity to key demand drivers including business districts, tourist attractions, beaches, dining venues, and transport links. Properties within 10 minutes' walk of multiple amenities consistently outperform those requiring vehicle transport for basic needs. Analyse the competitive landscape by identifying existing serviced apartments, hotels, and holiday rentals in the area, understanding current occupancy levels and daily rates through booking platform research.

Developer credibility provides important performance indicators, particularly for off-plan serviced apartment purchases. Established developers with proven track records of delivering quality projects on schedule reduce execution risk and create confidence in the final product meeting market expectations. Investigate previous developments, delivery timelines, build quality, and community management performance. Developers who maintain their completed projects well and foster thriving communities typically deliver better long-term investment performance.

Project specifications directly influence achievable daily rates and operational costs. Assess unit layouts for efficient use of space and appeal to target guests, ensuring adequate storage, workspace areas for business travellers, and quality kitchen facilities. Evaluate building amenities including pool facilities, gym quality, parking availability, and communal spaces that enhance guest experience. Higher-specification projects command premium rates that justify their typically higher purchase prices, whilst budget developments may struggle to achieve projected occupancy despite lower entry costs.

Management arrangements warrant thorough evaluation, as operational expertise determines whether theoretical yields translate into actual returns. For developments with appointed operators, research their track record managing similar properties, average occupancy rates achieved, owner satisfaction levels, and fee structures. Request detailed financial projections showing monthly revenue expectations, occupancy assumptions, operating costs, and net returns. Conservative projections from proven operators provide more reliable guidance than optimistic forecasts from unestablished management companies.

Regulatory compliance ensures your investment operates legally and avoids future complications. Verify that the development holds appropriate tourism licensing and approvals for short-term letting operations. Confirm that individual units can be separately licensed for serviced apartment operations rather than requiring whole-building licences. Understand owner obligations regarding insurance, safety standards, and operational compliance to avoid unexpected costs or restrictions.

Financial modelling should extend beyond simple gross yield calculations to comprehensive projections including all costs and realistic scenarios. Model conservative occupancy assumptions (65-70% for new operations, potentially higher for established buildings), seasonal revenue variations, management fees, service charges, maintenance provisions, utilities, insurance, and periodic refurbishment requirements. Calculate net yields under various scenarios to understand the range of potential outcomes and identify the minimum acceptable performance level.

Market timing influences both purchase prices and future appreciation potential. Off-plan purchases often provide developer discounts and payment plans that reduce upfront capital requirements, though they carry delivery risk and delay revenue generation. Completed, tenanted properties offer immediate income and proven performance data, though at higher prices reflecting reduced uncertainty. Consider RAK's development cycle and supply pipeline when timing purchases, seeking to acquire before major demand catalysts whilst avoiding periods of excessive supply delivery.

For investors seeking expert guidance in identifying and evaluating RAK's highest-yield serviced apartment opportunities, partnering with specialists who maintain exclusive access to off-plan and off-market developments provides distinct advantages. These partnerships often unlock opportunities unavailable through public marketing channels, including preferential pricing, prime unit selection, and favourable payment structures that enhance overall returns.

Serviced apartments in Ras Al Khaimah present a compelling investment proposition for discerning investors seeking hotel-style returns in one of the UAE's most dynamic emerging markets. The combination of attractive entry prices, strong rental yields of 5-7% net, robust capital appreciation forecasts of 8-12% annually, and RAK's improving fundamentals creates total return potential that significantly exceeds traditional property investments across the region.

The emirate's strategic positioning as an affordable alternative to Dubai and Abu Dhabi, coupled with substantial tourism infrastructure development and growing business activity, provides powerful demand drivers for serviced accommodation. Investors who understand the operational requirements, select prime locations, partner with professional management, and conduct thorough due diligence can capitalise on these market dynamics to build portfolios delivering consistent income and long-term wealth creation.

However, success in serviced apartment investing requires expertise, market knowledge, and access to the right opportunities. The difference between high-performing and disappointing investments often lies in subtle factors including precise location selection, development quality, management arrangements, and purchase timing—elements that separate exceptional opportunities from merely adequate ones.

As RAK's property market continues maturing and the emirate establishes itself as a permanent fixture in the UAE's investment landscape, early investors in quality serviced apartment assets are positioned to benefit from both immediate income generation and substantial capital appreciation as market pricing converges towards broader UAE norms.

Partner With RAK's Serviced Apartment Investment Specialists

Azimira Real Estate provides exclusive access to RAK's highest-yield serviced apartment opportunities, including off-plan developments and off-market properties unavailable through public channels. Our deep market expertise, established developer relationships, and comprehensive investment analysis help discerning investors identify and secure assets positioned for exceptional returns.

From initial market analysis through final purchase completion, our team provides unparalleled support throughout your investment journey, ensuring you capitalise on RAK's growth trajectory with confidence and clarity.

Explore exclusive RAK serviced apartment opportunities with Azimira's investment specialists today

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.