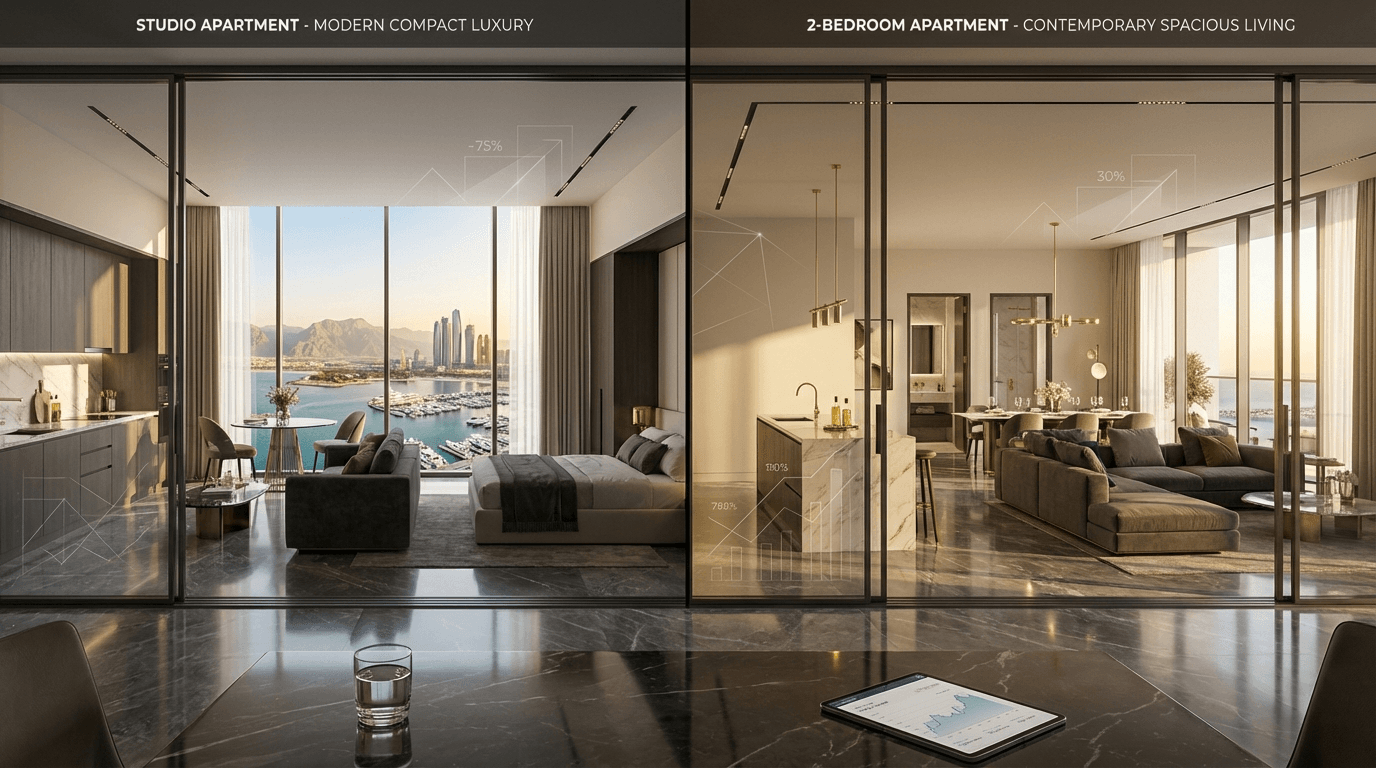

Studio vs 2-Bedroom in RAK: Which Size Delivers Better Returns?

Discover which property size delivers superior ROI in Ras Al Khaimah. Compare studio vs 2-bedroom investment returns, rental yields, and capital appreciation potential.

Table Of Contents

- Understanding the RAK Property Investment Landscape

- Studio Apartments: The Case for Compact Investment

- 2-Bedroom Apartments: The Family-Oriented Investment

- Head-to-Head Comparison: Key Investment Metrics

- Location Dynamics: Where Property Size Matters Most

- Capital Appreciation Potential: Long-Term Growth Outlook

- Portfolio Strategy: Which Option Aligns with Your Goals?

- Making Your Decision: Strategic Recommendations

Ras Al Khaimah has emerged as one of the UAE's most compelling property investment markets, offering attractive entry points and impressive growth potential. Yet for investors navigating this burgeoning market, one question consistently arises: should you invest in a studio apartment or a 2-bedroom unit?

This decision extends far beyond personal preference—it's a strategic choice that directly impacts your rental yields, capital appreciation, tenant stability, and overall return on investment. With RAK's off-plan market presenting exceptional opportunities and the emirate's infrastructure development accelerating, understanding which property size delivers superior returns has never been more crucial.

In this comprehensive analysis, we'll examine the financial performance, market dynamics, and strategic considerations for both studio and 2-bedroom apartments in Ras Al Khaimah. Whether you're building your first property portfolio or diversifying your existing holdings, this guide will equip you with the insights needed to make an informed investment decision that aligns with your financial objectives.

Understanding the RAK Property Investment Landscape

Ras Al Khaimah has undergone a remarkable transformation over the past five years, evolving from a quieter northern emirate into a genuine investment hotspot. The market's appeal stems from several compelling factors: property prices typically 30-50% lower than Dubai equivalents, ongoing infrastructure improvements including the expanded RAK International Airport, and the emirate's strategic tourism development initiatives.

For property investors, RAK presents a unique proposition. The off-plan market offers particularly attractive payment plans, often with just 10% down payments and extended completion timelines. This accessibility, combined with growing demand from both residents and tourists, creates a fertile environment for capital appreciation.

However, choosing the right property type requires careful analysis. Studio and 2-bedroom apartments serve distinctly different tenant markets, command varying rental rates, and experience different appreciation trajectories. Understanding these nuances is essential for maximising your investment returns.

Studio Apartments: The Case for Compact Investment

Studio apartments have long been favoured by investors seeking lower entry points and potentially higher percentage yields. In RAK's evolving market, these compact units offer several distinct advantages worth examining closely.

Financial Performance Metrics

The primary appeal of studio apartments lies in their accessible price points. In RAK, studio apartments in popular developments typically range from AED 300,000 to AED 550,000, depending on location and amenities. This relatively modest capital requirement allows investors to either enter the market with limited funds or diversify across multiple properties.

Rental yields for studio apartments in RAK generally range between 7-9% annually, which compares favourably to Dubai's 5-7% for similar properties. Monthly rental rates typically fall between AED 18,000 and AED 35,000 annually (AED 1,500-2,900 per month), with waterfront and resort-style developments commanding premium rates.

The lower acquisition cost translates to several financial benefits:

- Reduced financing requirements: Smaller mortgages mean lower interest payments and quicker paths to positive cash flow

- Lower service charges: Maintenance fees are calculated per square foot, making studios significantly more economical

- Minimal void period impact: Even short vacancy periods have less dramatic effects on annual returns

- Portfolio diversification: The same capital that purchases one 2-bedroom could acquire two studios in different locations

Market Demand Drivers

Studio apartments in RAK attract a specific tenant demographic that's experiencing robust growth. Young professionals working in the emirate's expanding hospitality, manufacturing, and service sectors represent the primary market. Many of these individuals are relocating from more expensive emirates or arriving as new UAE residents, seeking affordable yet quality accommodation.

Additionally, RAK's tourism sector creates demand for short-term holiday rentals. Studios in resort-style developments near popular attractions like Jebel Jais or beachfront locations can be marketed through platforms catering to tourists, potentially generating yields exceeding 10% when managed effectively.

The compact nature of studios also appeals to:

- Single expatriates on limited housing allowances

- Young couples beginning their UAE journey

- Contract workers on temporary assignments

- Investors seeking pied-à-terre properties for occasional personal use

Potential Drawbacks

Whilst studio apartments offer compelling yields, investors must acknowledge certain limitations. Tenant turnover tends to be higher, as occupants frequently upgrade to larger accommodation as circumstances change. This creates additional costs for marketing, tenant screening, and potential void periods.

The tenant pool is inherently more limited. Families, executives, and established professionals typically seek larger accommodation, narrowing your potential market. During economic downturns, studios often experience more significant rental pressure as they're perceived as non-essential upgrades from shared accommodation.

Capital appreciation potential may also be constrained. Whilst studios certainly appreciate, the percentage gains often lag behind family-oriented properties during strong market cycles, as buyer demand gravitates towards larger units when purchasing power increases.

2-Bedroom Apartments: The Family-Oriented Investment

Two-bedroom apartments occupy the middle ground in RAK's property market, offering balanced investment characteristics that appeal to both conservative and growth-oriented investors.

Return on Investment Analysis

In RAK, 2-bedroom apartments typically range from AED 600,000 to AED 1,200,000, depending on location, development quality, and amenities. This represents a significantly higher capital commitment than studios, but the investment profile differs substantially.

Rental yields for 2-bedroom units generally range between 6-8% annually. Whilst the percentage yield appears lower than studios, the absolute rental income is considerably higher. Annual rents typically span AED 40,000 to AED 75,000 (AED 3,300-6,250 monthly), providing more substantial cash flow for investors seeking regular income.

The financial equation shifts when examining total returns:

- Higher absolute income: A 2-bedroom generating AED 55,000 annually provides more actual cash than a studio earning AED 24,000, even if the percentage yield is lower

- Stronger appreciation trajectory: Family-oriented properties typically experience more robust capital gains during market upswings

- Premium positioning: Quality 2-bedroom units in desirable locations maintain value better during market corrections

- Financing advantages: Banks often offer more favourable mortgage terms for larger, more valuable properties

Tenant Demographics and Stability

Two-bedroom apartments attract a markedly different tenant profile, one that typically offers greater stability and reliability. Small families, established couples, and mid-level professionals form the core demand base—demographics that tend towards longer tenancies and more dependable payment records.

This tenant stability translates to tangible financial benefits. Longer tenancy periods reduce turnover costs, minimise void periods, and decrease the administrative burden of constant tenant management. Many 2-bedroom tenants in RAK remain for 2-4 years, compared to the 1-2 year average for studio occupants.

The broader appeal also provides rental resilience. During market softening, 2-bedroom apartments maintain occupancy more effectively as they serve essential family housing needs rather than discretionary individual accommodation choices.

Corporate demand represents another advantage. Companies relocating employees with families to RAK frequently seek 2-bedroom accommodation, often on longer-term contracts with corporate guarantees—an exceptionally attractive proposition for landlords.

Considerations and Challenges

The primary challenge with 2-bedroom investments is the higher capital requirement, which may limit portfolio diversification or require larger mortgage commitments. Service charges are also substantially higher, typically ranging from AED 8-15 per square foot annually, which can significantly impact net yields.

Maintenance costs tend to be more substantial. Larger properties experience greater wear, and tenant expectations for maintenance responsiveness are typically higher for family accommodation. Budget accordingly for periodic refurbishment to maintain rental competitiveness.

Liquidity considerations also differ. Whilst 2-bedroom apartments attract serious buyers during sales, the pool of potential purchasers is smaller than for studios, potentially extending sale timelines when exit strategies are implemented.

Head-to-Head Comparison: Key Investment Metrics

When directly comparing studio and 2-bedroom apartments in RAK, several critical metrics emerge:

Initial Investment: Studios require 40-55% less capital, enabling faster market entry or multi-property strategies. For investors with AED 1,000,000, you could acquire one premium 2-bedroom or potentially two well-located studios.

Gross Rental Yield: Studios typically edge ahead by 1-2 percentage points (7-9% vs 6-8%), making them more attractive for yield-focused strategies.

Net Rental Yield: The gap narrows when accounting for service charges, maintenance, and vacancy rates. Studios' higher turnover costs can erode their yield advantage.

Cash Flow: Two-bedroom apartments generate substantially higher absolute income (often 2-3 times studio income), benefiting investors seeking regular cash distributions.

Capital Appreciation: Market data suggests 2-bedroom apartments in RAK have appreciated 3-7% annually in established areas, often outpacing studios by 1-2 percentage points during growth cycles.

Tenant Stability: Two-bedroom units demonstrate markedly longer average tenancies (24-48 months vs 12-24 months), reducing turnover expenses and vacancy risk.

Market Liquidity: Studios typically sell faster due to broader buyer appeal and lower price points, whilst 2-bedroom apartments attract more qualified, serious purchasers.

Management Intensity: Studios require more active management due to higher turnover, whilst 2-bedroom units offer more passive investment characteristics.

Location Dynamics: Where Property Size Matters Most

The optimal choice between studio and 2-bedroom apartments varies significantly across RAK's diverse locations. Understanding these geographic nuances can substantially impact your investment returns.

Al Marjan Island represents RAK's premier waterfront development, where both property types perform strongly but serve different purposes. Studios here excel as holiday rental investments, capitalising on tourism demand with potential 9-11% yields through short-term letting. Two-bedroom apartments attract affluent residents seeking lifestyle properties, offering stable 6-7% yields with superior appreciation potential.

Mina Al Arab caters primarily to families and established professionals, making it decidedly more favourable for 2-bedroom investments. The community's family-oriented amenities, schools proximity, and residential atmosphere create stronger demand for larger units. Studios in this location may struggle to achieve optimal occupancy rates.

RAK City centre locations present balanced opportunities. The mix of young professionals and small families creates healthy demand for both property types. Studios benefit from proximity to employment centres, whilst 2-bedroom apartments attract long-term residents appreciating urban convenience.

Resort-style developments near tourist attractions favour studios and 1-bedroom units for holiday rental strategies, though 2-bedroom apartments can succeed if marketed effectively to family tourists seeking extended stays.

For investors exploring exclusive RAK off-plan projects, location selection should precede property type decisions. The development's positioning and target demographic will largely determine which size delivers optimal returns.

Capital Appreciation Potential: Long-Term Growth Outlook

Whilst rental yields provide immediate returns, capital appreciation drives long-term wealth creation. RAK's property market has demonstrated impressive growth, with certain areas appreciating 35-50% since 2019, but appreciation rates vary significantly by property type.

Historically, 2-bedroom apartments have delivered stronger capital gains during market upswings. This stems from several factors: broader buyer appeal when purchasing power increases, stronger family migration to RAK as infrastructure develops, and the "middle market" positioning that captures both upgrading studio owners and those downsizing from villas.

Studios certainly appreciate, particularly in prime locations, but their growth trajectory tends to be more linear. During robust market conditions, studios may lag 2-bedroom appreciation by 15-25%, whilst during corrections, they often experience slightly steeper percentage declines.

Looking forward, RAK's development plans suggest continued strong appreciation potential for both property types. The emirate's tourism targets (attracting 3 million visitors annually by 2025), infrastructure investments, and economic diversification initiatives create favourable conditions for sustained property value growth.

For investors prioritising capital appreciation, 2-bedroom apartments in master-planned communities with strong developer reputations represent the more compelling choice. However, studios in exceptional locations—particularly waterfront developments with tourism appeal—can deliver competitive appreciation whilst providing superior immediate yields.

Those interested in comprehensive market insights should explore our detailed guide on investing in RAK property, which examines appreciation forecasts across various property segments.

Portfolio Strategy: Which Option Aligns with Your Goals?

The optimal choice between studio and 2-bedroom apartments ultimately depends on your specific investment objectives, risk tolerance, and portfolio strategy.

Choose studio apartments if you:

- Prioritise maximum percentage yield over absolute income

- Have limited initial capital (under AED 500,000)

- Seek portfolio diversification across multiple properties

- Are comfortable with more active property management

- Target the holiday rental market in tourist locations

- Want faster capital deployment and market entry

- Can tolerate higher tenant turnover and vacancy risk

- Prefer properties with broader resale market appeal

Choose 2-bedroom apartments if you:

- Prioritise stable, substantial cash flow over maximum yields

- Seek lower-maintenance, more passive investments

- Have sufficient capital for larger acquisitions (AED 600,000+)

- Value tenant stability and longer-term tenancies

- Target family demographics and corporate tenants

- Prioritise capital appreciation potential

- Prefer properties with premium positioning

- Are building a concentrated portfolio in select locations

Consider a mixed strategy if you:

- Have capital exceeding AED 1,000,000 for diversification

- Want to balance immediate yield with long-term appreciation

- Seek exposure to different tenant demographics

- Desire both active (short-term rental studios) and passive (long-term 2-bedroom) investments

- Are testing the RAK market before committing fully to one approach

Many sophisticated investors implement hybrid strategies, acquiring studios in high-tourism areas for superior yields whilst holding 2-bedroom apartments in established residential communities for stability and appreciation. This balanced approach captures the advantages of both property types whilst mitigating their respective limitations.

Making Your Decision: Strategic Recommendations

After examining the financial metrics, market dynamics, and strategic considerations, several clear recommendations emerge for investors navigating the studio versus 2-bedroom decision in RAK.

For first-time investors with capital constraints, studios represent an accessible entry point into RAK's property market. The combination of lower acquisition costs, strong yields, and manageable ongoing expenses allows you to establish your investment track record whilst learning property management fundamentals. Focus on well-located developments with strong developer credentials and proven rental demand.

For income-focused investors seeking substantial cash flow, 2-bedroom apartments deliver superior absolute returns despite slightly lower percentage yields. The tenant stability and reduced management intensity create a more passive income stream, particularly valuable for investors balancing property holdings with professional commitments.

For growth-oriented investors prioritising capital appreciation, 2-bedroom apartments in master-planned communities offer the most compelling proposition. These properties benefit from RAK's demographic growth, infrastructure development, and economic diversification, positioning them for robust long-term value increases.

For diversification-minded investors with substantial capital, consider acquiring one 2-bedroom apartment for stability alongside one or two studios for enhanced yield. This balanced approach captures the immediate income benefits of studios whilst securing the appreciation potential and tenant stability of larger units.

Regardless of property size, success in RAK's market requires partnering with specialists who understand the emirate's unique dynamics, have access to pre-launch opportunities, and can guide you towards developments with genuine investment merit. Off-plan properties, in particular, demand careful due diligence regarding developer reputation, project viability, and location fundamentals.

The RAK property market presents exceptional opportunities for discerning investors, but property size selection significantly influences your investment outcomes. By aligning your choice with your financial objectives, risk tolerance, and portfolio strategy, you can maximise returns whilst managing risks effectively in this emerging UAE market.

The debate between studio and 2-bedroom apartments in RAK doesn't yield a universally correct answer—instead, it demands a personalised decision based on your unique investment profile. Studios offer accessible entry points, superior percentage yields, and portfolio diversification potential, making them ideal for yield-focused investors and those with limited capital. Two-bedroom apartments counter with substantial cash flow, tenant stability, stronger appreciation potential, and more passive investment characteristics.

What remains unequivocally clear is RAK's position as one of the UAE's most compelling property investment markets. The emirate's combination of accessible pricing, robust growth fundamentals, and expanding infrastructure creates favourable conditions for both property types to deliver attractive returns.

Your success ultimately depends not just on choosing the right property size, but on selecting exceptional developments in strategic locations with strong rental demand and appreciation potential. The off-plan market presents particularly compelling opportunities for investors who can identify projects with genuine merit before they reach the broader market.

As RAK continues its transformation into a major residential and tourism destination, both studio and 2-bedroom apartments offer pathways to investment success—the question is simply which pathway aligns most effectively with your financial goals and investment philosophy.

Ready to Identify Your Ideal RAK Investment?

At Azimira Real Estate, we specialise in connecting discerning investors with exceptional off-plan opportunities in Ras Al Khaimah and across the UAE. Our exclusive access to pre-launch and off-market properties ensures you discover high-yield investments before they reach the general market.

Whether you're seeking studio apartments for maximum yields or 2-bedroom units for long-term appreciation, our property specialists provide tailored guidance based on your specific investment objectives. We'll help you navigate RAK's evolving market, identify developments with genuine investment merit, and secure properties positioned for superior returns.

Schedule your personalised RAK investment consultation today and discover how strategic property selection can transform your investment outcomes in the UAE's most exciting emerging market.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.