The 4-Step Golden Visa Application: From Property to Passport Stamp

Complete guide to securing your UAE Golden Visa through property investment. Discover the 4-step process from selecting qualifying properties to receiving your residency approval.

Table Of Contents

- Understanding the Golden Visa Property Investment Pathway

- Step 1: Selecting a Qualifying Property Investment

- Step 2: Completing Your Property Purchase

- Step 3: Submitting Your Golden Visa Application

- Step 4: Receiving Your Golden Visa Approval

- Common Pitfalls to Avoid

- Why Azimira's Expertise Matters

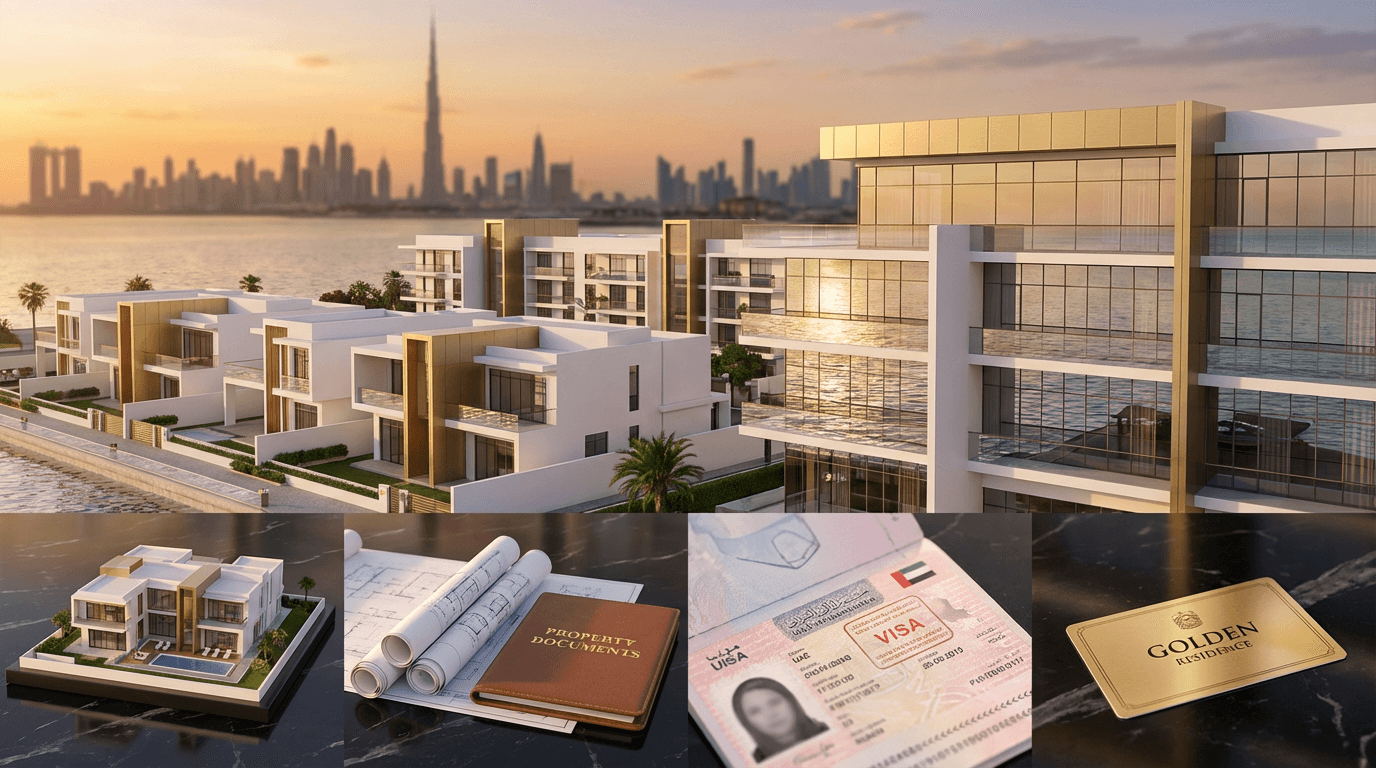

The UAE Golden Visa represents one of the world's most attractive long-term residency programmes, offering investors and their families a pathway to stability, security, and exceptional quality of life in one of the globe's most dynamic economies. For discerning property investors, the Golden Visa through real estate investment presents a dual opportunity: securing valuable residency rights whilst building a portfolio of assets in one of the fastest-appreciating property markets globally.

Navigating the Golden Visa application process, however, requires strategic planning, meticulous documentation, and an understanding of evolving regulations. The journey from identifying the right property investment to receiving that coveted passport stamp involves multiple stages, each with specific requirements and potential complications.

This comprehensive guide demystifies the entire process, breaking down the Golden Visa application into four clear, manageable steps. Whether you're considering premium waterfront developments in Ras Al Khaimah or exclusive villa communities across the UAE, understanding this framework will help you approach your investment with confidence and clarity.

Understanding the Golden Visa Property Investment Pathway

The UAE Golden Visa programme offers foreign investors the opportunity to obtain 10-year residency visas based on qualifying property investments. Unlike standard residency visas tied to employment or business sponsorship, the Golden Visa provides greater independence, allowing holders to live, work, and study in the UAE without requiring a traditional sponsor.

For property investors, this pathway offers remarkable flexibility. Your investment isn't merely a ticket to residency—it's a tangible asset that can generate rental income, appreciate in value, and serve as the foundation for broader wealth-building strategies. The UAE's tax-efficient environment, combined with world-class infrastructure and strategic global positioning, makes this combination particularly compelling for international investors seeking both lifestyle benefits and financial returns.

The property investment route has become increasingly popular amongst families, entrepreneurs, and high-net-worth individuals who recognise the strategic advantage of establishing a base in the UAE whilst diversifying their investment portfolios. Understanding the precise requirements and process is essential to maximising both your residency benefits and investment outcomes.

Step 1: Selecting a Qualifying Property Investment

Your Golden Visa journey begins with selecting the right property investment—a decision that requires balancing residency requirements with sound investment principles. The property you choose must meet specific criteria whilst aligning with your financial objectives and lifestyle aspirations.

Minimum Investment Requirements

As of the current regulations, property investors must meet the following thresholds to qualify for the Golden Visa:

For a 10-Year Golden Visa: A minimum property investment of AED 2 million is required. This investment must be maintained throughout the visa validity period, and the property must not be sold during this time. The investment can comprise a single property or multiple properties whose combined value meets the threshold.

Crucially, the AED 2 million threshold refers to the property's purchase value, not market value at the time of application. If you're purchasing off-plan properties, the total contracted value must meet this requirement. Mortgage financing is permitted, but many investors opt for cash purchases to simplify documentation and avoid complications during the application process.

Off-Plan vs Ready Properties

Both off-plan developments and completed properties qualify for the Golden Visa programme, but each option presents distinct advantages and considerations.

Off-plan properties offer several strategic benefits for Golden Visa applicants. These developments typically provide more competitive pricing, allowing your AED 2 million investment to secure larger or better-positioned units than equivalent ready properties. Exclusive RAK off-plan projects frequently offer payment plans extending over construction periods, improving cash flow management whilst still qualifying for the Golden Visa once the purchase contract is registered.

The emerging Ras Al Khaimah property market presents particularly compelling off-plan opportunities, with premium waterfront developments and luxury villa communities offering exceptional value compared to more saturated Dubai markets. These projects often combine Golden Visa eligibility with strong appreciation forecasts, allowing investors to benefit from capital growth during the construction phase.

Ready properties provide immediate possession and the ability to generate rental income from day one. For investors prioritising speed and certainty, completed developments eliminate construction risk and allow for faster visa processing, as all documentation is immediately available.

The choice between off-plan and ready properties should reflect your individual circumstances, risk tolerance, and timeline. Working with specialists who understand both the residency requirements and investment dynamics ensures your selection optimises both objectives.

Strategic Location Considerations

Whilst any UAE property meeting the investment threshold qualifies for the Golden Visa, location significantly impacts your investment's long-term performance and personal enjoyment.

Emerging markets such as Ras Al Khaimah offer exceptional value propositions for Golden Visa investors. With property prices considerably below Dubai and Abu Dhabi levels, your AED 2 million investment secures substantially more space, superior amenities, and often waterfront or beachfront positioning. RAK's ongoing infrastructure development, including the expansion of RAK International Airport and major tourism projects, positions the emirate for significant appreciation potential.

Established markets like Dubai offer proven liquidity, extensive amenities, and diverse property types. Areas such as Dubai Marina, Palm Jumeirah, and Downtown Dubai provide premium lifestyle benefits and strong rental yields, though at higher entry points.

Your location choice should consider factors beyond residency requirements: rental demand if generating income is important, proximity to schools and amenities if relocating family members, and long-term appreciation potential based on infrastructure development and economic diversification initiatives.

Step 2: Completing Your Property Purchase

Once you've identified your qualifying investment, completing the purchase with proper documentation becomes critical for your subsequent Golden Visa application. This stage requires meticulous attention to detail, as missing or incorrect documentation can delay or derail your residency application.

Essential Documentation Requirements

The property purchase process in the UAE generates several essential documents that will form the foundation of your Golden Visa application:

Sale and Purchase Agreement (SPA): This contract between you and the developer or seller outlines all transaction terms, including purchase price, payment schedule, and property specifications. For off-plan purchases, the SPA must clearly indicate the total purchase value, which should meet or exceed the AED 2 million threshold.

No Objection Certificate (NOC): If purchasing a resale property in certain developments, you'll require an NOC from the developer or owners' association, confirming approval of the transaction and that all service charges are settled.

Proof of Payment: Comprehensive documentation of all payments is essential. This includes bank transfer receipts, cheque copies, and payment schedules demonstrating that you've met the minimum investment requirement. Payments should originate from accounts in your name to avoid complications during visa processing.

Title Deed (Oqood for off-plan): For completed properties, the title deed issued by the Land Department represents your ownership. For off-plan purchases, the Oqood—an interim registration document—serves a similar function until project completion. Both documents are acceptable for Golden Visa applications, provided they demonstrate the qualifying investment amount.

Payment Structure and Proof of Funds

The Golden Visa programme requires clear evidence that you've genuinely invested the minimum amount. Structuring your payments appropriately and maintaining comprehensive records simplifies the application process considerably.

If financing your purchase through a mortgage, be aware that your Golden Visa application must demonstrate the full investment amount, not merely your deposit. Most successful applicants make substantial down payments (typically 50% or more) or purchase properties outright to avoid documentation complications.

All payments should be made through official banking channels, creating clear audit trails. Cash transactions or payments from third-party accounts can raise questions during the application review and potentially delay approval. Ensure all payment documentation clearly shows your name, the property details, and the amounts transferred.

For off-plan purchases with extended payment plans, you can apply for the Golden Visa once the sale agreement is registered and you've made the initial payments, even if the full amount isn't yet paid. However, you must demonstrate your commitment to the full purchase value and maintain the investment throughout the visa validity period.

Securing Your Title Deed

The title deed or Oqood registration is perhaps the most critical document for your Golden Visa application. This official registration with the relevant Land Department (Dubai Land Department, Ajman Land Department, RAK Properties Registration, etc.) provides government-verified proof of your property ownership and investment amount.

For ready properties, title deed transfer typically occurs on the same day as final payment, during an appointment at the Land Department. Both buyer and seller (or their legal representatives with proper power of attorney) must attend this appointment. The Land Department charges transfer fees (typically 4% of property value plus a nominal registration fee), which should be factored into your investment budget.

For off-plan properties, developers register the Oqood on your behalf once you've signed the SPA and made initial payments. This registration confirms your ownership rights and purchase commitment, providing the documentation needed for Golden Visa applications even though construction hasn't completed.

Ensure your title deed or Oqood accurately reflects all details, including the full purchase price meeting the AED 2 million threshold. Any discrepancies between your sale agreement and registered documents can complicate your visa application.

Step 3: Submitting Your Golden Visa Application

With your property purchase completed and documentation secured, you're ready to submit your Golden Visa application. This stage involves assembling additional supporting documents, completing medical requirements, and navigating the application channels.

Required Supporting Documents

Beyond your property documentation, the Golden Visa application requires several personal documents:

Valid Passport: Your passport must have at least six months' validity remaining. You'll need to provide colour copies of all pages, including blank ones, as well as the original for verification.

Passport Photographs: Recent passport-sized photographs with white background, meeting UAE visa photo specifications.

Current UAE Visa: If you're already in the UAE on another visa type, you'll need copies of your current visa and entry stamp. If applying from outside the UAE, you may need to enter on a tourist visa to complete certain application steps.

Property Investment Documents: Your complete property file, including the title deed or Oqood, SPA, proof of payment documentation, and NOC (if applicable).

Proof of Relationship: If including family members (spouse and children) in your Golden Visa application, you'll need marriage certificates, birth certificates, and passport copies for all dependants. All foreign documents must be attested by relevant authorities and, in some cases, translated into Arabic by approved translation services.

Health Insurance: Whilst not always explicitly required for the application itself, having UAE health insurance for yourself and dependants is advisable and may be requested during processing.

Application Channels and Processing

The UAE offers several channels for submitting Golden Visa applications, each with slightly different procedures:

Federal Authority for Identity and Citizenship (ICP): The primary government portal (icp.gov.ae) allows online application submission. You'll create an account, upload all required documents, and pay application fees through the portal. This channel provides transparency regarding application status and processing stages.

Approved Typing Centres: Licensed typing centres throughout the UAE can assist with application preparation and submission. These centres are particularly helpful if you're unfamiliar with the process or need assistance with Arabic documentation. They charge service fees beyond the government application costs.

VIP Services: Some property developers, particularly for premium developments, offer facilitated Golden Visa services as part of their investor support packages. These services streamline documentation and submission, though they typically involve additional fees.

Application fees vary depending on the visa duration and number of applicants but generally include approximately AED 2,000-3,000 for the primary applicant's 5-year Golden Visa, plus additional fees for dependants and various processing charges.

Medical Tests and Biometrics

All Golden Visa applicants must complete medical fitness tests and provide biometric data. These requirements apply to both primary applicants and dependants over 18 years of age.

Medical Fitness Test: You'll need to visit an approved medical centre for screening tests, including blood tests and chest X-rays. These tests screen for certain infectious diseases as per UAE public health requirements. The medical examination must be completed at government-approved facilities, which are widely available across all emirates. Results are typically uploaded directly to the immigration system.

Emirates ID Enrolment: Once your visa is approved in principle, you'll need to complete Emirates ID registration, which includes biometric data capture (fingerprints and photograph). This process occurs at designated Emirates ID centres and must be completed before your Golden Visa is finalised.

Both the medical examination and Emirates ID enrolment require separate fees, which should be budgeted alongside your application costs. Many applicants complete the medical examination early in the process to avoid delays once their application reaches approval stages.

Step 4: Receiving Your Golden Visa Approval

The final stage of your Golden Visa journey involves application processing, approval notification, and understanding your new residency status and privileges.

Processing Timelines

Golden Visa processing times vary based on application volume, documentation completeness, and the specific emirate where you've invested. Generally, applicants should expect the following timeline:

Initial Review: 2-4 weeks for the authorities to review your submitted documentation and verify property investment details. During this period, officials may request additional documentation or clarifications.

Approval in Principle: Once your application passes initial review, you'll receive approval in principle, allowing you to proceed with medical examinations and Emirates ID enrolment if not already completed.

Final Approval and Visa Issuance: Following successful medical clearance and Emirates ID processing, final visa approval typically occurs within 1-2 weeks. Your Golden Visa will be stamped in your passport at an immigration office, or if you're outside the UAE, an entry permit will be issued allowing you to enter and complete the visa stamping process.

End-to-end, most straightforward applications are completed within 2-3 months, though complex applications or those requiring document corrections may extend longer. Working with experienced advisors who understand the documentation requirements significantly reduces the likelihood of delays.

Visa Validity and Renewal

The property investment Golden Visa is issued for 10 years, with the possibility of renewal provided you maintain your qualifying investment. Several important points regarding validity and renewal:

Investment Maintenance: You must retain ownership of property worth at least AED 2 million throughout your visa validity period. Selling the property or allowing its value to fall below the threshold (through debt accumulation, for example) can jeopardise renewal eligibility.

Renewal Process: Approximately 3-6 months before your Golden Visa expires, you can begin the renewal process. This involves confirming continued property ownership, updated medical examinations, and payment of renewal fees. The renewal process is generally more straightforward than initial applications, as your investment history is already established.

Multiple Entry Privileges: The Golden Visa allows unlimited entries and exits from the UAE, with no maximum stay requirements outside the country. This flexibility makes it ideal for investors who divide their time between multiple countries.

Benefits and Privileges

Your Golden Visa confers numerous advantages beyond simple residency rights:

Family Inclusion: You can sponsor your spouse and children (regardless of age) under your Golden Visa, providing them with the same long-term stability and avoiding the complications of dependent children ageing out of standard visa categories.

Independent Residency: Your Golden Visa isn't tied to employment, meaning you can change jobs, start businesses, or retire without affecting your residency status, provided you maintain your property investment.

Extended Validity: The 10-year validity period eliminates the annual or biennial renewal cycles associated with employment or investor visas, reducing administrative burden and providing greater certainty for long-term planning.

Access to Services: Golden Visa holders can access UAE banking, education, healthcare, and other services on the same basis as standard residents, opening investment accounts, enrolling children in schools, and obtaining driving licences.

Business Opportunities: Your Golden Visa allows you to establish and operate businesses in the UAE mainland and free zones, creating entrepreneurial opportunities alongside your property investment.

Common Pitfalls to Avoid

Navigating the Golden Visa process successfully requires avoiding several common mistakes that can delay or derail applications:

Insufficient Documentation: Incomplete payment records or missing property documents are the most frequent cause of application delays. Maintain comprehensive files of all transactions and ensure your title deed accurately reflects the full investment amount.

Timing Missteps: Don't assume you can begin the visa application immediately upon signing a property contract. Ensure the sale agreement is properly registered and you have official documentation from the Land Department before proceeding.

Mortgage Complications: If financing your purchase, ensure your documentation clearly demonstrates the full property value, not just your equity stake. Some applicants face challenges when banks are involved in property ownership structures.

Currency Fluctuations: If your property's value is close to the AED 2 million threshold, exchange rate movements or valuation changes can create problems. Building in a buffer above the minimum requirement provides security.

Family Documentation: Attestation requirements for marriage certificates and birth certificates vary by country of origin. Research these requirements early, as obtaining properly attested documents can take weeks or months.

Renewal Planning: Some investors sell their qualifying properties shortly after receiving their Golden Visa, not realising this jeopardises renewal. Plan your investment strategy with the 10-year holding period in mind.

Why Azimira's Expertise Matters

Navigating the Golden Visa process whilst simultaneously making sound property investment decisions requires expertise across multiple disciplines—immigration regulations, real estate markets, legal documentation, and financial planning. This is where working with specialists who understand the complete picture becomes invaluable.

Azimira Real Estate combines deep market knowledge with comprehensive understanding of Golden Visa requirements, ensuring your property investment serves both residency and wealth-building objectives. Our exclusive access to premium off-plan projects in Ras Al Khaimah and across the UAE means you're selecting from properties with exceptional appreciation potential, not simply meeting minimum residency thresholds.

Our team guides clients through the entire journey—from identifying qualifying investments that align with your financial goals, through purchase completion with proper documentation, to coordinating with legal and immigration specialists for seamless visa processing. We understand that your AED 2 million investment represents significant capital that should work strategically for your family's future, not merely tick a residency box.

The Ras Al Khaimah market we specialise in offers particular advantages for Golden Visa investors: lower entry points that allow your investment to secure larger, higher-quality properties; emerging market dynamics that provide stronger appreciation potential; and an increasingly sophisticated infrastructure that makes RAK an attractive location for both investment and lifestyle.

Whether you're seeking waterfront luxury apartments with rental income potential or exclusive villa communities for family occupancy, our curated portfolio ensures you're accessing opportunities that combine Golden Visa eligibility with sound investment fundamentals.

The journey from property investment to Golden Visa approval represents more than an administrative process—it's a strategic decision that can profoundly impact your family's future, providing stability, opportunity, and wealth-building potential in one of the world's most dynamic regions.

By understanding the four-step framework—selecting qualifying property, completing your purchase with proper documentation, submitting a comprehensive application, and receiving your approval—you approach this process with clarity and confidence. Each stage builds upon the previous one, and attention to detail at every point ensures smooth progression towards your residency goals.

The UAE's Golden Visa programme continues to evolve, with authorities regularly refining processes and expanding benefits for qualifying investors. Staying informed about current requirements whilst working with advisors who understand both immigration regulations and property markets positions you for success.

Your property investment represents the foundation of this journey, making the selection of the right development, in the right location, at the right price point absolutely critical. This isn't merely about meeting the AED 2 million threshold—it's about deploying significant capital in assets that will appreciate, generate returns, and serve your family's needs for years to come.

Begin Your Golden Visa Journey with Expert Guidance

Ready to explore how the right property investment can secure both UAE Golden Visa residency and exceptional returns? Azimira Real Estate specialises in guiding discerning investors through this process, providing access to exclusive off-plan opportunities and premium developments that optimise both residency and investment objectives.

Our team combines comprehensive market knowledge with detailed understanding of Golden Visa requirements, ensuring your property selection meets all criteria whilst positioning you for long-term success in the UAE's dynamic real estate market.

Contact our specialists today to discuss your Golden Visa property investment strategy and discover opportunities that align with your residency and financial goals.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.