Wynn Resort RAK: What the Opening Means for Property Investors

Discover how Wynn Resorts' landmark Al Marjan Island development is transforming RAK's property market and creating unprecedented investment opportunities.

Table Of Contents

- The Wynn Resort RAK: A Game-Changing Development

- Understanding the Wynn Al Marjan Island Project

- How Wynn Resort Elevates RAK's Investment Profile

- Property Market Impact: What Investors Need to Know

- Investment Opportunities in RAK's Transformed Landscape

- Comparing RAK to Dubai: The New Investment Equation

- Strategic Locations for Property Investment Near Wynn Resort

- Future Outlook: RAK's Property Market Trajectory

The announcement of Wynn Resorts' entry into Ras Al Khaimah represents far more than simply another luxury hotel development in the UAE. This landmark project signals a fundamental shift in RAK's position within the region's property investment landscape, transforming what has long been considered an emerging market into a serious contender for discerning investors seeking exceptional capital appreciation.

For property investors who have been monitoring the UAE market, the Wynn Al Marjan Island development serves as a watershed moment. When one of the world's most prestigious luxury resort operators—synonymous with Las Vegas and Macau excellence—commits billions to a destination, it validates the location's long-term potential in a way that few other endorsements can match.

This comprehensive analysis explores precisely what the Wynn Resort opening means for property investors, examining both the immediate market impacts and the longer-term implications for capital growth in Ras Al Khaimah. Whether you're considering your first UAE property investment or expanding an existing portfolio, understanding this development's ripple effects is essential for making informed decisions in 2025 and beyond.

The Wynn Resort RAK: A Game-Changing Development

Wynn Resorts' decision to establish their first Middle Eastern property on Al Marjan Island in Ras Al Khaimah represents a pivotal validation of the emirate's transformation from a quiet northern territory into a sophisticated investment destination. The development, which broke ground in late 2022, encompasses a multi-billion dirham investment that will fundamentally reshape RAK's hospitality and residential landscape.

The significance of this development extends well beyond the physical construction of hotel rooms and gaming facilities. Wynn Resorts brings with it an established global clientele, operational excellence honed over decades, and a brand reputation that attracts high-net-worth individuals from across the world. This influx of international attention creates what property market analysts term a "halo effect"—where the prestige of a single development elevates the perceived value of an entire region.

For property investors, this validation from a world-renowned operator provides crucial third-party endorsement of RAK's investment thesis. Wynn's extensive due diligence process, which undoubtedly assessed everything from regulatory frameworks to long-term demographic trends, concluded that RAK offered superior risk-adjusted returns compared to alternative locations. Investors would be wise to pay attention to where sophisticated operators deploy capital.

The development timeline positions early investors particularly advantageously. With the resort's anticipated opening creating a defined catalyst for property value appreciation, those who establish positions before completion stand to benefit from both the anticipation phase and the post-opening reality of transformed infrastructure and international visitor numbers.

Understanding the Wynn Al Marjan Island Project

The Wynn Al Marjan Island resort encompasses a comprehensive integrated development that will feature over 1,000 luxury hotel rooms, premium gaming facilities, world-class dining establishments, a sophisticated spa and wellness centre, and extensive meetings and events spaces. The project occupies a prime waterfront position on Al Marjan Island, offering unobstructed views of the Arabian Gulf whilst maintaining convenient access to RAK's growing infrastructure network.

Architecturally, the development adheres to Wynn Resorts' signature aesthetic—contemporary elegance with meticulous attention to landscaping, lighting, and guest experience. The resort's design incorporates sustainable building practices whilst creating the sense of refined luxury that has become synonymous with the Wynn brand across their global portfolio.

The integrated resort model that Wynn employs creates a self-contained ecosystem of luxury experiences. This approach has proven particularly successful in driving both tourism and property values in locations such as Macau, where Wynn's presence catalysed broader property market appreciation throughout the surrounding areas. The resort will employ thousands of staff, creating a substantial economic multiplier effect that extends throughout RAK's economy.

Crucially for property investors, the development includes plans for luxury branded residences—a segment that has demonstrated exceptional performance in markets where Wynn operates. These branded properties typically command significant premiums over comparable non-branded developments, creating a new benchmark for luxury residential property in RAK.

How Wynn Resort Elevates RAK's Investment Profile

Ras Al Khaimah has been steadily building its credentials as an investment destination for several years, but the Wynn Resort development accelerates this trajectory considerably. The emirate's investment profile benefits from several key enhancements that directly result from Wynn's presence.

Firstly, international awareness of RAK as a destination increases exponentially. Wynn's global marketing apparatus, which reaches high-net-worth individuals across North America, Europe, and Asia, will consistently promote RAK to demographics that may have previously been unfamiliar with the emirate. This awareness translates directly into property investor interest, as international buyers begin to recognise RAK as a viable alternative to Dubai's increasingly expensive property market.

Secondly, the development raises quality standards across RAK's hospitality and residential sectors. Competing developments must now benchmark against Wynn's specifications, creating upward pressure on design, amenities, and service delivery throughout the market. This quality elevation benefits existing property owners whilst ensuring that new developments meet increasingly sophisticated buyer expectations.

Thirdly, Wynn's presence attracts complementary developments and operators. Luxury retail brands, fine dining establishments, and premium service providers naturally gravitate towards locations where their target clientele congregate. This clustering effect creates a virtuous cycle where each new entrant reinforces RAK's positioning as a luxury destination, further enhancing property values.

The regulatory environment also benefits from Wynn's presence. The emirate's government has demonstrated commitment to creating frameworks that support world-class developments, including enhanced property investment incentives that make RAK increasingly attractive for international investors seeking streamlined acquisition processes and favourable ownership terms.

Property Market Impact: What Investors Need to Know

The property market impact of the Wynn Resort development manifests across multiple dimensions that investors must carefully evaluate when formulating their RAK strategy. Understanding these impacts enables more precise targeting of opportunities that will benefit most substantially from the resort's opening.

Immediate Proximity Premium: Properties within a 5-kilometre radius of the Wynn development have already begun experiencing appreciation as investors anticipate the resort's completion. Al Marjan Island properties, particularly those offering sea views or direct beach access, have seen price increases of 15-25% since the project's announcement. This trend will likely continue as the opening date approaches, with further acceleration anticipated in the 12 months following the resort's launch.

Rental Yield Enhancement: The substantial increase in high-spending tourists that Wynn will attract creates enhanced rental demand, particularly for luxury properties suitable for short-term holiday lets. Properties that cater to families or groups seeking alternatives to hotel accommodation stand to benefit from significantly improved occupancy rates and nightly rates, with rental yields potentially increasing by 2-3 percentage points in prime locations.

Infrastructure Investment Acceleration: The Wynn development has catalysed accelerated investment in supporting infrastructure, including road improvements, utility enhancements, and expanded retail and dining options. These infrastructure improvements benefit the broader property market by enhancing liveability and accessibility, making RAK increasingly viable as both an investment and residential destination.

Market Maturation and Liquidity: As RAK attracts more international attention and investment capital, the property market itself matures. Increased transaction volumes improve market liquidity, making it easier for investors to enter and exit positions. This liquidity enhancement reduces one of the traditional concerns about investing in emerging markets—the ability to realise gains when desired.

Investment Opportunities in RAK's Transformed Landscape

The Wynn Resort development creates distinct investment opportunities across various property segments, each offering different risk-return profiles suited to different investor objectives and time horizons.

Off-Plan Developments in Strategic Locations: Exclusive RAK off-plan projects in areas that will benefit from Wynn-driven appreciation offer particularly compelling opportunities. Off-plan investments enable investors to enter at lower price points whilst benefiting from capital appreciation during the construction phase. Developments within Al Marjan Island itself, as well as neighbouring communities such as Mina Al Arab, warrant particular attention.

Properties offering strong rental fundamentals—proximity to the resort, quality finishes, and amenities that appeal to Wynn's visitor demographics—position investors to capitalise on both capital appreciation and enhanced rental yields. Two and three-bedroom apartments with sea views represent particularly strong opportunities, as they cater to both family tourists and executives visiting for extended business stays.

Luxury Villa Communities: RAK's villa communities offer investors exposure to a segment that has demonstrated consistent appreciation whilst providing lifestyle benefits that apartments cannot match. Developments such as Hayat Island and Flamingo Villas combine waterfront positions with community amenities, creating compelling propositions for both investors and end-users. The Wynn development elevates these communities' profiles by association, particularly for international buyers seeking luxury homes in proximity to world-class amenities.

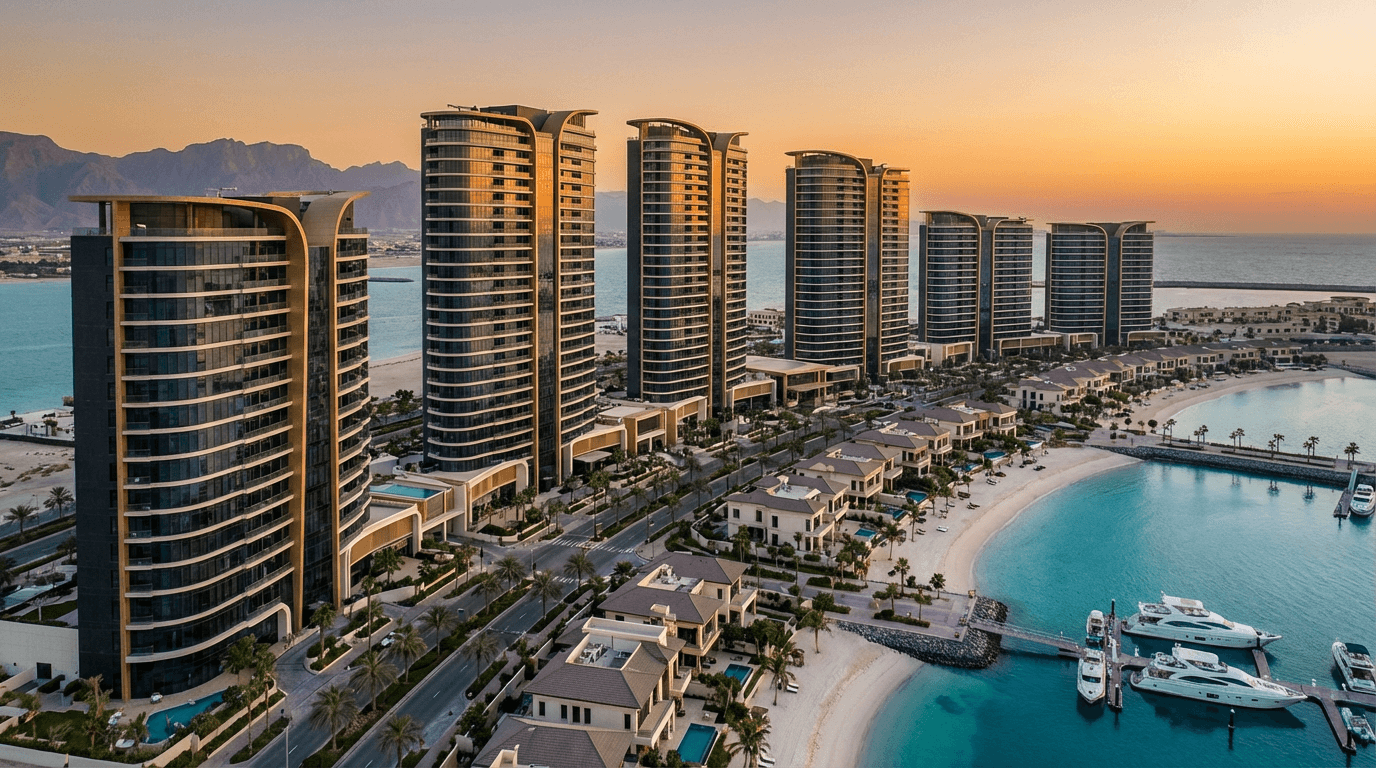

Waterfront Apartments with Premium Amenities: Purpose-built waterfront developments that offer resort-style amenities position investors to capture demand from buyers seeking the luxury lifestyle that Wynn's presence validates. Properties within gated communities that feature beach access, marina facilities, and comprehensive leisure amenities will likely outperform the broader market as RAK's luxury credentials strengthen.

Branded Residences and Serviced Apartments: The emergence of branded residential developments in RAK, catalysed partly by Wynn's own plans, offers investors access to premium segments with proven track records of value retention and appreciation. Branded residences typically command rental and resale premiums of 20-40% over comparable non-branded properties, whilst offering owners access to hotel-managed services and facilities.

Comparing RAK to Dubai: The New Investment Equation

The Wynn Resort development fundamentally alters the investment equation between Ras Al Khaimah and Dubai, creating compelling reasons for investors to seriously evaluate RAK as either an alternative to or complement for Dubai property holdings.

Price Point Advantages: RAK property prices remain substantially below equivalent Dubai properties, with luxury apartments in prime RAK locations typically priced 40-60% below comparable Dubai Marina or Palm Jumeirah units. This price differential creates exceptional value propositions, particularly as the amenity and lifestyle gap narrows with developments like Wynn Resort.

A two-bedroom apartment with sea views in Al Marjan Island might command AED 1.5-2 million, whilst a comparable property in Dubai Marina would likely exceed AED 3 million. For investors seeking to maximise capital deployed across multiple units or those targeting higher rental yields, this price advantage enables portfolio strategies that would be prohibitively expensive in Dubai.

Appreciation Potential: Whilst Dubai's property market has matured considerably, with more moderate appreciation rates expected going forward, RAK represents an earlier stage in its development trajectory. This positioning suggests stronger appreciation potential as the market matures and closes the valuation gap with more established locations. Property market analysts project that RAK could deliver capital appreciation of 8-12% annually over the next five years, compared to 4-6% projections for Dubai's established areas.

Regulatory and Tax Environment: Both emirates benefit from the UAE's favourable property ownership regulations, including freehold ownership for international buyers in designated areas and zero property taxes. However, RAK offers certain advantages including lower transaction fees and service charges, which improve overall investment returns. The emirate has also demonstrated particular responsiveness to investor needs, streamlining processes and introducing incentives designed to attract property investment capital.

Rental Yields: RAK's lower property prices combined with strengthening rental demand create superior gross rental yields compared to Dubai. Whilst prime Dubai properties typically deliver gross yields of 5-7%, well-positioned RAK properties can achieve 7-10%, with the Wynn Resort's opening likely to push these figures higher for properties in strategic locations.

Strategic Locations for Property Investment Near Wynn Resort

Identifying the specific locations that will benefit most substantially from the Wynn Resort development enables investors to optimise their positioning for capital appreciation and rental performance.

Al Marjan Island: As the home of the Wynn development itself, Al Marjan Island represents the epicentre of opportunity. The island's four segments offer various development types, from luxury apartment towers to villa communities, all benefiting from waterfront positions and improved infrastructure. Properties here enjoy the maximum proximity advantage whilst offering the lifestyle amenities—beaches, water sports, dining—that complement the Wynn Resort experience.

Investors should focus on developments offering unobstructed sea views, contemporary design, and comprehensive amenities. The island's master-planned nature ensures consistent quality standards whilst the variety of price points accommodates different investment budgets.

Mina Al Arab: Located adjacent to Al Marjan Island, Mina Al Arab offers investors opportunities in an established master-planned community that will benefit from Wynn-driven appreciation whilst maintaining slightly lower entry prices. The development's lagoons, beaches, and extensive amenities create a comprehensive lifestyle proposition that appeals to both investors and end-users.

Properties within Mina Al Arab's premium segments—particularly those with lagoon or sea views—position investors to capture appreciation whilst generating strong rental yields from families and groups seeking self-contained accommodation near the Wynn Resort.

Al Hamra Village: This established golf and marina community offers investors exposure to RAK's property market through a proven development with strong occupancy rates and consistent rental demand. Al Hamra's position along RAK's coastline, combined with its golf course, marina, and retail amenities, creates complementary appeal to the Wynn development whilst offering more accessible price points.

The community's mix of apartments and villas accommodates various investor strategies, whilst its established nature provides immediate rental income potential alongside capital appreciation prospects as RAK's profile rises.

Hayat Island: This exclusive island development targets the luxury segment with contemporary villas offering private beach access and marina facilities. For investors seeking exposure to RAK's high-end market, Hayat Island provides opportunities in a segment that will benefit particularly from the premium positioning that Wynn's presence reinforces.

The limited supply of luxury villas in RAK creates scarcity value, whilst the island's comprehensive amenities and security appeal to high-net-worth buyers seeking primary or secondary residences in proximity to world-class facilities.

Future Outlook: RAK's Property Market Trajectory

The Wynn Resort development represents one catalyst among several that are collectively transforming Ras Al Khaimah's property market trajectory. Understanding the broader context enables investors to assess RAK's long-term potential with greater clarity.

RAK's government has articulated an ambitious vision for the emirate that extends well beyond hospitality development. Infrastructure investments totalling billions of dirhams are enhancing connectivity both within RAK and to neighbouring emirates, reducing travel times and improving accessibility. The expansion of RAK International Airport, with new routes and increased capacity, will directly benefit property investors by expanding the pool of potential buyers and renters.

The emirate's economic diversification strategy is attracting businesses across manufacturing, logistics, and professional services sectors. This economic expansion creates employment growth that drives residential demand whilst reducing reliance on tourism-related activities. For property investors, economic diversification translates into more resilient rental demand and broader buyer demographics.

Educational and healthcare infrastructure investments are addressing the lifestyle requirements that influence residential location decisions. International schools and premium healthcare facilities make RAK increasingly viable for families, expanding the potential tenant and buyer pool beyond the tourism-focused demographics that have traditionally dominated the market.

The property market's regulatory framework continues evolving in investor-friendly directions. Recent initiatives have streamlined transaction processes, enhanced transparency, and introduced flexible payment plans that make property acquisition more accessible. These regulatory enhancements, combined with the UAE's broader reforms including extended visa categories and pathway to permanent residency, create a supportive environment for long-term property investment.

Property market analysts project that RAK's residential property market could expand by 40-60% in total value over the next five years, driven by a combination of volume growth and price appreciation. The Wynn Resort serves as a key driver of this expansion, but the broader transformation of RAK's infrastructure, economy, and lifestyle offerings provides fundamental support for sustained growth.

For investors considering RAK property opportunities, the current moment represents a particularly advantageous entry point. The Wynn development's catalyst effect is understood and anticipated, yet property prices have not fully reflected the long-term implications. Early positioning—before the resort's opening creates more tangible evidence of impact—enables investors to capture the full appreciation cycle from anticipation through realisation to maturity.

The expertise required to identify the specific opportunities that will deliver optimal returns demands deep market knowledge and access to exclusive off-plan developments. Working with specialists who maintain relationships with developers and understand the nuances of RAK's evolving market provides crucial advantages in identifying properties positioned for exceptional performance.

The Wynn Resort development represents a transformational moment for Ras Al Khaimah's property market, creating a catalyst that will drive appreciation and enhance the emirate's investment credentials for years to come. For discerning property investors, the implications are clear: RAK has transitioned from an emerging market to a compelling opportunity that warrants serious consideration within any UAE property strategy.

The combination of accessible price points, strong appreciation potential, enhanced rental yields, and the validation that Wynn's presence provides creates a compelling investment thesis. Properties in strategic locations—particularly those within Al Marjan Island and neighbouring communities—offer opportunities to capture significant capital growth whilst generating attractive rental returns.

The window for entering the RAK market at current valuations is finite. As the Wynn Resort approaches completion and the market increasingly recognises RAK's transformed investment profile, price appreciation will accelerate. Investors who establish positions now, selecting properties with optimal proximity and appeal to the demographics that Wynn will attract, position themselves for exceptional returns across both capital appreciation and rental performance.

Success in any property market requires not just understanding broad trends but identifying the specific opportunities that will outperform. RAK's evolving landscape demands expertise in evaluating developments, understanding infrastructure impacts, and accessing off-plan opportunities before they reach the general market.

Capitalise on RAK's Transformation with Expert Guidance

Navigating RAK's property market and identifying the opportunities best positioned to benefit from the Wynn Resort development requires specialist expertise and exclusive market access. Azimira Real Estate's deep knowledge of Ras Al Khaimah's emerging market, combined with our exclusive access to pre-launch and off-market properties, positions our clients to secure optimal investments before broader market recognition drives prices higher.

Our team provides comprehensive support throughout your property acquisition journey, from initial market analysis through to final purchase, ensuring you secure properties offering exceptional capital growth potential and strong rental fundamentals.

Discover how Azimira can help you capitalise on RAK's transformation. Contact our property investment specialists today to explore exclusive opportunities in Ras Al Khaimah's evolving luxury property market.

Related articles

FX Forward Contracts: Lock In Your Purchase Price for UAE Property Investment

Discover how FX forward contracts protect international property investors from currency fluctuations when purchasing UAE real estate, securing your investment budget.

Succession Planning: DIFC Foundations vs Offshore Trusts for UAE Property Investors

Discover the key differences between DIFC Foundations and Offshore Trusts for succession planning. Expert guidance for UAE property investors seeking optimal wealth protection.

Exit Costs Explained: Transfer Fees, Agency Fees, and Early-Settlement Charges in UAE Property

Comprehensive guide to UAE property exit costs including transfer fees, agency commissions, and early-settlement penalties. Learn how to calculate and minimise expenses when selling.