RAK Rental Income Replacing Corporate Salary: One Family's Journey to Financial Freedom

Discover how the Thompson family replaced a corporate salary with RAK rental income through strategic property investment, achieving financial independence in the UAE market.

Table Of Contents

- The Thompson Family's Turning Point

- Why RAK Became Their Investment Destination

- The Investment Strategy That Changed Everything

- Breaking Down the Numbers: From Salary to Rental Income

- The Off-Plan Advantage in RAK

- Challenges They Faced (And How They Overcame Them)

- Life After Corporate: What Financial Freedom Looks Like

- Key Lessons for Aspiring Property Investors

- Is RAK Right for Your Investment Goals?

For Sarah Thompson, the Monday morning alarm at 5:30 AM had become unbearable. After 12 years climbing the corporate ladder in Dubai's financial sector, the 40-year-old senior manager found herself questioning whether the six-figure salary was worth the mounting stress, endless meetings, and precious time away from her two young children. Her husband, James, felt similarly trapped in his role as an IT consultant. The couple shared a dream that seemed almost impossible: achieving financial independence whilst still in their early forties.

Today, just three years later, Sarah no longer sets that alarm. The Thompsons have successfully replaced her AED 35,000 monthly corporate salary with rental income from a carefully curated portfolio of properties in Ras Al Khaimah (RAK). Their journey from corporate employees to financially independent property investors offers valuable insights for anyone considering whether UAE real estate can genuinely provide an alternative income stream.

This isn't a story about overnight success or unrealistic windfalls. It's an honest account of strategic planning, calculated risks, and the emerging opportunities in RAK's property market that made their transition possible. Whether you're contemplating your own exit from corporate life or simply exploring ways to build passive income, the Thompson family's experience demonstrates what's achievable with the right approach to property investment in the UAE's fastest-growing emirate.

The Thompson Family's Turning Point

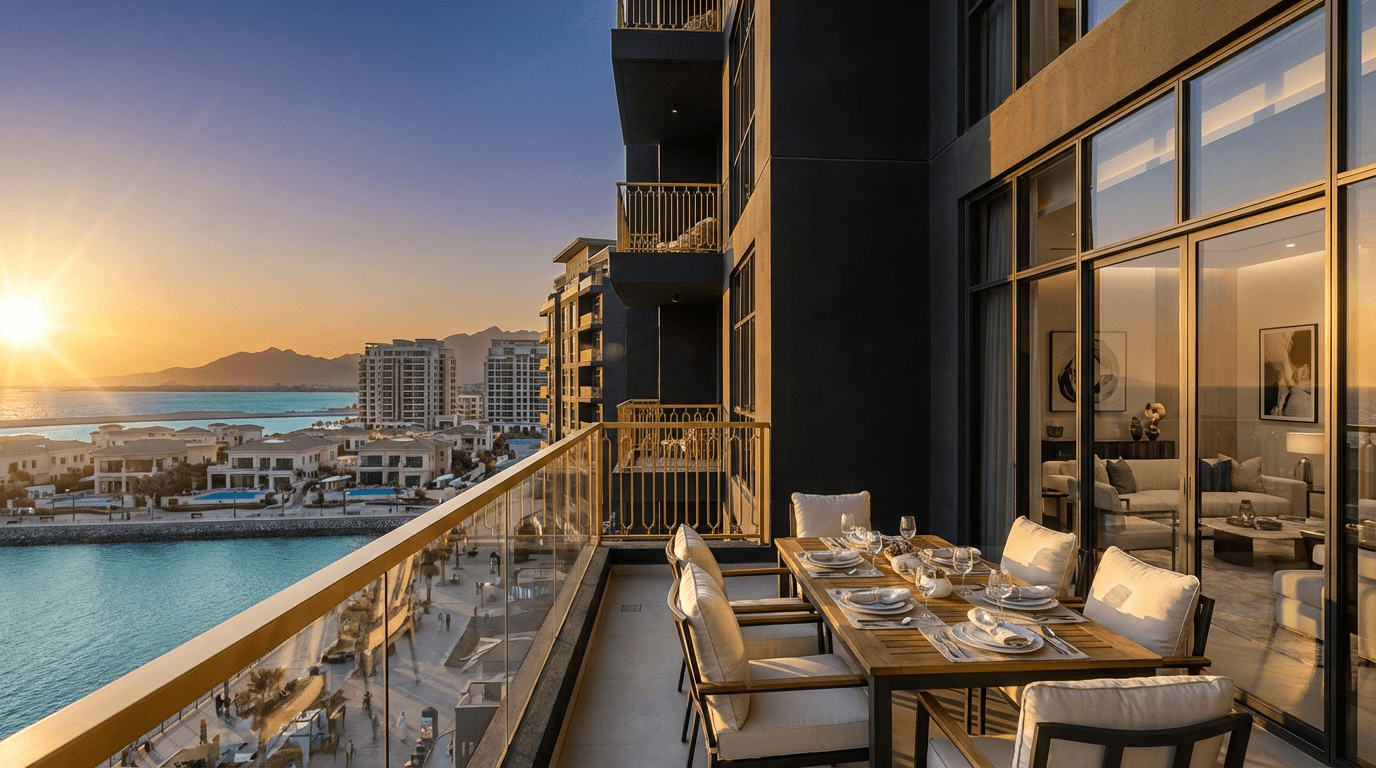

The catalyst came during a family holiday in early 2021. Whilst relaxing at a beachfront resort in Ras Al Khaimah, Sarah and James stumbled upon a property exhibition showcasing upcoming developments in the emirate. What began as casual browsing transformed into a serious conversation about their financial future. They noticed something striking: whilst Dubai property prices had surged beyond reach for many investors, RAK offered remarkably affordable entry points with rental yields that seemed almost too good to be true.

"We'd been putting aside money for years, thinking we'd eventually invest in Dubai property," Sarah recalls. "But the numbers never quite worked. When we discovered we could purchase a two-bedroom apartment in RAK for less than the deposit required for a comparable Dubai property, everything changed." The couple had accumulated approximately AED 400,000 in savings—not enough for their Dubai aspirations, but potentially transformative in RAK's emerging market.

James, with his analytical background, spent the following weeks conducting exhaustive research. He examined rental yields, capital appreciation forecasts, infrastructure developments, and government initiatives positioning RAK as a tourism and business hub. The data consistently pointed towards an undervalued market on the cusp of significant growth. However, they both recognised they needed expert guidance to navigate unfamiliar territory. This realisation led them to seek specialists who understood RAK's unique market dynamics and could identify opportunities beyond what general property portals offered.

Why RAK Became Their Investment Destination

The Thompsons' decision to focus exclusively on Ras Al Khaimah wasn't arbitrary—it stemmed from compelling market fundamentals that distinguished the emirate from other UAE investment destinations. RAK offered a unique combination of affordability, growth potential, and rental demand that aligned perfectly with their income-replacement objectives.

Firstly, the entry costs were substantially lower than Dubai or Abu Dhabi. Quality two-bedroom apartments in desirable RAK locations were available from AED 600,000 to AED 900,000, compared to AED 1.5 million or more for equivalent properties in Dubai's secondary locations. This pricing differential meant the Thompsons could acquire multiple properties rather than concentrating all capital into a single asset, thereby diversifying their risk and income streams.

Secondly, RAK's rental yields consistently outperformed most Dubai areas. Whilst prime Dubai locations typically delivered 5-7% gross yields, RAK properties were generating 8-10% or higher, particularly in developments near the beach, golf courses, and integrated resort communities. For investors prioritising cash flow over capital gains, these superior yields were transformative. The Thompsons calculated that the same capital deployed in RAK could generate 40-50% more monthly rental income than comparable Dubai investments.

Thirdly, RAK's development trajectory indicated strong appreciation potential. The emirate had launched ambitious infrastructure projects, including the expansion of RAK International Airport, the development of integrated tourism destinations, and significant enhancements to the Corniche and public amenities. Government initiatives to attract businesses through competitive licensing fees and streamlined processes were driving population growth. Tourism arrivals were increasing year-on-year, creating sustained demand for both short-term holiday rentals and long-term residential properties.

Finally, RAK's lifestyle appeal was undeniable. The Thompsons envisioned not just financial freedom, but the possibility of relocating from their cramped Dubai apartment to a spacious villa with mountain or sea views, all whilst maintaining lower living costs. The quality of life RAK offered—particularly for families—became an integral part of their long-term vision.

The Investment Strategy That Changed Everything

Armed with research and clear objectives, the Thompsons developed a phased investment strategy designed to systematically build their rental income portfolio. Their approach emphasised off-plan properties, strategic timing, and professional guidance—decisions that would prove critical to their success.

Phase One: The Foundation Properties

In mid-2021, they committed to their first two off-plan apartments in a beachfront development, investing AED 350,000 across both properties. The off-plan structure allowed them to secure the properties with just 20% deposits (AED 70,000) whilst the remainder would be paid through instalments during construction, aligned with completion milestones. This payment structure was crucial—it meant they could control AED 350,000 worth of property whilst retaining the majority of their capital for additional investments.

The development offered post-handover payment plans, meaning they would only need to arrange mortgage financing upon completion in 2023. During the construction period, property values in the development appreciated by approximately 18%, adding unrealised gains to their portfolio before they'd even taken ownership. This capital appreciation would later provide additional equity for leveraging further investments.

Phase Two: Diversification and Income Acceleration

Rather than waiting for the first properties to complete, the Thompsons reinvested their remaining capital into a third off-plan property in early 2022—a one-bedroom apartment in a development targeting young professionals and short-term rental markets. By staggering their purchases across different developments with varying completion dates, they ensured their rental income would commence in phases rather than all at once, allowing them to gradually transition Sarah out of corporate employment.

They also explored exclusive RAK off-plan projects that weren't widely marketed, gaining access to pre-launch pricing that offered 10-15% discounts compared to public launch prices. This strategy, facilitated through specialist property investment advisors, maximised their capital efficiency and positioned them ahead of the broader market.

Phase Three: Leveraging Equity and Scaling

When their first two properties completed in early 2023, professional valuations confirmed significant appreciation. The properties they'd purchased for AED 350,000 were now valued at approximately AED 420,000 combined. They refinanced these properties, securing mortgages at 75% loan-to-value ratios, which released substantial capital whilst maintaining positive cash flow after mortgage payments.

This released equity funded deposits on two additional properties, bringing their total portfolio to five units by mid-2023. Crucially, the rental income from the completed properties now exceeded AED 25,000 monthly—covering all mortgage payments with surplus remaining. This milestone provided the confidence for Sarah to negotiate reduced working hours, transitioning to a part-time consultancy arrangement that significantly improved her work-life balance.

Breaking Down the Numbers: From Salary to Rental Income

The financial transformation the Thompsons achieved becomes most compelling when examining the specific numbers. Their portfolio, as of early 2024, comprises five properties with a combined market value of approximately AED 2.1 million, generating monthly rental income that has successfully replaced Sarah's corporate salary.

Portfolio Breakdown:

- Property 1: Two-bedroom beachfront apartment - Purchase price AED 180,000 (off-plan, 2021), Current value AED 215,000, Monthly rental income AED 13,500, Gross yield 7.5%

- Property 2: Two-bedroom golf course apartment - Purchase price AED 170,000 (off-plan, 2021), Current value AED 205,000, Monthly rental income AED 12,800, Gross yield 7.5%

- Property 3: One-bedroom city centre apartment - Purchase price AED 145,000 (off-plan, 2022), Current value AED 175,000, Monthly rental income AED 11,200, Gross yield 7.7%

- Property 4: Two-bedroom family apartment - Purchase price AED 190,000 (off-plan, 2023), Current value AED 210,000, Monthly rental income AED 13,000, Gross yield 7.4%

- Property 5: Studio apartment - Purchase price AED 95,000 (off-plan, 2023), Current value AED 110,000, Monthly rental income AED 7,000, Gross yield 7.6%

Total monthly rental income: AED 57,500 Total monthly mortgage payments: AED 18,500 Net monthly passive income: AED 39,000

This net monthly income of AED 39,000 exceeds Sarah's previous corporate salary of AED 35,000, whilst also providing significant tax advantages. UAE rental income remains tax-free for residents, meaning the Thompsons retain the full amount, unlike salary income which often involves various deductions and expenses.

Equally impressive is the capital appreciation. Their total invested capital of approximately AED 780,000 (including deposits, instalments, and transaction costs) now controls assets worth AED 2.1 million, representing a 169% return on invested capital over just three years. The mortgage financing, rather than being a burden, has actually enhanced their returns through leverage whilst maintaining positive cash flow.

The Off-Plan Advantage in RAK

The Thompsons' success was fundamentally enabled by their strategic focus on off-plan properties—a decision that many novice investors overlook or avoid due to perceived risks. However, when approached correctly with proper due diligence and expert guidance, off-plan investments in RAK offer distinct advantages that completed properties simply cannot match.

Capital Efficiency and Payment Flexibility

Off-plan properties require significantly less upfront capital. The Thompsons typically paid 20% deposits followed by instalments during construction, meaning they could control multiple properties simultaneously without requiring full purchase amounts. This payment structure effectively provided interest-free financing during the construction period, allowing their capital to work harder across a diversified portfolio rather than being locked into a single property.

Below-Market Entry Pricing

Developers price off-plan properties below anticipated market values at completion to attract early investors and secure development financing. The Thompsons consistently purchased at 10-20% below what comparable completed properties commanded. This immediate equity buffer provided both a safety margin and appreciation potential from day one. When each property completed, they already held substantial unrealised gains before receiving the first rental payment.

Access to Prime Locations and Premium Developments

The most desirable developments in RAK—waterfront communities, golf course residences, and integrated resort projects—are predominantly sold off-plan. Waiting for completion often means missing opportunities entirely, as the best units are allocated during pre-launch and early sales phases. By investing in RAK property during off-plan stages, the Thompsons secured premium units in prime locations that would become increasingly scarce and expensive.

Customisation and Selection Advantages

Purchasing early in the sales cycle provided choice—the Thompsons could select units with optimal views, floor levels, and layouts rather than accepting whatever remained available. This selection advantage translated directly into rental appeal and higher occupancy rates when properties completed.

Developer Incentives and Value Additions

Developers frequently offer incentives to early buyers, including furniture packages, guaranteed rental returns during initial periods, or waived service charges. These incentives provided the Thompsons with immediate value and reduced their initial operational costs, improving cash flow from the outset.

However, the Thompsons emphasise that off-plan investing requires rigorous due diligence. They exclusively selected developments from established developers with proven track records, verified that projects had appropriate regulatory approvals, and ensured robust escrow account protections were in place. Working with specialists who understood RAK's development landscape proved invaluable in navigating these considerations.

Challenges They Faced (And How They Overcame Them)

The Thompsons' journey wasn't without obstacles. Understanding the challenges they encountered—and their solutions—provides realistic expectations for anyone considering a similar path.

Challenge 1: Construction Delays

One of their properties experienced a six-month completion delay, postponing anticipated rental income. This delay created a temporary cash flow gap that could have derailed their timeline for Sarah leaving corporate employment. They overcame this by maintaining a contingency reserve equivalent to six months of expenses and by not becoming over-leveraged. The delay ultimately proved minor in the context of their long-term strategy, and the property still delivered expected returns once completed.

Challenge 2: Initial Vacancy Periods

Two properties remained vacant for 6-8 weeks after completion whilst they identified suitable tenants. The Thompsons had anticipated immediate occupancy and found the vacancy period concerning. They addressed this by engaging professional property management services with established tenant networks and by pricing their properties competitively within market ranges. Subsequently, they've maintained occupancy rates exceeding 95%, with most tenants renewing annually.

Challenge 3: Mortgage Application Complexity

Securing mortgage financing for their third and subsequent properties proved more complex than anticipated. Banks assessed their debt-to-income ratios conservatively, and the application processes were time-consuming. The Thompsons worked with mortgage advisors who specialised in investment property financing and who maintained relationships with multiple lenders. Shopping amongst different banks ultimately secured competitive rates and appropriate loan structures.

Challenge 4: Market Knowledge Gaps

Despite extensive research, the Thompsons initially lacked nuanced understanding of which specific RAK locations and developments offered optimal rental demand. They overcame this limitation by partnering with property specialists who possessed granular market insights, including tenant preferences, rental price sensitivity, and emerging hotspots. This expertise prevented costly mistakes and optimised their property selection.

Challenge 5: Emotional Uncertainty

Perhaps the most significant challenge was psychological—the fear and uncertainty of leaving stable corporate employment for variable rental income. Sarah experienced considerable anxiety about relinquishing her salary security, despite the numbers supporting their strategy. They managed this by implementing a phased transition rather than an abrupt departure, allowing Sarah to reduce to part-time work initially whilst monitoring portfolio performance. This gradual approach built confidence and proved the concept before full commitment.

Life After Corporate: What Financial Freedom Looks Like

Eighteen months after Sarah's final day in corporate employment, the Thompsons' daily life bears little resemblance to their previous existence. The transformation extends far beyond finances into lifestyle, relationships, and personal fulfilment.

Sarah now dedicates mornings to her children's school routines without the frantic rush that previously characterised their mornings. She's developed a photography business—a long-dormant passion—that generates modest additional income but, more importantly, provides creative satisfaction. James continues working but has negotiated remote arrangements, allowing the family to spend extended periods in their RAK villa whilst maintaining his consultancy income.

Their monthly expenses have actually decreased since relocating to RAK from Dubai. The family resides in a spacious three-bedroom villa with garden and mountain views—accommodations that would cost multiples more in Dubai—for approximately AED 85,000 annually. Combined with lower school fees, reduced transportation costs, and more affordable daily expenses, their required income to maintain a superior lifestyle is substantially less than their previous Dubai overhead.

The passive nature of rental income is perhaps the most transformative aspect. Whilst properties require occasional attention, professional management services handle tenant relations, maintenance coordination, and rent collection for modest fees. The Thompsons typically spend 3-4 hours monthly reviewing financial statements and making strategic decisions about their portfolio—a stark contrast to Sarah's previous 50-60 hour work weeks.

Financially, they've established clear objectives for the coming years. Rather than expanding their portfolio indefinitely, they're now focusing on accelerating mortgage repayments to increase net cash flow. Their goal is to hold all properties mortgage-free within eight years, which would increase their monthly net income to approximately AED 57,500 whilst simultaneously building substantial equity in appreciating assets.

Perhaps most significantly, they've reclaimed time—the one truly finite resource. Sarah reflects: "We calculated that even if I'd continued climbing the corporate ladder to director level, the salary increase would never have compensated for the time I'm now spending with my children during their formative years. That time is irreplaceable, and property investment gave us access to it whilst we're still young enough to enjoy it."

Key Lessons for Aspiring Property Investors

The Thompsons distilled their experience into practical lessons for others considering whether property investment might provide alternative income streams:

Start with clear, specific financial objectives. Rather than vague goals about "making money from property," they calculated exactly how much monthly income they needed, by when, and worked backwards to determine required portfolio size, yields, and financing structures.

Focus on cash flow, not just capital appreciation. Whilst property value increases are beneficial, they're unrealised until you sell. Monthly rental income pays bills and replaces salaries. The Thompsons prioritised yield over speculative appreciation, which proved essential for achieving their income-replacement goals.

Leverage professional expertise rather than attempting everything independently. The Thompsons credit specialist property advisors with helping them avoid costly mistakes, access better opportunities, and navigate complex processes more efficiently. The modest fees involved delivered multiples in value through optimised property selection and negotiated pricing.

Embrace off-plan opportunities with appropriate due diligence. The capital efficiency, pricing advantages, and appreciation potential of off-plan properties accelerated their portfolio growth substantially. However, rigorous developer assessment and proper legal protections are non-negotiable.

Maintain adequate reserves and avoid over-leveraging. Unexpected vacancies, maintenance costs, and delays occur. Adequate contingency funds prevented these normal occurrences from becoming crises.

Consider emerging markets rather than exclusively pursuing established locations. RAK's combination of affordability and growth trajectory provided opportunities that simply didn't exist in saturated Dubai markets. Sometimes the best opportunities exist where fewer people are looking.

Plan for gradual transitions rather than dramatic leaps. Reducing work commitments in phases allowed them to validate their strategy whilst managing risk. This approach proved psychologically easier and financially safer than abrupt changes.

Treat property investment as a business, not a hobby. The Thompsons maintained detailed financial records, regularly reviewed performance metrics, and made decisions based on data rather than emotions. This professional approach ensured they stayed on track towards defined objectives.

Is RAK Right for Your Investment Goals?

The Thompson family's success demonstrates what's achievable through strategic property investment in Ras Al Khaimah, but their approach won't suit everyone. Determining whether RAK aligns with your specific circumstances requires honest assessment of your objectives, resources, and risk tolerance.

RAK property investment is particularly appropriate if you're prioritising cash flow and rental yield over pure capital appreciation. The emirate's superior rental returns make it ideal for investors seeking to generate passive income, replace employment earnings, or build diversified income streams. If your primary objective is maximum capital growth in the shortest timeframe, other UAE locations might warrant consideration, though RAK's appreciation trajectory remains compelling.

The emirate suits investors with medium to long-term horizons—typically five years or longer. Whilst the Thompsons achieved significant results within three years, their strategy assumed holding properties through market cycles rather than quick flipping. RAK's market fundamentals support patient investors who can benefit from both ongoing rental income and gradual appreciation.

Financially, RAK's accessibility is distinctive. Unlike Dubai or Abu Dhabi where entry barriers can exclude many aspiring investors, RAK enables portfolio building with more modest capital. However, success still requires adequate reserves, realistic financing, and proper financial planning. The Thompsons' AED 400,000 starting capital is achievable for many UAE residents, but attempting similar strategies with insufficient resources or excessive leverage invites unnecessary risk.

RAK particularly appeals to investors comfortable with emerging markets and willing to conduct thorough due diligence. The emirate's growth trajectory is compelling, but it remains less established than Dubai. Investors requiring the comfort of completely mature markets with decades of track record might prefer alternatives, though they'll likely sacrifice the yield advantages and affordability that RAK provides.

Ultimately, assessing whether RAK suits your investment goals requires personalised analysis of your specific circumstances, objectives, and constraints. The market presents genuine opportunities, as the Thompson family's experience demonstrates, but success requires alignment between the investment characteristics RAK offers and the outcomes you're pursuing. Professional guidance from specialists who understand both the RAK market and your individual situation can prove invaluable in making informed decisions.

For investors ready to explore whether RAK property investment might help achieve your financial objectives, connecting with experienced advisors who can provide tailored insights into current opportunities, market dynamics, and strategic approaches specific to your circumstances represents a prudent first step towards potentially transformative outcomes.

The Thompson family's journey from dual corporate careers to financial freedom through RAK rental income illustrates both the possibilities and practicalities of property investment in the UAE's fastest-growing emirate. Their success wasn't accidental—it resulted from clear objectives, strategic planning, professional guidance, and disciplined execution over a sustained period.

Whilst their specific path won't suit everyone, the underlying principles they applied offer valuable frameworks for any investor considering whether property might provide alternative income streams. RAK's combination of affordability, superior yields, and growth potential creates conditions where carefully planned investment strategies can genuinely deliver life-changing outcomes for families willing to approach property investment with appropriate seriousness and professionalism.

The Thompsons emphasise that their story continues to evolve. They're now exploring additional opportunities in emerging RAK developments, considering whether to expand into commercial property, and planning how to structure their portfolio for long-term wealth preservation. Their journey from that chance property exhibition in 2021 to financial independence demonstrates what becomes possible when market opportunity meets strategic action.

Begin Your RAK Investment Journey

Are you ready to explore whether RAK property investment might help you achieve your financial objectives? Azimira Real Estate specialises in identifying exceptional off-plan opportunities and high-yield properties in Ras Al Khaimah's most promising developments.

Our team provides personalised investment strategies, exclusive access to pre-launch properties, and comprehensive support throughout your investment journey—from initial consultation to final purchase and beyond.

Schedule a confidential consultation to discuss your specific goals and discover current RAK opportunities aligned with your investment criteria.

Related articles

Investment Property Management: Maximise Net Yield in RAK

Investment property management in RAK: reduce vacancy, control costs, optimise pricing and maintenance, and maximise net yield with a practical playbook.

Off Market Properties in the UAE: How to Access Real Deals

Learn how to access off market properties in the UAE safely, from pre-launch allocations to private resales, with due diligence steps to avoid scams.

Investment Property Checklist for UAE Buyers (Off-Plan and Ready)

Use this investment property checklist for UAE buyers to compare off-plan vs ready homes, verify documents, budget costs, and protect your ROI.