Al Hamra Developers: Which Development is Best For You? Complete Investment Comparison

Compare Al Hamra Greens, Al Hamra Waterfront, and Aila Homes by Al Hamra Developers. Detailed analysis of costs, specifications, amenities, and ROI potential for investors.

Table Of Contents

- Understanding Al Hamra Developers: A Premium RAK Portfolio

- Al Hamra Greens: Family-Focused Affordable Living

- Al Hamra Waterfront: Luxury Coastal Living

- Aila Homes: Exclusive Villa Community

- Side-by-Side Comparison: Key Metrics

- Which Al Hamra Development Should You Choose?

- Why Ras Al Khaimah Represents Exceptional Investment Value

Al Hamra Developers has established itself as one of Ras Al Khaimah's most prestigious property developers, creating communities that blend luxury, affordability, and strategic location advantages. For investors and owner-occupiers seeking opportunities in the RAK market, understanding the differences between Al Hamra Greens, Al Hamra Waterfront, and Aila Homes is essential to making an informed decision aligned with your financial objectives and lifestyle requirements.

Each development within the Al Hamra portfolio targets distinct buyer profiles and offers unique value propositions. Al Hamra Greens caters to families seeking affordable, community-focused living with exceptional amenities. Al Hamra Waterfront appeals to those desiring luxury waterfront residences with marina views and premium finishes. Aila Homes represents the pinnacle of exclusive villa living, offering privacy, space, and bespoke design within a gated community.

This comprehensive comparison analyses the costs, specifications, amenities, and projected returns on investment for each development, providing you with the data-driven insights necessary to identify which Al Hamra property aligns with your investment strategy. Whether you're seeking capital appreciation, rental yields, or your dream home in one of the UAE's fastest-growing emirates, this guide will illuminate the path forward.

Al Hamra Developers Investment Comparison

Find Your Perfect RAK Property Match

💡 Investment Snapshot

Al Hamra Developers offers three distinct property types in Ras Al Khaimah, each targeting different investor profiles and lifestyle needs. Choose based on your investment goals: cash flow, capital appreciation, or balanced returns.

Al Hamra Greens

Family-focused affordable living with exceptional yields

Al Hamra Waterfront

Luxury coastal living with marina and sea views

Aila Homes

Exclusive villa community with premium amenities

Quick Comparison Matrix

| Factor | Greens | Waterfront | Aila Homes |

|---|---|---|---|

| Entry Capital | Low | Medium | High |

| Service Charges | AED 8-12/sqft | AED 14-18/sqft | AED 25-45K/yr |

| Target Market | Families | Executives | HNW Individuals |

| Liquidity | High | Medium | Medium-Low |

🎯 Which Development Suits You?

- You want maximum rental yields (7-9%)

- You're a first-time investor

- You need low entry capital

- You prefer high liquidity

- You want balanced yield + growth

- You value waterfront lifestyle

- You seek premium tenants

- You want strong appreciation (34-61%)

- You prioritize capital growth (40-74%)

- You're seeking luxury villa living

- You have substantial capital

- You want land ownership

Ready to Invest in RAK?

Partner with RAK investment specialists for exclusive access to pre-launch opportunities and tailored investment strategies.

Schedule Your ConsultationUnderstanding Al Hamra Developers: A Premium RAK Portfolio

Al Hamra Developers operates as a subsidiary of Al Hamra Real Estate Development, the master developer behind the 5.4 million square metre Al Hamra Village—one of Ras Al Khaimah's most established and sought-after integrated communities. The development company has built a reputation for delivering quality residential properties that combine thoughtful design with competitive pricing, positioning RAK as an attractive alternative to Dubai and Abu Dhabi's premium-priced markets.

The strategic location of Al Hamra Village, situated along the Arabian Gulf coastline with the dramatic Hajar Mountains as a backdrop, provides residents with a unique lifestyle proposition. The community features an 18-hole championship golf course designed by Peter Harradine, a marina accommodating over 350 boats, beach clubs, international schools, retail centres, and dining establishments. This established infrastructure significantly enhances the investment appeal of properties within the Al Hamra portfolio.

For investors, Al Hamra Developers represents an opportunity to access the burgeoning RAK market through a developer with an established track record and completed projects demonstrating strong capital appreciation over the past five years. The emirate's strategic initiatives—including infrastructure developments, tourism expansion, and pro-business regulations—create favourable conditions for property value growth across all three developments examined in this analysis.

Al Hamra Greens: Family-Focused Affordable Living

Al Hamra Greens positions itself as the entry point to the Al Hamra lifestyle, offering townhouses and apartments designed specifically for families seeking value without compromising on community amenities or build quality. The development emphasises green spaces, children's play areas, and family-oriented facilities, creating a neighbourhood atmosphere that appeals to both long-term residents and investors targeting the family rental market.

The architectural design incorporates contemporary Arabian influences with clean lines, generous natural light, and functional layouts that maximise usable space. The community features landscaped gardens, swimming pools, fitness centres, and dedicated children's recreational areas, ensuring residents enjoy comprehensive amenities without leaving the development. Proximity to Al Hamra Village's broader facilities—including the golf course, marina, and beach clubs—provides additional lifestyle benefits typically associated with premium communities.

Pricing and Payment Plans

Al Hamra Greens offers the most accessible pricing within the Al Hamra portfolio, with studio apartments starting from approximately AED 450,000, one-bedroom units from AED 650,000, two-bedroom apartments from AED 950,000, and three-bedroom townhouses ranging from AED 1.4 million to AED 1.8 million. These price points represent exceptional value compared to equivalent properties in Dubai or Abu Dhabi, where similar specifications command premiums of 40-60%.

Development payment plans typically follow a structure of 20% deposit, 40% during construction, and 40% upon handover, though specific terms vary based on unit type and promotional periods. For investors operating with capital constraints, these flexible payment structures enable portfolio diversification across multiple units or markets without requiring substantial upfront capital deployment.

Service charges average AED 8-12 per square foot annually, depending on unit type and community facilities access. These charges remain competitive within the RAK market whilst covering comprehensive maintenance of common areas, security services, and amenity upkeep. The transparent fee structure enables accurate calculation of net rental yields and total ownership costs.

Specifications and Unit Types

Al Hamra Greens offers diverse unit configurations to accommodate various family sizes and investment strategies:

Studio Apartments: Ranging from 450-550 square feet, these compact units feature open-plan living areas, integrated kitchens with modern appliances, and efficient bathroom layouts. Ideal for single professionals or young couples, studios generate strong rental demand from the hospitality workforce and individuals relocating to RAK for employment opportunities.

One-Bedroom Apartments: Spanning 650-850 square feet, these units provide separate bedroom spaces, living areas with balconies, and fully equipped kitchens. The configuration appeals to couples and small families, offering flexibility for home offices or guest accommodation whilst maintaining affordability.

Two-Bedroom Apartments: With floor areas between 1,100-1,400 square feet, these residences incorporate master bedrooms with en-suite facilities, second bedrooms, family bathrooms, generous living spaces, and balconies with community views. The layout serves growing families and investors targeting mid-range rental segments.

Three-Bedroom Townhouses: The premium offering within Al Hamra Greens, these properties span 1,800-2,200 square feet across multiple levels, featuring three bedrooms (master with en-suite), additional bathrooms, spacious living and dining areas, modern kitchens, private gardens, and designated parking spaces. The townhouse format appeals to families prioritising space, privacy, and long-term residence.

All units incorporate quality finishes including porcelain tiling, contemporary sanitaryware, built-in wardrobes, and energy-efficient air conditioning systems. Kitchen appliances from reputable manufacturers come as standard, reducing initial fit-out costs for investors and ensuring immediate rental readiness.

Estimated ROI and Investment Potential

Al Hamra Greens demonstrates strong investment fundamentals across both rental yield and capital appreciation metrics. Current market data indicates rental yields of 7-9% annually, significantly outperforming Dubai's typical 5-6% returns and providing investors with consistent cash flow generation.

Studio apartments command monthly rents of AED 2,500-3,200, generating annual rental income of AED 30,000-38,400. Against purchase prices of AED 450,000-550,000, this translates to gross yields of approximately 6.7-7.6%. One-bedroom units rent for AED 3,500-4,500 monthly (AED 42,000-54,000 annually), producing yields of 6.5-8.3% on purchase prices of AED 650,000-750,000.

Two-bedroom apartments achieve monthly rents of AED 5,500-7,000 (AED 66,000-84,000 annually), delivering yields of 6.9-8.8% on acquisition costs of AED 950,000-1,100,000. Three-bedroom townhouses, whilst commanding higher purchase prices of AED 1.4-1.8 million, generate monthly rents of AED 9,000-12,000 (AED 108,000-144,000 annually), producing yields of 7.7-8.6%.

Capital appreciation forecasts based on RAK's development trajectory and Al Hamra's established market position suggest 5-8% annual growth over the next five years. This projection factors in the emirate's infrastructure investments, tourism expansion initiatives, and increasing recognition among international investors seeking alternatives to saturated markets. Properties purchased at current prices could realise 28-47% total appreciation over a five-year holding period, excluding rental income contributions.

For investors employing leveraged acquisition strategies with 25% deposits and mortgage financing, the combination of rental yields and capital appreciation can generate total returns exceeding 25-35% annually on deployed capital, positioning Al Hamra Greens as an exceptional opportunity within the UAE property market.

Al Hamra Waterfront: Luxury Coastal Living

Al Hamra Waterfront represents the premium residential offering within the Al Hamra portfolio, featuring contemporary apartments and penthouses overlooking the marina and Arabian Gulf. The development targets affluent buyers seeking luxury finishes, waterfront views, and proximity to leisure amenities including yacht berths, beach clubs, and fine dining establishments. The architectural design emphasises floor-to-ceiling glazing, expansive balconies, and high-specification interiors that reflect international luxury standards.

Residents of Al Hamra Waterfront enjoy direct access to the marina promenade, creating a lifestyle centred around coastal leisure activities and social engagement. The development's position within the established Al Hamra Village infrastructure ensures comprehensive amenities whilst maintaining an exclusive residential character. For investors, the waterfront location provides differentiation within the RAK market, appealing to high-net-worth individuals and expatriate executives seeking premium accommodation.

Pricing and Payment Plans

Al Hamra Waterfront commands premium pricing reflective of its superior location and specifications. One-bedroom apartments start from approximately AED 950,000, two-bedroom units from AED 1.5 million, three-bedroom apartments from AED 2.3 million, and penthouses exceeding AED 4 million depending on size and specific marina or sea views.

These price points, whilst representing significant premiums over Al Hamra Greens (approximately 40-50% higher for equivalent bedroom configurations), remain competitive when benchmarked against comparable waterfront developments in Dubai Marina or Abu Dhabi's Al Reem Island, where similar properties command 60-80% premiums.

Payment structures typically follow 30% deposit, 40% during construction phases, and 30% on completion, reflecting the premium positioning and targeting more capitalised buyers. Post-handover payment plans occasionally feature in promotional periods, enabling investors to secure units with reduced initial capital requirements whilst benefiting from rental income during extended payment periods.

Annual service charges range from AED 14-18 per square foot, reflecting the enhanced amenities, waterfront maintenance requirements, and premium common area finishes. Marina berth fees apply separately for residents wishing to utilise yacht facilities, though these remain optional rather than mandatory charges.

Specifications and Unit Types

Al Hamra Waterfront's residences incorporate luxury specifications and thoughtful design across all unit types:

One-Bedroom Apartments: Spanning 850-1,050 square feet, these units feature open-plan living and dining areas, premium kitchen installations with European appliances, spacious bedrooms with en-suite bathrooms, and balconies offering marina or partial sea views. The configuration suits professionals, couples, and investors targeting the luxury rental segment.

Two-Bedroom Apartments: Ranging from 1,400-1,800 square feet, these residences provide master bedrooms with en-suite facilities and walk-in wardrobes, second bedrooms with family bathroom access, expansive living spaces, contemporary kitchens with breakfast counters, and generous balconies maximising water views. The layout accommodates small to medium families and executive tenants.

Three-Bedroom Apartments: With floor areas between 2,000-2,600 square feet, these premium units incorporate three bedrooms (master with en-suite and walk-in wardrobe, additional bedrooms with en-suite or shared bathroom access), separate living and dining areas, modern kitchen installations, maid's rooms in select units, and extensive balconies with unobstructed marina or sea vistas.

Penthouses: Representing the pinnacle of Al Hamra Waterfront living, penthouses span 3,000-4,500 square feet across single or multi-level configurations. These exceptional residences feature four to five bedrooms, multiple bathrooms, expansive living areas, gourmet kitchens, maid's quarters, private roof terraces, and panoramic views encompassing the marina, Arabian Gulf, and Hajar Mountains.

All units incorporate luxury finishes including marble flooring in living areas, premium sanitaryware from international brands, built-in wardrobes with quality carpentry, VRV air conditioning systems, smart home integration capabilities, and floor-to-ceiling windows maximising natural light and views. Kitchen installations feature stone countertops and integrated appliances from European manufacturers.

Estimated ROI and Investment Potential

Al Hamra Waterfront generates rental yields of 6-8% annually, marginally lower than Al Hamra Greens due to higher purchase prices but compensated by superior capital appreciation potential and tenant quality. The premium positioning attracts corporate tenants, senior executives, and affluent families willing to pay premiums for waterfront living and luxury specifications.

One-bedroom apartments command monthly rents of AED 5,500-7,000 (AED 66,000-84,000 annually), producing yields of 6.9-8.8% on purchase prices of AED 950,000-1,100,000. Two-bedroom units achieve monthly rents of AED 9,000-12,000 (AED 108,000-144,000 annually), delivering yields of 7.2-9.6% on acquisition costs of AED 1.5-1.8 million.

Three-bedroom apartments rent for AED 14,000-18,000 monthly (AED 168,000-216,000 annually), generating yields of 7.3-9.4% on purchase prices of AED 2.3-2.8 million. Penthouses, whilst commanding higher acquisition costs exceeding AED 4 million, achieve monthly rents of AED 25,000-35,000 (AED 300,000-420,000 annually), producing yields of 6.5-8.5%.

Capital appreciation forecasts for waterfront properties within established communities suggest 6-10% annual growth, outpacing standard residential properties due to scarcity value, lifestyle appeal, and increasing demand from international buyers. The waterfront location provides inherent protection against market oversupply, as marina and sea view inventory remains limited regardless of broader market development activity.

Five-year appreciation projections indicate potential capital gains of 34-61%, with waterfront penthouses and larger units demonstrating strongest appreciation due to their appeal to ultra-high-net-worth individuals and limited comparable inventory. For investors prioritising capital growth over immediate yield, Al Hamra Waterfront represents the optimal choice within the Al Hamra portfolio.

Aila Homes: Exclusive Villa Community

Aila Homes represents Al Hamra Developers' response to demand for exclusive villa living within a gated community environment. The development comprises luxury villas featuring contemporary architecture, private pools, landscaped gardens, and premium finishes throughout. The community design emphasises privacy, space, and family-oriented amenities whilst maintaining connectivity to Al Hamra Village's broader facilities.

The villa layouts accommodate multi-generational families, providing separate living zones, multiple en-suite bedrooms, entertainment areas, and outdoor spaces suitable for RAK's favourable climate. For owner-occupiers seeking their ultimate family residence, Aila Homes delivers international standards within a secure, prestigious community. Investors targeting the luxury rental market or seeking long-term capital preservation will find Aila Homes offers scarcity value and differentiation within the RAK villa segment.

Pricing and Payment Plans

Aila Homes positions at the premium end of the Al Hamra portfolio, with three-bedroom villas starting from approximately AED 2.8 million, four-bedroom villas from AED 3.5 million, and five-bedroom signature villas exceeding AED 5 million. These price points reflect the substantial plot sizes, private amenities, and exclusive community positioning.

Compared to equivalent villa communities in Dubai (Arabian Ranches, Dubai Hills Estate) or Abu Dhabi (Yas Acres, West Yas), Aila Homes offers 30-45% price advantages whilst delivering comparable specifications and amenities. This value proposition attracts investors seeking portfolio diversification and buyers prioritising space and privacy over proximity to major business districts.

Payment structures typically require 30-40% deposits with the balance distributed across construction milestones and completion, reflecting the higher transaction values and targeting established buyers with substantial capital reserves. Select promotional periods may offer extended payment terms or post-handover plans, though these remain less common for villa products compared to apartment offerings.

Annual service charges for community amenities, landscaping, and security average AED 25,000-45,000 depending on villa size, with individual owners responsible for their property's internal maintenance and private pool upkeep. The community fee structure ensures comprehensive common area maintenance whilst allowing owners autonomy over their individual villa management.

Specifications and Unit Types

Aila Homes offers three primary villa configurations, each designed to maximise functionality and luxury:

Three-Bedroom Villas: Spanning 2,800-3,200 square feet of built-up area on plots of 3,500-4,000 square feet, these villas feature three en-suite bedrooms (master with walk-in wardrobe), maid's room with separate entrance, open-plan living and dining areas, contemporary kitchen with family area, powder room, covered parking for two vehicles, private swimming pool, and landscaped gardens. The configuration suits smaller families or investors seeking entry to the luxury villa segment.

Four-Bedroom Villas: Ranging from 3,800-4,400 square feet of built-up area on plots of 4,500-5,500 square feet, these residences provide four en-suite bedrooms (master with dressing area and luxury bathroom), maid's room, separate living and family rooms, formal dining area, gourmet kitchen with separate preparation and storage areas, study or home office, powder room, covered parking for three vehicles, private pool with deck area, and extensive gardens. The layout accommodates larger families and those requiring dedicated entertaining spaces.

Five-Bedroom Signature Villas: Representing the ultimate in Aila Homes living, these prestigious properties span 5,000-6,000 square feet of built-up area on plots exceeding 6,000 square feet. They incorporate five en-suite bedrooms (master suite with sitting area, walk-in wardrobe, and spa-style bathroom), maid's quarters with separate facilities, multiple living areas, formal dining room, entertainment room or cinema, gourmet kitchen with separate preparation kitchen, home office, powder rooms, covered parking for four vehicles, infinity pool with extensive decking, outdoor kitchen or BBQ area, and landscaped gardens with feature lighting.

All villas incorporate luxury specifications including marble or premium tile flooring, European kitchen installations with integrated appliances, contemporary sanitaryware from international brands, built-in wardrobes throughout, ducted air conditioning systems, smart home pre-wiring, video intercom systems, and aluminium windows with energy-efficient glazing. External finishes feature contemporary facades with stone and render combinations, landscaped gardens with irrigation systems, and boundary walls ensuring privacy.

Estimated ROI and Investment Potential

Aila Homes generates rental yields of 5-7% annually, lower than apartment offerings due to higher capital requirements but compensated by exceptional capital appreciation potential, tenant stability, and property type scarcity within RAK. The luxury villa rental market attracts senior executives, business owners, and affluent families seeking long-term residences, resulting in extended tenancy periods and reduced vacancy rates.

Three-bedroom villas command annual rents of AED 150,000-180,000, producing yields of 5.4-6.4% on purchase prices of AED 2.8-3.2 million. Four-bedroom villas achieve annual rents of AED 200,000-250,000, delivering yields of 5.7-7.1% on acquisition costs of AED 3.5-4.2 million. Five-bedroom signature villas rent for AED 300,000-380,000 annually, generating yields of 6.0-7.6% on purchase prices of AED 5.0-6.0 million.

Capital appreciation forecasts for luxury villas in established communities suggest 7-11% annual growth, outperforming apartments due to land value appreciation, scarcity of quality villa inventory, and increasing demand from high-net-worth individuals relocating to the UAE. The combination of land ownership (unlike apartment purchases where land remains under developer control) and physical asset scarcity creates inherent value protection.

Five-year appreciation projections indicate potential capital gains of 40-74%, with larger signature villas demonstrating strongest performance due to their appeal to ultra-high-net-worth segments and limited comparable alternatives within RAK. For investors prioritising long-term capital preservation, generational wealth building, or seeking properties suitable for eventual personal occupation, Aila Homes represents the superior choice within the Al Hamra portfolio.

Side-by-Side Comparison: Key Metrics

To facilitate informed decision-making, the following comparison summarises the critical metrics across all three Al Hamra developments:

| Metric | Al Hamra Greens | Al Hamra Waterfront | Aila Homes |

|---|---|---|---|

| Property Types | Studios, 1-3 bed apartments, townhouses | 1-3 bed apartments, penthouses | 3-5 bed villas |

| Starting Price | AED 450,000 | AED 950,000 | AED 2,800,000 |

| Target Buyer | Families, first-time investors | Luxury seekers, premium investors | Villa buyers, high-net-worth individuals |

| Rental Yield | 7-9% annually | 6-8% annually | 5-7% annually |

| Capital Appreciation (5yr) | 28-47% | 34-61% | 40-74% |

| Service Charges | AED 8-12/sq.ft | AED 14-18/sq.ft | AED 25,000-45,000/year |

| Key Amenities | Pools, gyms, play areas, gardens | Marina access, beach clubs, waterfront promenade | Private pools, gated community, luxury facilities |

| Ideal For | Cash flow investors, growing families | Lifestyle investors, executives | Capital growth investors, large families |

| Entry Capital Required | Low (from AED 90k deposit) | Medium (from AED 285k deposit) | High (from AED 840k deposit) |

| Liquidity | High (broad buyer pool) | Medium (premium segment) | Medium-Low (niche luxury market) |

| Tenant Profile | Families, professionals, hospitality workers | Executives, affluent couples, small families | Senior executives, business owners, expatriate families |

This comparison illustrates the distinct positioning of each development and highlights how investor objectives determine optimal selection.

Which Al Hamra Development Should You Choose?

Selecting the appropriate Al Hamra development requires alignment between your investment objectives, capital availability, risk tolerance, and timeline. The following framework provides guidance based on common investor profiles:

Cash Flow Investors seeking immediate rental income and strong yields should prioritise Al Hamra Greens, particularly two-bedroom apartments and three-bedroom townhouses which generate 7.7-8.8% annual returns. The combination of affordable entry prices, broad tenant demand, and established rental market creates ideal conditions for consistent cash flow generation. The lower service charges and maintenance requirements enhance net yields, whilst the diversified unit mix enables portfolio construction across multiple properties with moderate capital deployment.

Capital Appreciation Investors prioritising long-term value growth and wealth building should focus on Aila Homes villas, which demonstrate projected five-year appreciation of 40-74%. The scarcity value of luxury villa inventory, land ownership component, and appeal to ultra-high-net-worth segments create structural conditions favouring sustained capital growth. Whilst rental yields moderate at 5-7%, the total return profile incorporating capital gains significantly outperforms apartment alternatives over extended holding periods.

Balanced Investors seeking equilibrium between yield and appreciation should examine Al Hamra Waterfront, which delivers 6-8% annual rental returns alongside robust 34-61% five-year capital appreciation forecasts. The waterfront location provides scarcity value and lifestyle appeal, attracting quality tenants willing to pay premiums whilst ensuring strong resale demand. Two-bedroom apartments offer optimal balance between capital requirements, rental demand, and appreciation potential.

Owner-Occupiers planning eventual personal residence should consider their family size and lifestyle preferences. Growing families benefit from Al Hamra Greens townhouses offering space and community amenities at accessible prices. Affluent buyers seeking waterfront lifestyle and luxury finishes find Al Hamra Waterfront aligns with their requirements. Large families or those prioritising privacy, outdoor space, and ultimate luxury should focus exclusively on Aila Homes villas.

First-Time Investors entering the UAE property market should begin with Al Hamra Greens studios or one-bedroom apartments, which require minimal capital (deposits from AED 90,000-130,000), generate strong yields exceeding 7%, and provide liquidity through broad buyer demand. The accessible entry point enables market participation without excessive capital commitment, whilst the established rental market ensures consistent tenant demand.

Portfolio Investors with substantial capital seeking diversification should consider multi-property strategies combining developments. A balanced portfolio might include two Al Hamra Greens apartments for cash flow, one Al Hamra Waterfront unit for balanced returns, and one Aila Homes villa for capital appreciation. This diversification captures different market segments, balances yield and growth, and provides protection against segment-specific market fluctuations.

Regardless of selected development, partnering with property investment specialists possessing deep RAK market knowledge ensures access to optimal units, negotiated pricing, and strategic acquisition timing that maximises return potential across all Al Hamra developments.

Why Ras Al Khaimah Represents Exceptional Investment Value

Understanding the broader RAK market context enhances appreciation of Al Hamra developments' investment potential. Ras Al Khaimah has emerged as the UAE's fastest-growing property market, driven by strategic government initiatives, infrastructure development, and competitive advantages versus saturated markets.

The emirate's real estate prices remain 40-60% below equivalent Dubai properties, creating exceptional value for investors whilst maintaining quality standards and amenities comparable to premium developments in larger emirates. This price differential enables capital deployment across larger unit sizes or multiple properties, enhancing both lifestyle outcomes for owner-occupiers and return profiles for investors.

RAK's strategic location—positioned between Dubai (45 minutes) and Musandam, with direct access to the Arabian Gulf and Hajar Mountains—creates unique lifestyle appeal combining coastal leisure, mountain adventure, and connectivity to major business centres. The ongoing development of Al Marjan Island, expansion of RAK International Airport, and hospitality sector growth support sustained property demand across residential segments.

Government initiatives including business-friendly regulations, 100% foreign ownership across all areas, competitive utility costs, and quality education and healthcare infrastructure attract international businesses and expatriate families. These factors create sustained rental demand and population growth supporting long-term property value appreciation.

RAK's property market demonstrates resilience through economic cycles, with transaction volumes and price appreciation outperforming Dubai and Abu Dhabi during recent periods. The combination of affordability, lifestyle appeal, infrastructure development, and strategic positioning creates favourable conditions for sustained capital growth across the next decade.

For investors seeking exposure to the UAE property market whilst avoiding premium pricing and market saturation characterising established emirates, RAK represents exceptional investment value with Al Hamra developments offering quality entry points across multiple price segments and property types.

Exclusive RAK Off-Plan Projects provide additional opportunities for early-stage investors seeking pre-launch pricing advantages and maximum appreciation potential through Dubai's proven off-plan investment model now emerging in Ras Al Khaimah's maturing market.

Al Hamra Developers' portfolio of Al Hamra Greens, Al Hamra Waterfront, and Aila Homes provides investors and owner-occupiers with distinct opportunities aligned to different objectives, budgets, and lifestyle preferences. Al Hamra Greens delivers exceptional rental yields of 7-9% with accessible entry prices ideal for cash flow investors and families seeking affordable quality living. Al Hamra Waterfront balances premium waterfront lifestyle with strong yields of 6-8% and superior capital appreciation of 34-61% over five years. Aila Homes represents the ultimate in luxury villa living with projected appreciation of 40-74%, appealing to capital growth investors and large families.

Your selection amongst these developments should reflect your primary investment objective—whether immediate cash flow, long-term capital appreciation, balanced returns, or personal residence. The broader RAK market context, characterised by 40-60% price advantages versus Dubai, strategic infrastructure development, and government initiatives supporting population growth, creates favourable conditions for sustained property value appreciation across all Al Hamra developments.

Successful property investment requires not only identifying quality developments but also securing optimal units, negotiating favourable terms, and timing acquisitions strategically within market cycles. Partnering with property investment specialists possessing exclusive access to pre-launch opportunities and deep market intelligence maximises return potential whilst minimising acquisition risks inherent in property transactions.

Partner With RAK Investment Specialists

Azimira Real Estate specialises in premium UAE property investments with particular expertise in Ras Al Khaimah's emerging market. Our team provides exclusive access to pre-launch Al Hamra developments, off-market opportunities, and tailored investment strategies aligned to your financial objectives.

Whether you're seeking high-yield apartments in Al Hamra Greens, luxury waterfront residences, or exclusive Aila Homes villas, our market insights and developer relationships ensure you secure optimal units at competitive pricing with payment plans structured to your requirements.

Schedule your confidential consultation today to explore how Al Hamra developments can enhance your property portfolio and deliver the exceptional returns that position RAK as the UAE's premier investment opportunity.

Related articles

Double-Tax Treaties: How the UAE Helps You Avoid Capital Gains Tax

Discover how the UAE's extensive double-tax treaty network protects property investors from capital gains tax, creating exceptional wealth preservation opportunities.

Visa Renewal After Property Sale in UAE: Maintaining Residency Eligibility

Discover how to maintain UAE visa eligibility after selling property. Expert guidance on renewal options, Golden Visa retention, and strategic investment pathways.

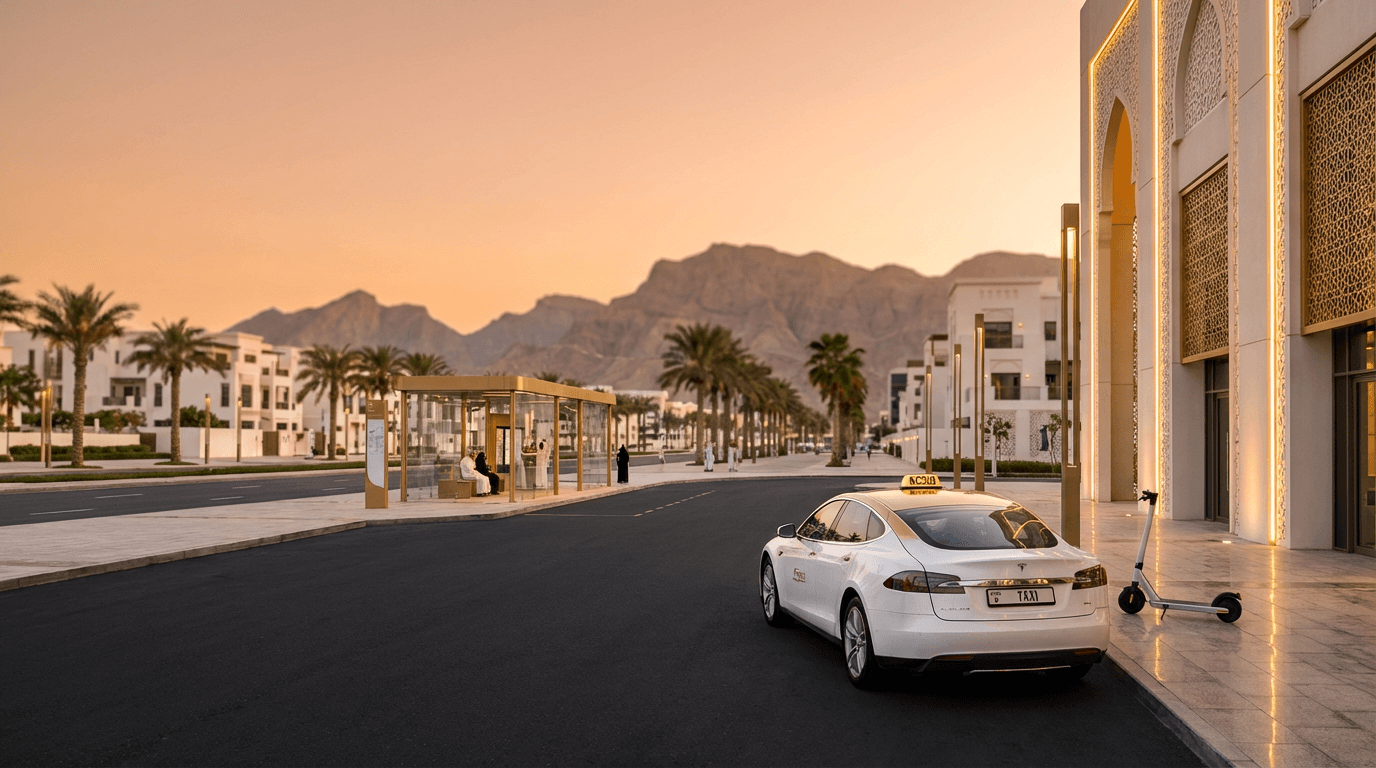

4 Ways to Get Around RAK Without a Car: Your Complete Transport Guide

Discover how to navigate Ras Al Khaimah without a car. From taxis to e-scooters, explore RAK's transport options with costs, tips, and local insights.