Visa Renewal After Property Sale in UAE: Maintaining Residency Eligibility

Discover how to maintain UAE visa eligibility after selling property. Expert guidance on renewal options, Golden Visa retention, and strategic investment pathways.

Table of Contents

- Understanding UAE Property-Linked Residency Visas

- What Happens to Your Visa When You Sell Property

- Golden Visa Holders: Special Considerations

- Standard Property Investor Visa: Post-Sale Scenarios

- Maintaining Residency Without Property Ownership

- Strategic Reinvestment to Preserve Visa Status

- Timeline Considerations and Grace Periods

- RAK Property Investment: An Alternative Pathway

- Documentation Requirements for Visa Renewal

- Common Mistakes to Avoid

Selling a property in the UAE often triggers concerns amongst visa holders who obtained residency through their property investment. Whether you're repositioning your portfolio, capitalising on market appreciation, or simply exploring alternative investment opportunities, understanding how property sales affect your visa status is crucial for maintaining your UAE residency without disruption.

The relationship between property ownership and visa eligibility varies significantly depending on which residency programme you've utilised. Golden Visa holders enjoy markedly different provisions compared to standard property investor visa recipients, whilst the emirate where you purchased property can also influence your options. With UAE property markets—particularly emerging destinations like Ras Al Khaimah—offering exceptional capital growth opportunities, many investors find themselves weighing the benefits of portfolio repositioning against visa implications.

This comprehensive guide examines the regulatory framework governing visa renewal after property sale, explores alternative pathways to maintaining residency, and provides strategic insights for investors seeking to optimise their property portfolios whilst preserving their UAE residency status. From grace periods and documentation requirements to reinvestment strategies and emerging market opportunities, we'll address the critical considerations that discerning property investors must navigate in today's dynamic UAE real estate landscape.

Understanding UAE Property-Linked Residency Visas

The UAE offers several residency pathways connected to property investment, each with distinct eligibility criteria and renewal requirements. Understanding which category applies to your situation is fundamental to planning any property sale strategy.

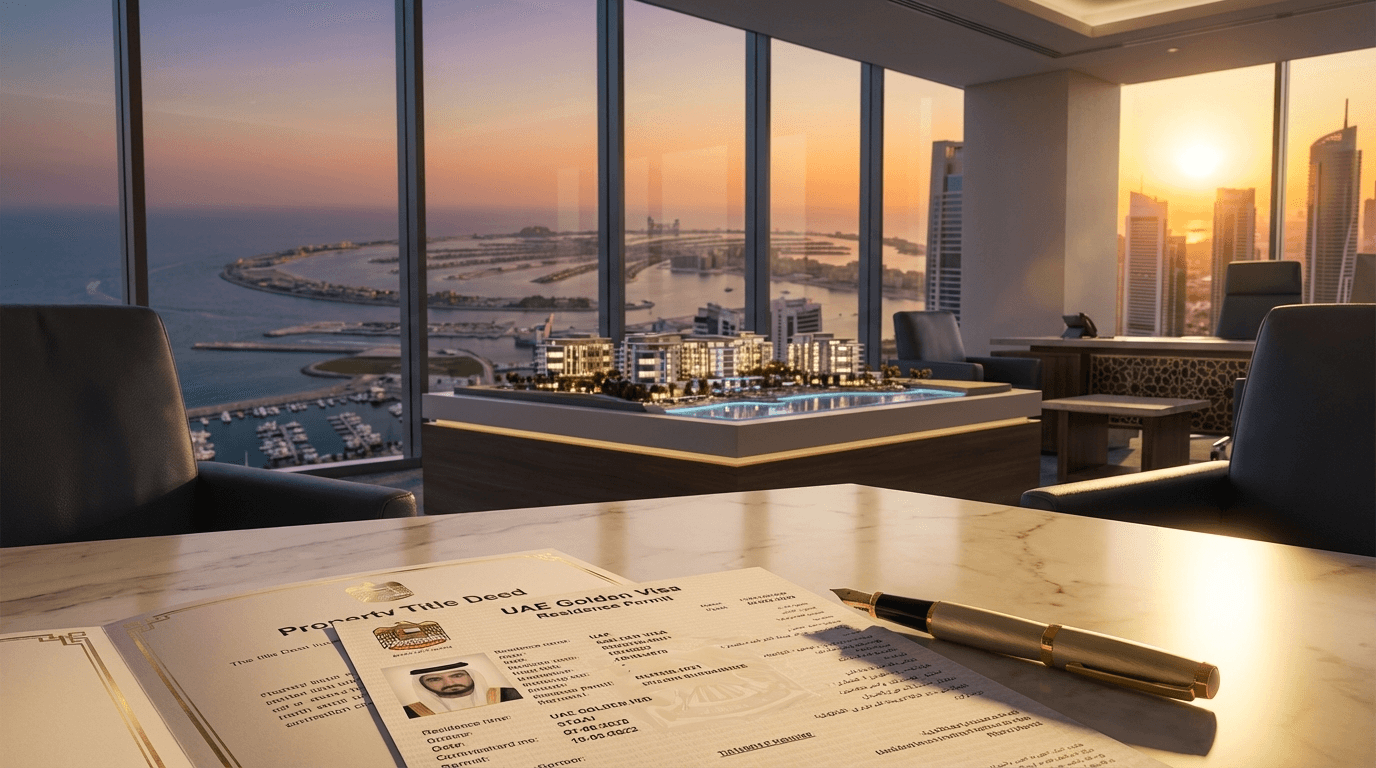

The Golden Visa programme, introduced in 2019 and expanded in subsequent years, provides long-term residency of 10 years for investors who purchase property valued at AED 2 million or above. This premium residency option includes significant benefits, including the ability to sponsor family members and the absence of a traditional sponsor requirement. Crucially, Golden Visa regulations have evolved, with the most recent updates clarifying conditions for visa retention following property disposal.

Standard property investor visas, typically offering 2 or 3-year residency, are available to individuals purchasing property below the Golden Visa threshold. These visas are generally facilitated through developer relationships or property management companies and often require maintaining the property investment throughout the visa validity period. The specific requirements vary by emirate, with Dubai, Abu Dhabi, and Ras Al Khaimah each implementing their own frameworks within federal guidelines.

Additionally, some investors hold employment visas or business owner visas whilst also owning property. In these cases, property ownership serves as a secondary asset rather than the primary basis for residency, creating different dynamics when considering property sales. Understanding your visa's foundational basis—whether property-linked, employment-based, or investor-category—determines your obligations and options post-sale.

The distinction between visa categories becomes particularly important when evaluating market opportunities. For instance, investors initially purchasing in established markets may now recognise superior capital appreciation potential in emerging destinations, making portfolio repositioning strategically attractive if it can be accomplished without jeopardising residency status.

What Happens to Your Visa When You Sell Property

The immediate impact of selling property on your visa status depends primarily on which residency programme you're utilising and where you stand within your current visa validity period.

For Golden Visa holders, recent regulatory clarifications have provided greater flexibility. Whilst the initial Golden Visa issuance requires property ownership valued at AED 2 million or above, once issued, the visa's validity is not automatically revoked upon property sale. However, upon renewal, authorities may request evidence of continued investment in UAE assets or alternative qualifying criteria. This creates a window during which Golden Visa holders can sell property, reinvest proceeds, and maintain residency status, provided they plan strategically for the renewal cycle.

Holders of standard property investor visas face more immediate implications. These visas are typically directly tied to ongoing property ownership, meaning the sale of your qualifying property may trigger visa cancellation processes. Many emirates require notification of property disposal within specified timeframes, and failing to maintain the investment basis for your visa can result in residency termination. However, the practical enforcement and grace periods vary considerably between jurisdictions.

It's essential to recognise that your visa's validity period continues until its expiration date regardless of property ownership changes. Selling property doesn't automatically invalidate your current visa stamp; rather, it affects your ability to renew when the visa expires. This distinction provides planning time for investors who sell property mid-cycle, allowing them to explore alternative residency pathways before their current visa expires.

The property handover and transfer process itself doesn't immediately trigger visa changes. Your residency status remains intact during the sale transaction, completion procedures, and even following property registration transfer to the new owner. The critical juncture arrives at renewal time, when authorities assess whether you continue meeting the eligibility criteria that initially qualified you for residency.

Proactive planning is therefore essential. Rather than waiting until visa expiration to address property sale implications, sophisticated investors evaluate their options well in advance, exploring reinvestment opportunities, alternative visa pathways, or strategic timing to ensure seamless residency continuation.

Golden Visa Holders: Special Considerations

The Golden Visa programme offers the most flexibility for investors managing property portfolios, though important nuances warrant careful attention.

Once issued, your Golden Visa remains valid for its full term—10 years —regardless of whether you continue holding the property that initially qualified you. This security of tenure distinguishes the Golden Visa from standard property investor visas and provides considerable strategic flexibility. You can sell your AED 2 million property, deploy proceeds into alternative investments, and maintain your residency status throughout your current visa period.

However, renewal requirements introduce considerations that forward-thinking investors must address. When your Golden Visa approaches expiration and renewal becomes necessary, authorities will reassess your eligibility. Whilst the exact documentation requirements continue evolving, recent guidance suggests that demonstrating ongoing economic contribution to the UAE—whether through maintained property investment, business activities, or other qualifying criteria—strengthens renewal applications.

Many Golden Visa investors adopt a strategic reinvestment approach, selling appreciated properties whilst simultaneously acquiring new UAE real estate before renewal periods. This maintains continuous property investment visibility, satisfies regulatory expectations, and capitalises on market opportunities. For instance, an investor who purchased a Dubai property at AED 2.5 million in 2020 might sell at significant appreciation in the current market, then reinvest proceeds into emerging markets like Ras Al Khaimah, where the same capital secures superior assets whilst maintaining Golden Visa eligibility.

The family sponsorship benefits attached to Golden Visas add another dimension. Even if the primary visa holder could potentially maintain residency through alternative means, dependent family members' visas are linked to the main applicant's status. This creates additional incentive to maintain Golden Visa qualification rather than downgrading to alternative residency categories.

Some investors explore diversified qualification pathways, recognising that Golden Visas can be obtained through public investment funds, company ownership, or specialised talent categories beyond property investment alone. Selling property needn't end Golden Visa eligibility if you simultaneously qualify through alternative approved pathways, providing sophisticated investors with portfolio optimisation flexibility.

Standard Property Investor Visa: Post-Sale Scenarios

Investors holding standard property-linked residency visas encounter more restrictive circumstances when selling property, though viable pathways exist for maintaining UAE residency.

These visas are typically directly conditioned on ongoing property ownership. The property investment that qualified you for residency must generally be maintained throughout your visa's validity, and selling removes the foundational basis for your residency status. However, the practical timeline and enforcement mechanisms vary between emirates and specific circumstances.

Upon selling property, you theoretically should notify the relevant authorities within prescribed timeframes. Whilst enforcement of notification requirements varies, failing to disclose property disposal whilst attempting to renew your visa using that property as qualification will inevitably result in rejection and potential complications. Transparency with immigration authorities, solicitors, and property developers managing your visa arrangements is advisable.

The remaining validity period on your current visa provides a crucial planning window. If you sell property whilst holding a visa valid for another 18 months, you have substantial time to arrange alternative residency pathways before your current status expires. This might involve securing employment sponsorship, establishing a business, or reinvesting in qualifying property—ideally accomplished well before your visa renewal deadline.

Reinvestment in qualifying property represents the most straightforward pathway for standard visa holders who sell property. By purchasing replacement property that meets investor visa criteria before your current visa expires, you can transition your residency basis from the old property to the new one. Coordinating the timing—ideally having your new property purchase completed and documented before disposing of your original property—creates the smoothest transition, though practical market timing considerations may prevent perfect sequencing.

Alternatively, if your property investment has appreciated sufficiently, you might upgrade to Golden Visa eligibility by reinvesting proceeds into property valued at AED 2 million or above. This not only resolves your visa renewal concerns but elevates your residency status, providing long-term security and enhanced benefits. For investors who initially purchased more modest properties but have experienced significant appreciation, this upgrade pathway merits serious consideration.

Some investors explore company formation as an alternative residency pathway following property sale. Establishing a UAE business—whether a mainland company or free zone entity—provides independent residency qualification unconnected to property ownership. Whilst this involves business setup costs and ongoing compliance obligations, it offers strategic benefits for investors engaged in property portfolio management or other commercial activities within the UAE.

Maintaining Residency Without Property Ownership

Several pathways enable maintaining UAE residency after selling property, each with distinct requirements, costs, and strategic implications.

Employment sponsorship represents the most common alternative, whether through securing employment with an established organisation or setting up your own company to self-sponsor. UAE employment visas typically provide 2 or 3-year residency and can sponsor dependent family members, offering comparable benefits to property investor visas. For professionals with marketable skills or investors willing to establish business entities, this pathway provides reliable residency independent of property ownership.

Freelance permits and remote work visas have expanded significantly, particularly following pandemic-driven regulatory innovations. Several UAE free zones now offer freelance permits providing residency for independent professionals, whilst the remote work visa programme allows individuals employed by overseas companies to obtain UAE residency. These options suit property investors who work remotely or operate international businesses whilst maintaining UAE residence for tax, lifestyle, or business connectivity purposes.

Company ownership through free zone or mainland business establishment provides residency for business owners and, depending on the business structure and licensing, potentially for partners and employees. The initial setup investment varies considerably depending on jurisdiction and business activity, ranging from approximately AED 15,000 for basic free zone establishments to substantially higher amounts for mainland companies. However, business ownership offers strategic advantages beyond residency, including business banking access, commercial opportunities, and potential tax benefits.

Retirement visas recently introduced for individuals over 55 years old provide another alternative, requiring financial criteria including specified savings or income levels, UAE property ownership (valued at AED 2 million or above), or a combination of financial assets and property below the threshold. For eligible investors, this programme might allow selling existing property whilst maintaining residency through the retirement visa pathway, provided other financial requirements are satisfied.

Family sponsorship arrangements, where one family member obtains residency through employment or business whilst sponsoring other family members, can provide household residency security even after property sales. This approach works particularly well for families where one spouse pursues business or professional activities whilst property investments are managed independently of residency requirements.

Each alternative pathway involves distinct cost structures, documentation requirements, and ongoing obligations. Sophisticated investors typically evaluate these options holistically, considering factors including renewal cycles, family sponsorship provisions, business objectives, and long-term residency security when determining optimal strategies following property sales.

Strategic Reinvestment to Preserve Visa Status

For many investors, the optimal approach to maintaining residency whilst selling property involves strategic reinvestment within the UAE property market, potentially upgrading to superior assets or accessing emerging high-growth destinations.

The concurrent ownership approach involves securing new qualifying property before disposing of existing assets. By completing purchase of replacement property prior to selling your original investment, you ensure continuous property ownership throughout the transition, eliminating any gap in visa qualification. This approach requires coordinating two simultaneous transactions and temporarily deploying additional capital, but provides maximum security for residency continuity.

Alternatively, the sequential timing strategy involves selling property, then reinvesting proceeds within a compressed timeframe whilst relying on your current visa's remaining validity. This approach suits investors whose visas have substantial remaining terms, allowing time to identify optimal reinvestment opportunities without the pressure of concurrent transactions. However, it requires confidence in completing property purchase procedures before visa renewal deadlines.

Portfolio upgrading represents an opportunity to simultaneously maintain visa eligibility whilst improving investment quality. An investor selling a property purchased several years ago at AED 1.5 million—now valued at AED 2 million due to appreciation—might reinvest the proceeds into a Golden Visa-qualifying property, elevating their residency status whilst capitalising on market gains. This strategy transforms a regulatory requirement into a strategic opportunity for residency enhancement.

Emerging market repositioning allows investors to maintain or establish visa qualification whilst accessing superior growth potential. The Ras Al Khaimah property market, for instance, currently offers exceptional capital appreciation forecasts compared to more established emirates, with waterfront developments, luxury villa communities, and premium off-plan projects providing Golden Visa-qualifying investment opportunities at comparatively attractive price points. Investors selling appreciated assets in Dubai or Abu Dhabi can reinvest proceeds into RAK properties offering both visa qualification and enhanced return prospects.

Off-plan investment strategies deserve particular attention, as off-plan purchases often provide superior value compared to completed properties whilst offering flexible payment plans. By reinvesting property sale proceeds into exclusive off-plan projects, investors can secure larger or better-located properties, potentially upgrade to Golden Visa eligibility, and benefit from projected appreciation during construction phases. Payment plan structures on off-plan developments also preserve capital liquidity compared to full upfront payments required for completed properties.

The timing of property handover in off-plan investments introduces an additional consideration. Since visa qualification typically requires completed property with transferred title deeds, investors purchasing off-plan must ensure their current visa validity extends through the construction period, or arrange interim residency solutions. However, many developers provide visa facilitation services even during construction phases, enabling residency continuity throughout the development cycle.

Strategic reinvestment not only preserves visa eligibility but transforms regulatory requirements into opportunities for portfolio optimisation, market repositioning, and enhanced returns—an approach that aligns regulatory compliance with investment performance objectives.

Timeline Considerations and Grace Periods

Understanding the temporal dynamics of visa validity, renewal procedures, and grace periods is essential for planning property sales without residency disruption.

Your current visa validity continues uninterrupted regardless of property ownership changes until the expiration date shown in your visa stamp. Selling property on 1st March when your visa expires on 30th September doesn't invalidate your residency for those intervening six months. However, once your visa approaches expiration, renewal applications will assess your current eligibility status, at which point property disposal becomes relevant.

Renewal lead times vary by emirate and application complexity, but most residency renewals can be processed within 2-4 weeks when documentation is prepared. However, allowing 2-3 months before visa expiration provides comfortable margin for addressing any documentation queries, scheduling medical examinations, and completing administrative procedures without time pressure. For investors who've sold property and are pursuing alternative residency pathways, this extended timeframe is particularly important.

The UAE provides grace periods for visa holders whose residency expires. Currently, individuals whose visas expire are typically granted 30 days to either renew residency or arrange departure. This grace period allows limited additional time for completing renewal procedures, though remaining in the country beyond visa expiration (even within grace periods) can complicate matters and should be avoided when possible. The grace period should be viewed as an emergency buffer rather than planned planning time.

Property sale completion timeframes in the UAE typically require 4-6 weeks from offer acceptance through final registration transfer, though this varies depending on property type, developer procedures, and whether mortgages are involved. For investors coordinating property sales with reinvestment strategies, understanding these timeframes enables realistic scheduling that accommodates both transaction completion and visa renewal procedures.

Off-plan property purchase timeframes extend considerably longer, as title deed transfer only occurs upon project completion—potentially 2-4 years following initial purchase. Investors selling existing property to reinvest in off-plan developments must therefore arrange interim residency solutions unless their developers provide visa facilitation services during construction phases. Some developers offer investor visas linked to off-plan purchases, though terms and availability vary.

The Golden Visa processing period currently requires approximately 2-4 weeks following application submission with complete documentation, including property valuation certificates and Emirates ID registration. Investors upgrading from standard property visas to Golden Visas through reinvestment should account for this processing time, ensuring applications are submitted with sufficient margin before existing visa expiration.

Proactive timeline planning—mapping your current visa expiration, property sale target dates, reinvestment transaction schedules, and renewal application submissions—enables coordinated execution without stressful last-minute urgency. Creating a detailed timeline with contingency buffers protects against unexpected delays whilst maintaining residency continuity throughout portfolio transitions.

RAK Property Investment: An Alternative Pathway

Ras Al Khaimah has emerged as a compelling destination for investors seeking to maintain or establish visa qualification whilst accessing exceptional capital growth potential at attractive price points.

The emirate offers Golden Visa-qualifying properties at significantly more accessible values compared to Dubai or Abu Dhabi's premium districts. Luxury waterfront apartments and exclusive villa communities meeting the AED 2 million threshold provide spacious, high-quality residences that would command considerably higher prices in more established markets. For investors selling appreciated properties in expensive locations, RAK enables acquiring superior physical assets whilst maintaining or establishing Golden Visa eligibility.

Capital appreciation forecasts for RAK properties consistently exceed those of mature markets, with infrastructure development, tourism expansion, and economic diversification driving robust demand growth. The emirate's strategic initiatives—including significant hospitality projects, enhanced connectivity, and free zone expansion—create fundamental value drivers supporting property appreciation. Investors repositioning from markets with moderating growth prospects into RAK's dynamic landscape can potentially enhance portfolio returns whilst satisfying visa requirements.

The exclusive off-plan opportunities available in RAK deserve particular attention from investors managing visa considerations alongside portfolio performance. Pre-launch and off-market developments accessible through specialist property investment firms offer first-mover advantages, preferential pricing, and selection of premium units before general market availability. These opportunities combine visa qualification potential with exceptional investment metrics—a powerful combination for sophisticated investors.

Developer payment plans on RAK off-plan projects typically provide attractive structures, often requiring only 10-20% initial deposits with remaining payments distributed across construction milestones. This preserves capital liquidity compared to completed property purchases requiring full payment, enabling investors to maintain financial flexibility whilst securing visa-qualifying investments. The payment structures particularly suit investors selling existing properties, allowing strategic deployment of sale proceeds across time rather than requiring immediate full reinvestment.

Lifestyle considerations also merit attention, as RAK offers distinctive appeal compared to the urban intensity of Dubai or Abu Dhabi. Proximity to natural attractions, emerging luxury amenities, and a more relaxed pace attract investors seeking balanced lifestyles alongside investment performance. For Golden Visa holders who don't require daily employment in other emirates, RAK provides an attractive residential environment with connectivity to broader UAE commercial centres when needed.

The rental yield potential in RAK creates additional investment appeal, with returns often exceeding those available in mature markets. For investors maintaining properties as rental investments rather than personal residences, RAK's combination of competitive purchase prices and healthy rental demand generates attractive income yields alongside capital appreciation prospects.

Investors considering portfolio repositioning following property sales would benefit from exploring RAK's exceptional opportunities, where visa qualification aligns seamlessly with superior investment performance potential.

Documentation Requirements for Visa Renewal

Navigating visa renewal after property changes requires meticulous documentation preparation, with requirements varying by visa category and individual circumstances.

For Golden Visa renewal applications, essential documentation typically includes:

- Valid passport with minimum 6-month validity

- Current Emirates ID and visa documentation

- Property title deed (if using property investment as qualification basis)

- Property valuation certificate confirming value exceeds AED 2 million (obtainable from approved valuation companies)

- No Objection Certificate (NOC) if applicable

- Passport-sized photographs meeting UAE specifications

- Health insurance documentation covering UAE residency

- Completed application forms with accurate information

If you've sold your original Golden Visa property and reinvested in different UAE real estate, your renewal application should clearly demonstrate the new property investment, including recent title deed registration, valuation certificate for the new property, and any bridging documentation showing the transition timeline. Transparency regarding property changes, accompanied by clear evidence of continued qualifying investment, strengthens applications.

For standard property investor visa renewals, requirements generally include:

- Valid passport and current visa/Emirates ID documentation

- Property title deed registered in your name

- Tenancy contract (if property is leased out) or occupancy documentation

- Developer or property management company sponsorship letter

- Medical fitness certificate from approved health centres

- Passport photographs and completed application forms

Investors who've reinvested in new property should provide the new property's title deed, potentially alongside explanation letters documenting the property portfolio change. Some visa processing centres may request additional documentation explaining why property ownership has changed, making proactive preparation of timeline explanations advisable.

For those pursuing alternative visa pathways following property sale—such as employment sponsorship or company formation—entirely different documentation sets apply, including employment contracts, trade licence copies, labour contract documentation, and employer sponsorship letters. Preparing these materials well in advance of visa expiration reduces stress and ensures smooth transitions.

Attestation and translation requirements apply to certain documents, particularly those issued outside the UAE or in languages other than Arabic or English. Banking statements, foreign employment contracts, or international qualifications may require attestation through appropriate governmental channels and certified translation services.

The property valuation process for Golden Visa applications involves engaging approved valuation companies who conduct physical property inspections and issue official certificates confirming market values. This process typically requires 5-7 working days and involves fees ranging from AED 2,000-3,500 depending on property type and location. Scheduling valuations well before renewal deadlines prevents last-minute complications.

Maintaining organised documentation files—including copies of all property transaction records, previous visa applications, Emirates ID registrations, and related correspondence—substantially simplifies renewal processes. When property ownership has changed, comprehensive documentation demonstrating the full timeline and current investment status provides immigration officials with clear visibility into your circumstances, facilitating smoother processing.

Common Mistakes to Avoid

Property investors managing visa renewals after sales frequently encounter preventable challenges that meticulous planning can circumvent.

Selling property without renewal planning represents the most common error. Many investors dispose of properties without considering visa implications until expiration deadlines approach, creating stressful scrambles to arrange alternative residency or rushed reinvestment decisions. Visa planning should precede property sales, with clear strategies established before committing to disposal transactions.

Assuming Golden Visas are permanent leads some investors to believe selling property carries no consequences. Whilst Golden Visas provide long-term security and remain valid following property sales, renewal requirements may involve demonstrating continued qualifying criteria. Treating your initial property investment as completely disconnected from future visa status creates renewal complications.

Failing to coordinate transaction timing frequently causes problems when investors simultaneously pursue property sales and reinvestment. Selling property quickly whilst replacement purchases proceed slowly can create gaps in visa qualification. Conversely, purchasing replacement property long before selling existing assets ties up capital unnecessarily. Coordinated timeline management optimises both transaction efficiency and visa continuity.

Inadequate documentation retention creates renewal difficulties when investors cannot produce historical property ownership records, previous visa applications, or transaction documentation that authorities request. Comprehensive record-keeping throughout property ownership and visa periods prevents documentation gaps that delay or complicate renewals.

Ignoring emirate-specific requirements leads to confusion, as visa regulations and enforcement approaches vary between Dubai, Abu Dhabi, RAK, and other emirates. Requirements applicable in one jurisdiction may differ in another, making location-specific research essential rather than assuming uniform procedures across the UAE.

Last-minute renewal applications submitted days before visa expiration create unnecessary stress and leave no margin for addressing documentation queries or unexpected complications. Beginning renewal procedures 2-3 months before expiration provides comfortable timeframes for resolving issues without residency disruption.

Overlooking alternative visa pathways causes some investors to focus exclusively on property-based residency when employment sponsorship, company formation, or other options might provide superior solutions given their circumstances. Comprehensive evaluation of all available pathways often reveals alternatives that weren't initially apparent.

Underestimating off-plan timelines creates problems when investors sell existing properties to reinvest in off-plan developments without recognising that title deed transfers won't occur until project completion potentially years later. Understanding development timelines and arranging interim visa solutions prevents unexpected residency gaps.

Neglecting professional guidance leads some investors to navigate complex immigration and property procedures independently when expert advice would prevent costly mistakes. Engaging experienced property investment advisers who understand both real estate markets and visa implications provides invaluable support throughout portfolio transitions.

Avoiding these common pitfalls requires proactive planning, comprehensive research, attention to procedural details, and realistic timeline management—approaches that transform potentially stressful visa renewals into smoothly executed administrative procedures supporting broader investment strategies.

Planning Your Next Steps

Maintaining UAE residency whilst optimising your property portfolio requires strategic planning that integrates regulatory compliance with investment performance objectives.

Begin by assessing your current visa status, including exact expiration dates, visa category specifications, and foundational qualification criteria. Understanding precisely which programme governs your residency and how much remaining validity you possess establishes the planning framework for any property decisions.

Evaluate your property portfolio in light of current market conditions, appreciation potential, and alignment with investment objectives. Properties purchased years ago may have appreciated substantially, potentially justifying repositioning into higher-growth markets or upgraded assets that better serve your financial goals whilst maintaining visa qualification.

Research alternative residency pathways to understand all available options beyond property-linked visas. Employment opportunities, business formation prospects, or family sponsorship arrangements might provide residency security whilst freeing property investments from visa considerations, enabling purely performance-driven portfolio decisions.

Explore emerging market opportunities that combine visa qualification with exceptional investment potential. Markets like Ras Al Khaimah offer Golden Visa-qualifying properties at attractive valuations with superior appreciation forecasts, enabling simultaneous regulatory compliance and portfolio enhancement.

Develop detailed timelines mapping property sale targets, reinvestment schedules, visa renewal deadlines, and key documentation milestones. Visual timeline planning reveals potential conflicts or tight deadlines requiring adjustment, enabling proactive solutions rather than reactive crisis management.

Engage specialist advisers who understand both UAE property markets and visa regulations. Expert guidance navigating the intersection of investment strategy and residency requirements prevents costly mistakes whilst identifying opportunities that might not be apparent to individual investors.

The UAE's dynamic property market creates exceptional opportunities for investors willing to actively manage their portfolios, whilst the residency visa framework—though requiring attention—offers sufficient flexibility for sophisticated planning that maintains status throughout portfolio transitions.

Selling property in the UAE need not jeopardise your residency status when approached with proper planning, regulatory understanding, and strategic foresight. Whilst visa categories vary significantly in their post-sale implications—with Golden Visas offering substantially more flexibility than standard property investor visas—viable pathways exist for maintaining UAE residency across virtually all scenarios.

The key to successful navigation lies in proactive planning that begins well before visa expiration deadlines or property sale commitments. Understanding your specific visa category, assessing available alternative pathways, coordinating transaction timelines, and preparing comprehensive documentation transform potentially stressful regulatory compliance into manageable administrative procedures that support broader investment objectives.

For many investors, property sales present opportunities to enhance portfolio performance through strategic reinvestment in higher-growth markets or upgraded assets that simultaneously satisfy visa requirements. Emerging destinations like Ras Al Khaimah exemplify how regulatory needs and investment excellence can align, offering Golden Visa-qualifying properties with exceptional appreciation potential at attractive valuations.

Ultimately, maintaining visa eligibility after property sales requires the same strategic thinking that drives successful property investment itself: comprehensive research, careful planning, expert guidance, and decisive execution aligned with clearly defined objectives. Investors who approach residency planning with the same rigour they apply to portfolio management will find that UAE visa frameworks support rather than constrain their investment strategies.

Navigate Your UAE Property Investment Journey with Confidence

Whether you're considering selling existing property, exploring portfolio repositioning opportunities, or seeking visa-qualifying investments in high-growth markets, expert guidance ensures you maintain residency whilst optimising returns.

At Azimira Real Estate, we specialise in helping discerning investors navigate the intersection of UAE property investment and residency planning. Our deep expertise in emerging markets like Ras Al Khaimah, exclusive access to off-plan and pre-launch developments, and comprehensive understanding of visa frameworks enable strategic solutions tailored to your unique circumstances.

Discover how strategic reinvestment in premium off-plan opportunities can simultaneously maintain your visa eligibility and enhance your portfolio performance. Contact our specialist team today to explore personalised investment strategies that align regulatory requirements with exceptional capital growth potential.

Related articles

Double-Tax Treaties: How the UAE Helps You Avoid Capital Gains Tax

Discover how the UAE's extensive double-tax treaty network protects property investors from capital gains tax, creating exceptional wealth preservation opportunities.

4 Ways to Get Around RAK Without a Car: Your Complete Transport Guide

Discover how to navigate Ras Al Khaimah without a car. From taxis to e-scooters, explore RAK's transport options with costs, tips, and local insights.

Al Hamra Developers: Which Development is Best For You? Complete Investment Comparison

Compare Al Hamra Greens, Al Hamra Waterfront, and Aila Homes by Al Hamra Developers. Detailed analysis of costs, specifications, amenities, and ROI potential for investors.